How to Trade Forex for Beginners

The Forex market, also known as the foreign exchange or fx market, is the largest financial market, and has been

attracting the attention of many traders worldwide. It stands out with its high liquidity, accessibility,

around-the-clock trading opportunities, and, last but not least, potentially high profits. However, it’s important

to note that Forex trading also comes with significant risks, and thus requires particular knowledge and skills.

In this guide, we have gathered all the necessary information about Forex trading for beginners, including Forex

terminology, the advantages and disadvantages of this financial instrument, risks and tips for beginner Forex

traders, as well as the best Forex trading strategies to start with.

Table of Contents

What is Forex trading

A Brief History of Forex

An Overview of Forex Markets

Forex Terminology

How to trade Forex

Charts Used in Forex Trading

Pros and Cons of Trading Forex

Forex trading examples

Forex basics

Understanding Currency Pairs

Types of Currency Pairs

Major Currency Pairs

Minor Currency Pairs

Exotic Currency Pairs

Risks every Forex Trader Should Know

Difference between long and short positions

Forex leverage

Forex holding costs

Beginner Forex trading strategies

5 Forex trading tips for beginners

Where to trade Forex

What is an online Forex broker

Forex trading platform

Forex mobile trading app

Fundamental Analysis

The biggest fundamental analysis indicators

Technical Analysis

The three most popular technical indicators in trading

Learn Forex trading

FAQ

What is trading?

How do I learn Forex trading?

How do I start Forex trading?

Is Forex trading profitable?

Ready to trade with a world-leading broker?

What Is Forex Trading?

Forex trading, also known as foreign exchange trading, is the act of buying and selling currencies with the goal of

making a profit. Forex traders can speculate on currency exchange rates, buying a currency when it is undervalued

and selling it when it is overvalued. Forex trading is conducted around the clock and is accessible to individual

retail traders, corporations, and financial institutions.

A Brief History of Forex

The Forex currency market has a long history. Here we have outlined its main stages.

-

Ancient times. Foreign exchange trading dates back to the ancient world, when coins and other

forms of money were exchanged between different nations.

-

Gold standard. This standard existed from the end of the 19th century to the beginning of the 20th

century. During this time, currencies were backed by gold, and their exchange rates were fixed.

-

Floating exchange rates. When the gold standard was finally abandoned, the value of currencies could

fluctuate depending on market forces.

-

Electronic Forex trading. During the 20th century, Forex markets were rapidly developing. They became

open to individual traders. Also, in the 1990s, the concept of electronic trading appeared, which made Forex

even more convenient and accessible. Numerous popular trading platforms and brokers made it possible to

trade currency pairs from anywhere in the world.

-

Nowadays. Today, the Forex market is the largest financial market in the world, with a daily trading

volume of over $6 trillion.

An Overview of the Forex Market

The Forex market is a global market used for trading all currencies. Some of the foreign exchange's unique features

include:

-

Decentralized nature. The currency market is not represented by any central exchange. Moreover, it

doesn’t have any physical buildings.

-

24-hour trading. The Forex market allows traders to speculate on currency pairs 24 hours a day, 5 days

a week.

-

Accessibility. The large number of Forex trading platforms makes this financial market accessible for

any type of participant: retail investors, investment banks, corporations, etc.

-

Large trading volume. As already mentioned, Forex is the largest financial market: it deals with over

$6 trillion in daily trading volume.

-

Volatility. The Forex market is highly volatile, which, on the one hand, offers Forex traders more

opportunities for potential profits, but, on the other hand, exposes them to higher risks.

Forex Terminology

To get a better understanding of the Forex market and trading currencies, it’s necessary to know some common terms.

Let’s have a look at the most important ones.

-

Bid priceis the highest market price a buyer is ready to pay for a currency.

-

Ask price is the lowest market price a seller is ready to accept for a currency.

-

Spread is the difference between a particular currency pair's bid price and ask price.

-

A pip is the smallest unit of price change in a currency pair.

-

Leverage is the ability to trade with a large amount of capital without having to invest the total

amount of the asset’s value.

-

Currency pair is a quote of two currencies (base currency and quote currency), showing the value of

one currency in terms of the other.

-

Base currency is the first currency in a currency pair.

-

Quote currency is the second currency in a currency pair.

-

Forex account is an account that is used to trade currencies on the foreign exchange market. Forex

trading accounts are opened with brokers that provide traders with trading platforms and tools.

How to Trade Forex

The following steps are important for beginners who want to begin trading on Forex markets.

-

Educate yourself about Forex trading. Trading Forex involves high risks of losing money rapidly

because it is such a volatile financial instrument. It's therefore important to understand the mechanics of

currency trading before you start trading in Forex markets. The best way to do this is by reading books,

taking online courses, seeking advice from professionals, and/or participating in webinars.

-

Choose a broker and open a retail account. Forex trading can be done through a broker. You should

conduct thorough research and find a reliable provider that will meet your trading needs. It’s advised to

opt for a trading platform that is regulated, provides a wide variety of technical tools, and offers

competitive commission rates. Once you've selected a broker, you'll need to open a trading account. This

usually involves providing personal information and proof of identity, as well as funding the account.

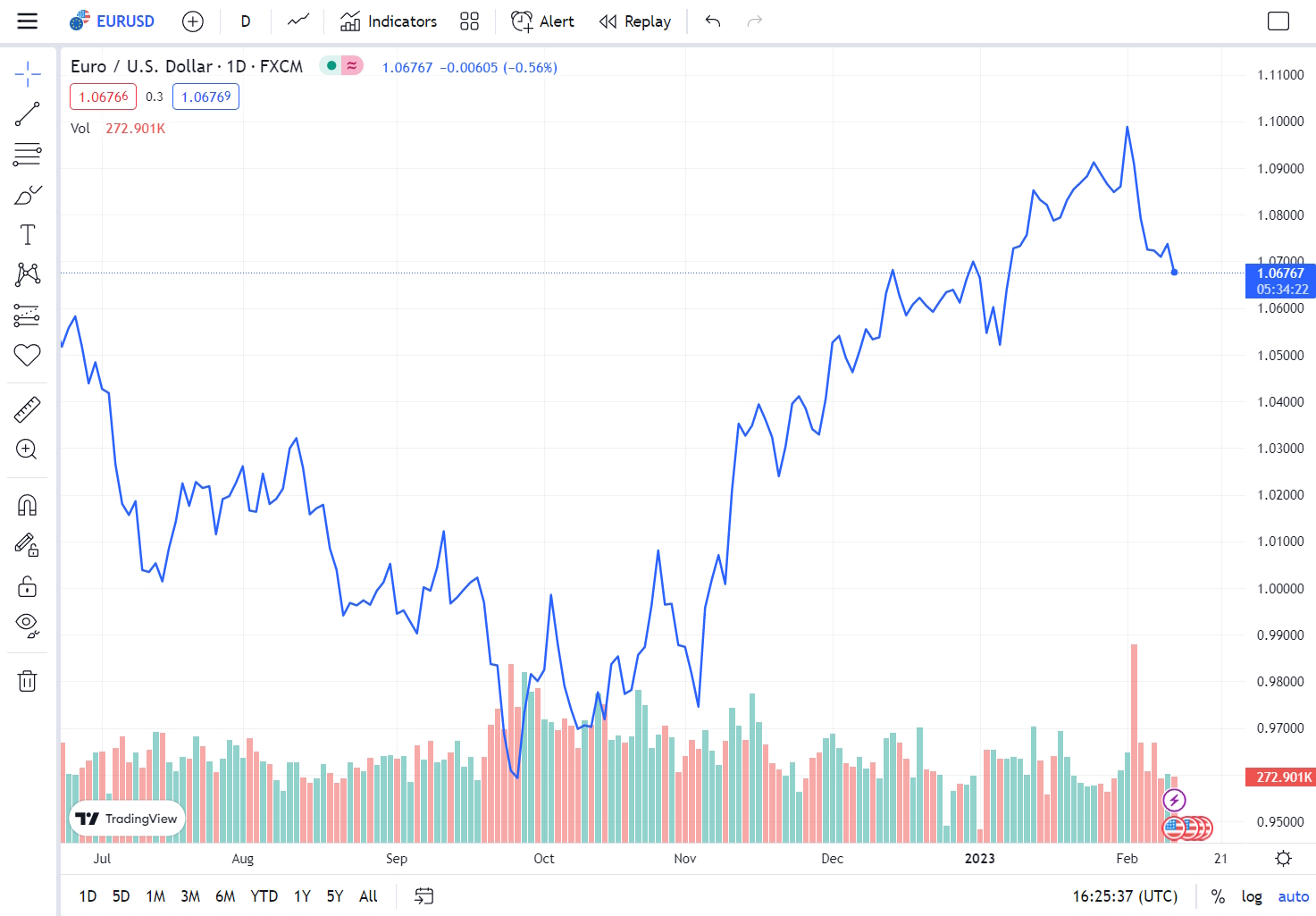

Charts Used in Forex Trading

Forex traders use a wide range of charts to analyze and make trading decisions. The most commonly used charts in

Forex trading are line charts, bar charts, and candlestick charts.

- Line charts. This is the simplest type of chart and plots the closing price of a currency pair over a

specified time period. Line charts can be useful for seeing the overall trend of a currency pair.

-

Bar charts. These are more informative charts in contrast to

line charts. They can provide Forex traders with high, low, open, and close currency prices for a

specified time period. Each bar shows one time period and the vertical lines stand for the price range

for that particular period.

-

Candlestick charts. This chart type is similar to bars but

with a different visual representation. Each "candlestick" stands for one time period, while the body of

the candle shows the price range for that particular period. The color of the candlestick indicates

whether the price moved up or down.

Pros and Cons of Trading Forex

Forex is a highly popular form of investment, but it also has its own set of pros and cons that traders should

consider.

|

Pros

|

Cons

|

-

Market size. The Forex market is the largest financial market in the world, which

means that traders can easily enter and exit trades.

|

-

High risk.Forex trading carries a high risk and can result in large losses in retail

investor accounts if the market turns against the traders.

|

|

2. Liquidity. As it is the largest market, with an extremely high trading volume, Forex assets

are highly liquid.

|

2. Volatility. The foreign exchange market comes with high volatility, which means that

assets’ price movements can be sudden and large. It can be complicated for inexperienced traders to

keep control of such situations.

|

|

3. Accessibility. Forex trading can be done 24 hours a day, 5 days a week.

|

3. Steep learning curve. Forex trading involves a deep understanding of economic and political

factors, as well as technical analysis.

|

|

4. Leverage. It helps Forex traders gain larger

exposure to the market without big initial investments.

|

Forex Trading Examples

As previously mentioned, Forex trading implies buying or selling currency pairs to profit from changes in exchange

rates. Let’s see a real-life example.

Let's take one of the most popular currency pairs: EUR/USD (EUR - base currency, USD - quote currency). Let’s say a

trader thinks the value of the euro will increase relative to the US dollar and the euro will enter a bull market.

At the current exchange rate, 1 euro can be exchanged for 1.20 US dollars. The trader decides to buy 10,000 euros at

this rate, and thus pays $12,000 (10,000 x 1.20).

A few days later, the price of the euro goes up just as the trader expected, and the exchange rate for EUR/USD

increases to 1.25. The trader decides to sell his 10,000 euros at this new exchange rate, which now gets him $12,500

(10,000 x 1.25), so the trader gains a $500 profit.

Forex Basics

Becoming a successful Forex trader requires an understanding of the Forex basics, and a lot of education, practice,

and discipline. To make informed trading decisions and gain potential profits from Forex trades, investors have to

be aware of currency pairs, the use of leverage, risk management and trading strategies, and much more.

Understanding Currency Pairs

A currency pair is a basic block in Forex trading. It is a quotation of the relative value of one currency unit

against another currency unit in the foreign exchange market. The two currencies that make up a currency pair are

referred to as the base currency and the quote currency.

For example, in the currency pair USD/JPY, the US dollar (USD) is the base currency and the Japanese yen (JPY) is the

quote currency. The exchange rate denotes how many Japanese yen a trader needs to buy one US dollar. If the exchange

rate is 130, it means a Forex trader needs to spend 130 Japanese yen to buy 1 US dollar.

Types of Currency Pairs

Currency pairs can be divided into three main types: major currency pairs, minor currency pairs, and exotic currency

pairs.

Major Currency Pairs

What unites major currency pairs is the USD, which can represent either the base or the quote currency. These are the

popular currency pairs, which include EUR/USD, USD/JPY, GBP/USD, USD/CHF, and AUD/USD. These Forex currency pairs

are considered the "majors," because they are traded most frequently and their exchange rates are highly liquid.

Minor Currency Pairs

These are less popular currency pairs that don’t contain the US dollar. Some examples of minor pairs include CAD/JPY

(Canadian dollar and Japanese yen), EUR/GBP (euro and British pound), and EUR/AUD (euro and Australian dollar).

Exotic Currency Pairs

Exotic currency pairs contain one major currency and one less heavily traded currency, such as EUR/TRY (euro and

Turkish lira) or USD/MXN (US dollar and Mexican peso). These currency pairs often have wider spreads and lower

liquidity compared to the major currency pairs.

Risks Every Forex Trader Should Know

Forex trading can be a profitable investment, but it also comes with a number of risks. If an investor doesn’t have

enough trading experience, these risks can make investor accounts lose money.

-

Leverage risk.Forex trading often involves high levels of leverage, which is a complex trading

instrument that can amplify both profits and losses. This means that even a small change in the value of a

currency can result not only in a large potential profit, but also in a significant loss.

-

Interest rate risk. When trading Forex, interest rates play a crucial role in determining the value of

a currency. When countries’ central banks raise interest rates, they can increase demand for the currencies

and cause their value to increase. Conversely, when central banks lower interest rates, they can decrease

demand for their national currencies and cause their value to fall.

-

Lack of regulation. Forex markets are mostly unregulated. This means that there is little protection

for traders in situations such as Forex broker default or market manipulation.

Difference Between Long and Short Positions

When traders want to enter the Forex market, they have a choice between opening a long (buying) position or a short

(selling) position.

A long position is taken when a trader expects that the price of a currency will increase. For example, if a Forex

trader considers that the US dollar will increase in value against the euro, they might go long on the US dollar and

take a profit if their predictions are right.

A short position, in contrast, refers to a trade in which a trader sells a currency with the expectation that its

value will fall. For example, if a trader expects that the euro will decrease in value against the US dollar, they

might go short on the euro and gain profit if the market develops as they predicted.

It is crucial to note that both long and short positions imply risks, and to limit them, Forex traders are advised to

employ effective risk management strategies.

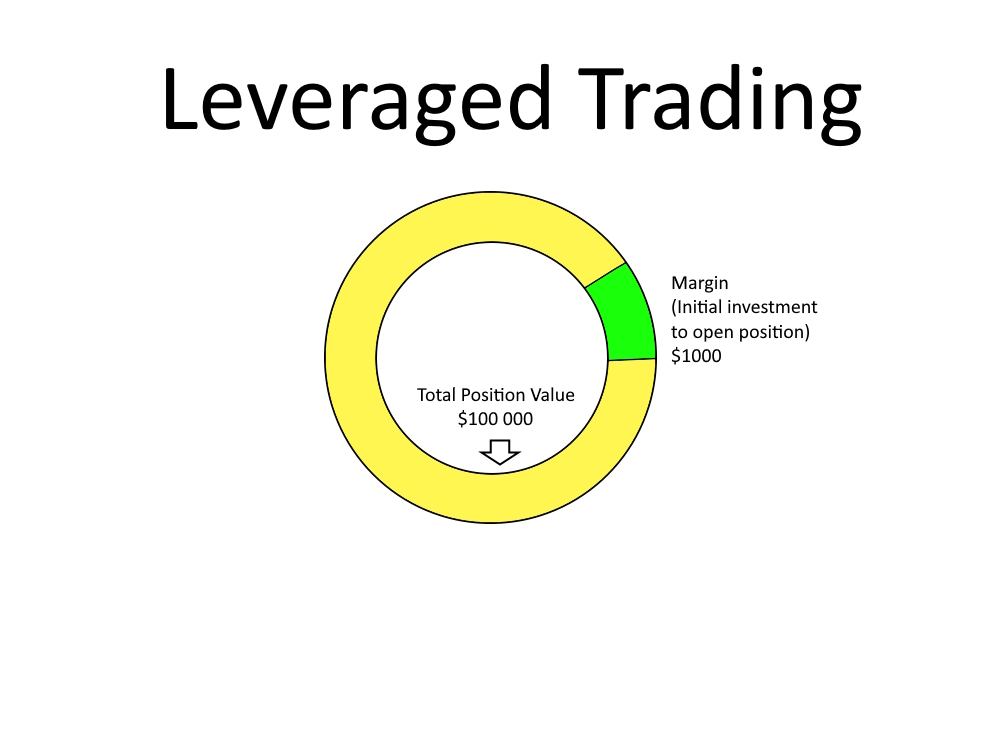

Forex Leverage

Leverage in Forex trading (particularly when spread betting or trading CFDs) refers to the use of borrowed capital.

It’s a complex instrument that can be used to increase traders’ exposure to a currency position, with the aim of

magnifying potential profits. In other words, leverage allows speculators to control a large amount of currency with

a relatively small amount of initial capital. However, it’s crucial to keep in mind that leverage not only increases

the potential profits, but also can lead to drastic losses, especially if a trader doesn’t have enough trading

experience and skills.

Let’s consider an example of leveraged trading. If a trader has $1,000 in their retail investor account and they want

to trade a currency pair with a standard lot size of 100,000 units, they would normally have to outlay the full

asset price of $100,000 to open a position in the market. However, with leverage, the trader can control the same

amount of currency with a smaller capital outlay. If the leverage ratio is 100:1, the trader can control $100,000

worth of assets with just $1,000.

Forex Holding Costs

When trading Forex pairs, holding cost (aka overnight financing or rollover) refers to the cost of keeping a currency

position open overnight. It is calculated as the interest rate differential between the two currencies in the

currency pair. The holding cost can have a significant impact on a trader's profits and losses, especially for those

holding positions for longer timeframes. As such, traders must monitor the market closely and consider the holding

cost when making their trading decisions.

Beginner Forex Trading Strategies

A trading strategy is a set of rules or guidelines that a trader follows when making decisions about buying and

selling currency pairs in Forex markets. A robust trading plan helps traders identify their goals, manage their

risks, and make informed trading decisions. Let’s have a look at some common strategies for foreign exchange

trading.

-

Scalping. This strategy involves taking advantage of small market movements to make quick profits.

Scalpers will enter and exit trades within minutes or even seconds.

-

Trend trading. This strategy involves identifying a trend in the market and making Forex trades in the

direction of that trend. Investors who follow this strategy look for chart patterns and technical indicators

(such as moving averages) to help identify the direction of the trend.

-

Swing trading. This trading strategy involves holding positions for a period of some days or even

weeks, with the goal of capturing medium-term (more than a trading day) price movements in the market. Swing

traders typically use technical trading analysis to identify trade opportunities, and may also pay attention

to economic data releases and central bank policies.

5 Forex Trading Tips for Beginners

Here are some tips to keep in mind when trading Forexcurrency pairs.

-

Continuously educate yourself. Before entering the Forex market, it is important to learn the basics

of currency trading and the factors that influence currency price movements. Moreover, a trader should

understand the basics of technical and fundamental analysis.

-

Develop a Forex trading strategy and stick to it. A robust trading strategy developed in compliance

with your trading style and goals will help to mitigate the risks and bring potentially higher profits.

-

Implement risk management. Use tools such as stop-loss and take-profit orders to limit the risks of a

volatile Forex market and lock in profits.

-

Choose a reliable Forex broker. Opt for a broker that is regulated by a reputable financial authority,

has a good reputation in the industry, and can provide you with a wide range of trading instruments.

-

Diversify your portfolio. Consider investing in a number of currencies to reduce your exposure to any

single currency or economic event.

Where to Trade Forex

The most common way to trade Forex is through an online broker. There is a wide range of Forex brokers on the market

that provide access to the foreign exchange market through software platforms. Just2Trade is one of them.

It’s important to mention that in addition to directly trading currency pairs, many individuals also trade Forex

through Contracts for Difference (CFDs) and spread betting. Both CFDs and spread betting come with a higher degree

of leverage, meaning that traders can control large positions with a relatively small amount of capital outlay.

However, when using these complex financial instruments, traders can also find themselves with large losses, so it's

important to understand the risks involved and manage one's trades carefully.

What Is an Online Forex Broker?

An online Forex broker is a company that provides retail traders with access to the foreign exchange market through

the internet. Online brokers usually provide traders with a variety of services, such as access to the Forex market,

educational resources, and trading tools and platforms.

It’s worth noting that many online brokers offer an opportunity to practice Forex trading in risk-free demo accounts.

This type of account creates a simulated environment where a trader can use virtual funds to get accustomed to a

particular trading instrument or experiment with different Forex trading strategies.

A Forex trading platform is software that enables individual traders to access the foreign exchange market and

execute trades. Brokers usually provide trading platforms in various forms, including desktop platforms, web-based

platforms, and mobile apps. Forex platforms typically offer real-time pricing information, charting and technical

analysis tools, and the ability to execute trades and manage the retail investor account.

Forex Mobile Trading App

A Forex trading mobile app is a mobile application that allows individuals to access the Forex market and trade from

their mobile devices, such as smartphones and tablets. Mobile trading apps typically offer many of the same features

as desktop and web-based platforms. However, their key advantage is that they allow individuals to trade from

anywhere and at any time, providing greater flexibility and convenience.

Fundamental Analysis

Fundamental and technical analysis are the two main approaches to analyzing and making decisions in Forex trading.

Let’s consider their key features.

Fundamental analysis is the study of economic, financial, and other qualitative and quantitative factors to foresee

the future performance of a currency pair.

The Biggest Fundamental Analysis Indicators

Some of the most common fundamental analysis indicators are listed below:

-

Economic indicators such as Gross Domestic Product (GDP), employment data, inflation rates, interest rates,

trade balance, and others

-

Government policies and political events

-

Geopolitical tensions

-

Natural disasters

-

Changes in consumer behavior

-

And more

Technical Analysis

Technical analysis, in contrast to fundamental analysis, is the study of past market data and past performance of the

asset price, which is used to identify patterns and make trading decisions. Technical analysts believe that the past

behavior of the market can be used to predict future price movements. They use charts and technical indicators to

help make their predictions.

The Three Most Popular Technical Indicators in Trading

There are many technical indicators that traders can use when trading Forex, but some of the most widely used are:

-

Moving Averages. These are trend-following indicators, which are commonly used to identify the overall

trend and potential buy and sell trading signals.

-

Bollinger Bands. A volatility indicator that uses standard deviation to set upper and lower bands

around a moving average, Bollinger bands are used to define potential breakouts and trend reversals.

-

RSI (Relative Strength Index). A momentum oscillator that compares the magnitude of recent gains to

recent losses to define whether a currency is overbought or oversold. RSI can help to identify potential

trend reversals.

For your convenience, we have also prepared a table comparing the core features of technical and fundamental

analysis:

|

Feature

|

Technical Analysis

|

Fundamental Analysis

|

|

Approach

|

Study of past market data to identify future price performance

|

Study of economic, financial, and other factors to forecast future performance

|

|

Focus

|

Price and volume data

|

Economic indicators, such as GDP, employment data, inflation rates, and interest rates

|

|

Tools

|

Charts, technical indicators (e.g., moving averages, trend lines)

|

Economic and financial reports, news events, data releases

|

|

Time Horizon

|

Short- to medium-term

|

Long-term

|

Learn Forex Trading

If you're a beginner trader, it's important to take the time to learn the basics of Forex before starting your

trading journey. Forex can be a complex and fast-changing market, and thus without a solid understanding of how it

works and the factors that influence currency values, it can be easy to make mistakes and lose money.

By learning the basics of Forex, including how to read charts, understand technical and fundamental analysis, and

develop a trading strategy, you'll be better equipped to make robust trading decisions. Additionally, many online

Forex brokers offer educational resources and demo accounts, which can be valuable tools for newbies to practice in

a risk-free environment.

FAQ

What is trading?

Trading is the process of buying and selling securities or other financial instruments with the goal of making a

profit. This can be done through various financial markets, such as the stock market, commodities market, or foreign

exchange market. To start trading Forex, you will need to find a reliable online broker, open a trading account,

fund it, and, of course, educate yourself before starting your Forex trading journey.

How do I learn Forex trading?

If you want to get exposure to foreign exchange markets, start by learning the basics of Forex trading, including how

the foreign exchange market works, the different currency pairs, and the factors that influence currency values.

Another good tip is to practice trading in a demo account that allows you to trade with virtual money without

risking your real capital. Last but not least, study technical and fundamental analysis and develop a trading

strategy in compliance with your risk tolerance and trading style.

How do I start Forex trading?

To start Forex trading, choose a reputable broker that offers a trading platform and financial instruments that meets

your needs. Open a trading account, fund it, and start using the trading platform. Practice with a demo account

before starting to trade Forex with real money. Make sure to educate yourself on the basics of Forex trading.

Remember that Forex trading involves high risk, so ensure that you trade only with money you can afford to lose.

Is Forex trading profitable?

Forex trading can be profitable, but it’s crucial to remember that it also involves a significant amount of risk. The

profitability of a Forex trade depends on various factors, such as trading strategy, knowledge and experience, risk

management, and more. There is no guarantee of profits in Forex trading, and it is possible to lose money as well as

make it.

Ready to trade with a world-leading broker?

Just2Trade is one of the leading providers of

brokerage services. It’s a regulated Forex broker that provides traders with direct access to various financial markets,

including foreign exchange. You can easily start trading with Just2Trade by using the web application or downloading the

mobile app.