Euro to Zloty Forecast 2024, 2025 - 2028

Staying on top of the volatile forex market is crucial for traders of the Euro and Zloty, making the EUR to PLN forecast a necessary tool. Whether you are new to trading or have experience, knowing the Zloty forecast can offer insights into how the EUR to PLN exchange rate may move in the short- and long-term perspective.

In this article, we will analyze the Euro to Polish Zloty exchange rate trends for 2024, while also looking towards 2025 and beyond, providing insight into the factors that could influence these changes in forex pairs in the upcoming years.

Table of Contents

Key Takeaways

Short-term EURO/PLN price forecast for 2024

Euro to Zloty Forecast for 2025

Euro to Zloty Forecast for 2026

Euro to Zloty Forecast for 2027

Euro to Zloty Forecast for 2028

Euro to Zloty technical analysis

About EUR/PLN currency rate forecast

What Affects EURO to ZLOTY Rate

How to predict the Euro - PLN exchange rate

Conclusion

FAQs

Key Takeaways

-

2024: Minor EUR/PLN fluctuations, ending the year around 4.3-4.4.

- 2025: Zloty may strengthen, with EUR to PLN forecast ranging from 4.3 to 3.993.

- 2026: Mixed projections; WalletInvestor sees EUR rising to 4.8, LongForecast suggests stability around 4.2 for EUR to PLN forecast.

- 2027: Predicted stability, Euro to Polish zloty forecast around 4.5-4.79.

- 2028: Bearish trend for EUR to PLN forecast, slight Zloty strength expected.

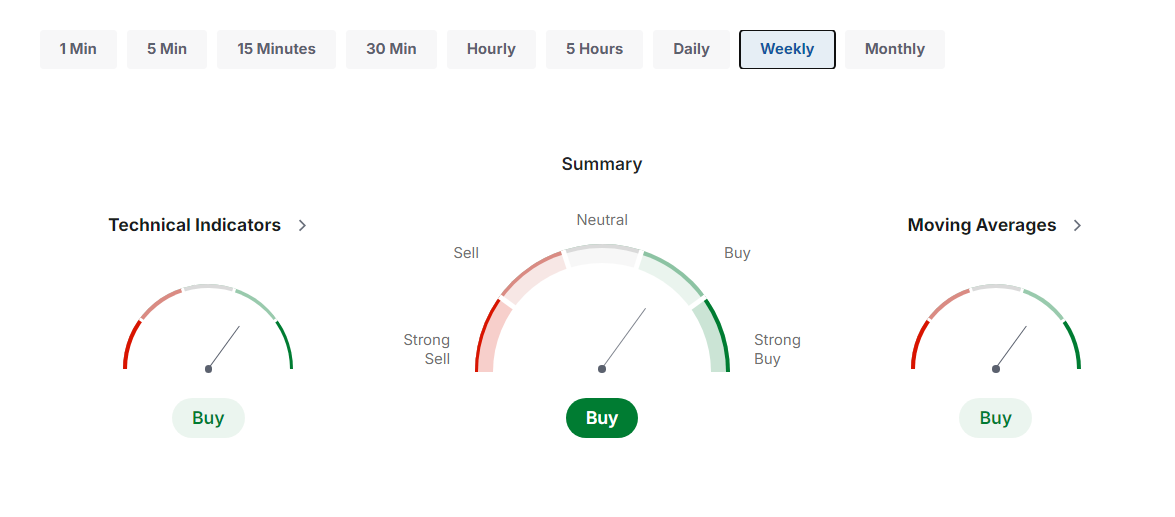

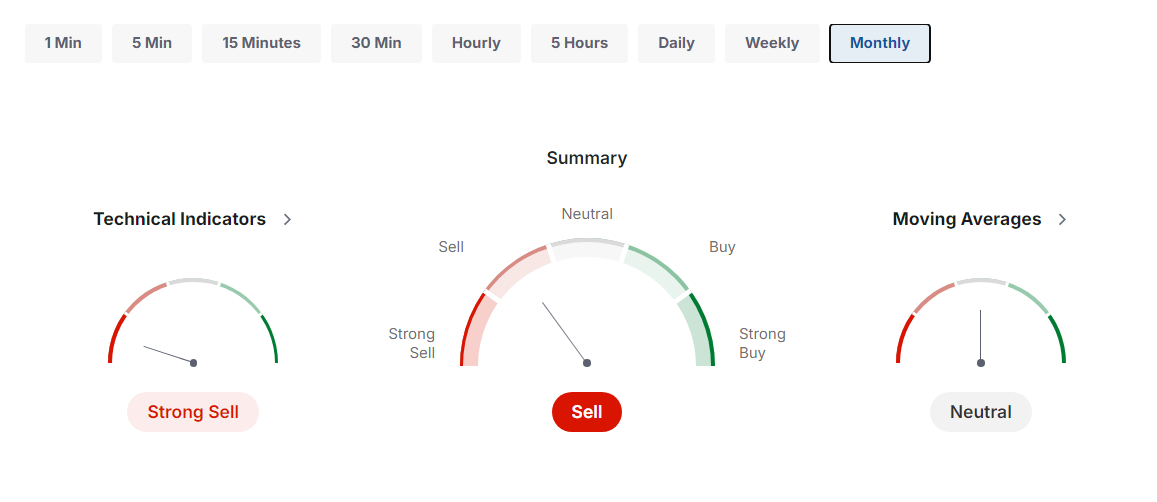

- Technical Analysis: PLN forecast for tomorrow and short-term bullish; long-term bearish signals.

Short-term EURO/PLN price forecast for 2024

The short-term EUR to PLN forecast for 2024 from Walletinvestor shows a slight decline. In November, the forex pair is expected to move from 4.313 to 4.311, while December could see a further dip to 4.309.

| Month |

Minimum value |

Maximum value |

Change |

| November 2024 |

4.306 |

4.313 |

-0.05 %▼ |

| December 2024 |

4.308 |

4.312 |

-0.02 %▼ |

According to Longforecast, however, the value is expected to rise in the coming months, ranging between 4.206 and 4.450.

| Month |

Open |

Low-High |

Close |

Total, % |

| November |

4.347 |

4.280-4.446 |

4.380 |

2.2% |

| December |

4.380 |

4.318-4.450 |

4.384 |

2.3% |

Euro to Zloty Forecast for 2025

The EUR to PLN forecast for 2025 shows a potential appreciation of the Zloty, with varying patterns from different analysis sources. WalletInvestor projects the rate will fluctuate between 4.3 and 4.5 early in the year, closing at around 4.49 in December. Conversely, LongForecast suggests a more pronounced downward trend, starting at 4.213 in January and potentially falling to around 3.993 by October. This indicates a general trend toward Zloty strengthening, reflecting cautious optimism for Poland’s currency performance against the EUR throughout 2025.

| Month |

Open |

Low-High |

Close |

Total, % |

| Jan |

4.213 |

4.213-4.342 |

4.278 |

-0.1% |

| Feb |

4.278 |

4.184-4.312 |

4.248 |

-0.8% |

| Mar |

4.248 |

4.095-4.248 |

4.157 |

-3.0% |

| Apr |

4.157 |

4.044-4.168 |

4.106 |

-4.2% |

| May |

4.106 |

3.965-4.106 |

4.025 |

-6.0% |

| Jun |

4.025 |

3.943-4.063 |

4.003 |

-6.6% |

| Jul |

4.003 |

3.939-4.059 |

3.999 |

-6.7% |

| Aug |

3.999 |

3.954-4.074 |

4.014 |

-6.3% |

| Sep |

4.014 |

3.971-4.091 |

4.031 |

-5.9% |

| Oct |

4.031 |

3.933-4.053 |

3.993 |

-6.8% |

| Nov |

4.216 |

4.029-4.216 |

4.090 |

-4.5% |

| Dec |

4.090 |

4.090-4.276 |

4.213 |

-1.7% |

Euro to Zloty Forecast for 2026

In 2026, WalletInvestor forecasts a steady rise in the Euro to Zloty rate, starting around 4.23 in January and reaching 4.8 by December, signaling a weakening Zloty. LongForecast shows a more stable trend, with the rate fluctuating near 4.16 at the start and settling around 4.09 in November, suggesting slight Zloty strength. Overall, the EUR to PLN forecast rate is expected to range between 4.2 and 4.8 throughout the year.

Here is a detailed EUR to PLN forecast for 2026:

| Month |

Open |

Low-High |

Close |

Total, % |

| Jan |

4.213 |

4.213-4.342 |

4.278 |

-0.1% |

| Feb |

4.278 |

4.184-4.312 |

4.248 |

-0.8% |

| Mar |

4.248 |

4.095-4.248 |

4.157 |

-3.0% |

| Apr |

4.157 |

4.044-4.168 |

4.106 |

-4.2% |

| May |

4.106 |

3.965-4.106 |

4.025 |

-6.0% |

| Jun |

4.025 |

3.943-4.063 |

4.003 |

-6.6% |

| Jul |

4.003 |

3.939-4.059 |

3.999 |

-6.7% |

| Aug |

3.999 |

3.954-4.074 |

4.014 |

-6.3% |

| Sep |

4.014 |

3.971-4.091 |

4.031 |

-5.9% |

| Oct |

4.031 |

3.933-4.053 |

3.993 |

-6.8% |

| Nov |

3.993 |

3.821-3.993 |

3.879 |

-9.5% |

| Dec |

3.879 |

3.879-4.046 |

3.986 |

-7.0% |

Euro to Zloty Forecast for 2027

In 2027, Coindex has the EUR to PLN forecast with an exchange rate between 4.50 and 4.79. This spread suggests moderate fluctuations, reflecting a period of relative stability for the Zloty. The projected low of 4.50 and high of 4.79 indicate minor volatility within a controlled range.

| Year |

Yearly Low |

Yearly High |

| 2027 |

zł 4.50 |

zł 4.79 |

LongForecast’s 2027 monthly EUR to PLN forecast show gradual changes in the EUR to PLN rate. Beginning at 3.986 in January, the Zloty fluctuates, reaching lows of 3.916 and highs of 4.223 by December, closing at 4.161. These fluctuations result in an overall annual change of -2.9%, suggesting slight Zloty appreciation.

| Month |

Open |

Low-High |

Close |

Total, % |

| Jan |

3.986 |

3.916-4.036 |

3.976 |

-7.2% |

| Feb |

3.976 |

3.946-4.066 |

4.006 |

-6.5% |

| Mar |

4.006 |

4.006-4.179 |

4.117 |

-3.9% |

| Apr |

4.117 |

3.968-4.117 |

4.028 |

-6.0% |

| May |

4.028 |

3.999-4.121 |

4.060 |

-5.2% |

| Jun |

4.060 |

3.950-4.070 |

4.010 |

-6.4% |

| Jul |

4.010 |

4.010-4.173 |

4.111 |

-4.0% |

| Aug |

4.111 |

4.042-4.166 |

4.104 |

-4.2% |

| Sep |

4.104 |

3.940-4.104 |

4.000 |

-6.6% |

| Oct |

4.000 |

4.000-4.139 |

4.078 |

-4.8% |

| Nov |

4.078 |

4.021-4.143 |

4.082 |

-4.7% |

| Dec |

4.082 |

4.082-4.223 |

4.161 |

-2.9% |

Euro to Zloty Forecast for 2028

The EUR to PLN forecast for 2028 shows a mostly bearish outlook. According to projections, the exchange rate starts around 4.069 in January and sees gradual declines throughout the year, with minor fluctuations.

A table with a detailed EUR to PLN forecast for 2028 is below.

| Month |

Open |

Low-High |

Close |

Total, % |

| Jan |

4.161 |

4.061-4.185 |

4.123 |

-3.8% |

| Feb |

4.123 |

4.105-4.231 |

4.168 |

-2.7% |

| Mar |

4.168 |

4.139-4.265 |

4.202 |

-1.9% |

| Apr |

4.202 |

4.070-4.202 |

4.132 |

-3.5% |

| May |

4.132 |

4.003-4.132 |

4.064 |

-5.1% |

| Jun |

4.064 |

4.064-4.224 |

4.162 |

-2.8% |

| Jul |

4.162 |

4.101-4.225 |

4.163 |

-2.8% |

| Aug |

4.163 |

4.066-4.190 |

4.128 |

-3.6% |

| Sep |

4.128 |

4.128-4.267 |

4.204 |

-1.9% |

| Oct |

4.204 |

4.029-4.204 |

4.090 |

-4.5% |

| Nov |

4.090 |

4.090-4.218 |

4.156 |

-3.0% |

Euro to Zloty technical analysis

In the EUR/PLN technical analysis, mixed signals emerge. On a week timeframe, bullish indicators and positive moving averages suggest potential upward momentum, indicating short-term buying opportunities.

However, the monthly chart paints a different picture, with bearish signals dominating. Technical indicators suggest a strong sell, and moving averages are neutral, hinting at longer-term downward pressure.

Investors should be cautious and consider both timeframes for EUR to PLN forecast before making any moves. As part of your investment advice, it's crucial to monitor support levels and overall trends to adapt to changes in the PLN forecast and the exchange rate.

About EUR/PLN currency rate forecast

When trading the EUR/PLN pair, it's crucial to consider that liquidity may be lower than with more commonly traded forex pairs like EUR/USD, resulting in wider spreads. That’s why risk management is even more important in this case. The volatility of the Euro to Polish zloty pair is generally elevated, particularly in times of economic uncertainty. Traders need to pay attention to timing because the majority of trading takes place during European trading hours. Moreover, it's important to monitor both the Polish and EU economic calendars for significant events, as they can cause sudden fluctuations in prices.

What Affects EURO to ZLOTY Rate

Here are the main factors that influence EUR to PLN forecast:

-

Economic factors such as inflation rates, GDP growth, and employment numbers.

- Political events: changes in government, elections, and geopolitical tensions.

- Central bank policy and decisions, for example, interest rate changes and monetary policy from both the Eurozone and Poland.

- Global market trends: investor sentiment and global economic conditions.

- Financial crises, including sudden economic downturns or financial instability.

How to predict the Euro - PLN exchange rate

To forecast the EUR to PLN rate, you need to focus on key elements in the forex market. Fundamental analysis is your best tool here - track economic indicators like interest rates, inflation, and political events that can influence currency values. Understanding these factors will help you gauge potential risks and make more informed investment decisions.

Conclusion

The overall EUR to PLN forecast for 2024 through 2028 is largely positive, with periods of fluctuation and volatility expected. While the PLN exchange rate shows strength at times, predictions suggest growth opportunities for euro investors. Traders should be aware of market risks and global uncertainties. Make sure to implement a solid risk management plan to navigate potential downturns and capitalize on favorable market movements.

FAQs

What is the zloty to euro prediction?

EUR to PLN forecast indicates the Zloty may see minor appreciation against the Euro, with rates ranging from 4.3 to 4.5 in early 2025, potentially reaching up to 4.8 by late 2026.

Is Polish Zloty going up?

EUR to PLN forecasts suggest slight appreciation in 2025, with the Zloty exchange rates gaining value against the Euro initially, though projections for 2026 indicate potential weakening toward 4.8 per Euro.

What is the prediction for Euro to Polish Zloty for 2025?

2025 EUR to PLN forecast shows fluctuations around 4.3 to 4.5, with minor upward movement in Zloty value expected through mid-year. However, gradual weakening toward late 2025 could raise rates.

What is the forecast for the EUR PLN in 2026?

The 2026 EUR to PLN forecast predicts fluctuations, starting around 4.23 in January and potentially rising to 4.8 by December, indicating a general weakening of the Zloty against the Euro.