Oil Analysis and Price Forecast

In 2022 and 2023, the global economy was overwhelmed by geopolitical events, which consequently affected physical oil markets and is taking a toll on production growth of oil around the world. How can it hit both Brent and WTI prices? Will the bull run return, or is the oil price poised to keep falling in 2024 and beyond? Let’s try to forecast crude oil prices based on the current trends and historical cost performance, as well as projections made by well-known agencies and analytical websites.

Table of Contents

A Quick Overview of Oil Price PredictionsWhat Shapes the Cost of Oil in 2023 and 2024?

Oil Forecast Q1 2024: Threats and Hopes

Technical Oil Price Forecast Q1 2024

Oil Brands

Oil Price Prediction for 2024, and 2025-2030

Algorithm-Based (AI) Oil Price Prediction

Oil Price Forecast for the Next 5 Years and Further

Recent Historical Changes in Oil Rates

Conclusion

FAQ

A Quick Overview of Oil Price Predictions

Here is short a rundown of oil pricing scenarios that summarizes all the forecasts mentioned below:

-

Q4 2023: After such a good Q3, it's unclear if the market can reach the $100 threshold. The EIA says WTI will close at around $86, while Brent may surpass $90 by the end of December 2023.

- 2024: The institutional estimate for Brent and WTI has increased to $100 and $95, respectively, due to prolonged reduction in Saudi Arabia's production, as well as anticipations of increased consumption in certain regions.

- 2025-2030 and further: Some believe that a decline in consumption of fossil fuels would result in price reduction. The average cost of Brent is predicted by the EIA to stay above $60 in 2025 and $72 in 2030.

What Shapes the Cost of Oil in 2023 and 2024?

Global oil production is still one of the major factors defining the cost of the asset. However, there are many other aspects that influence oil prices, directly or indirectly.

War and Oil Prices

At the end of 2022, the European Union, the G7, and Australia imposed a price restriction of $60 per barrel on Russian crude oil imports by sea. Previously, they had banned refined oil goods in February 2022.

Russia's seaborne exports have suffered due to these sanctions, but volumes have increased after shifting its trading routes to Asia and Africa. Given that sanctioning partners want to maintain the price limit at least 5% below the current Russian rate, it might affect the country’s shipments of the resource.

Production Limits by OPEC+

OPEC+ members introduced an unanticipated cut of oil output to 1.6 million barrels per day in early April 2023. Reuters projects that this will cause a significant oil production drop by OPEC+ (which includes Russia and a row of countries) to 3.6 mln bpd, which is more than 3.5% of the world's overall consumption.

Worries About the Economy

Investors are beginning to doubt whether oil futures are worth keeping because of ongoing inflation that's been slowing down the US economy and American banks, posing the threat of US debt default. Inflation concerns were acute in March at 3.6%, but they have since declined, partly because traders have accepted the worsening state of economic activity and a slowdown in inflation in the energy industry as oil rates have declined.

The US economy's capacity for future development will be crucial: a hawkish Fed may spark fresh positive momentum in the US currency, which might push WTI above $75.

The US Stock Market

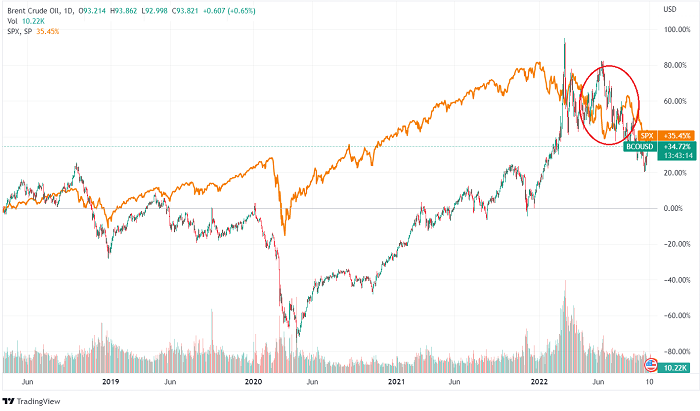

The cost of Brent futures has frequently (but not always) followed the US stock market's movements in the last decade. During the second half of 2020 and 2021, for instance,

Brent rates and the S&P 500, a stock index of publicly listed US businesses, both rose as economic expansion manifested in growing corporate profits and increasing oil demand.

At the beginning of 2022, as worries about the global petroleum supply increased due to the Russian conflict with Ukraine, oil rates and stocks started to move in opposing ways.

Oil Forecast Q1 2024: Threats and Hopes

Oil prices surpassed the $98 mark in September, after Saudi Arabia and Russia extended their voluntary production cutbacks until 2024, and as crude and distillate stockpiles fell to minimal thresholds.

This means that the majority of increases in world production in 2023 and 2024 will come from non-OPEC production countries. OPEC crude oil production is declining this year, despite Iran being on course to overtake the US in growth rates.

Global Oil Supply Projections

The EIA states that OPEC+ oil output is expected to decline to about 38 mln bpd in 2023, which is 1.4 mln bpd lower than in 2022. Afterwards, it predicts the supply to lower further to 37.8 mln bpd in 2024.

The agency also states that global liquid fuel production may grow by 1.3 mln bpd in 2023, and by 0.9 mln bpd in 2024 around the world. In 2023, the rise in non-OPEC extraction was expected to balance the decrease in OPEC production by 2.2 mln bpd. Newly-opened fields in North and South America are the main drivers of the non-OPEC production boost.

Global Oil Demand Projections

The most recent IEA Oil Market Report predicts that global oil consumption will reach 1 mln bpd in 2024, which is more than 50% lower than 1.6 mln bpd in 2023. In contrast, OPEC expects this metric to surpass 2.25 mln bpd in 2024.

Global Oil Inventories Projections

Initially, the EIA predicted that decreased oil stockpiles triggered by production limits and increased demand would drive higher oil rates until the end of 2023. Yet, we see that it is not happening. Oil stockpiles increased by an average of 600k bpd in Q1-Q2 2023, but as OPEC+ works to prevent rises in global oil stockpiles, further voluntary cutbacks, together with other variables, will maintain actual OPEC+ crude oil output far below objectives.

Technical Oil Price Forecast Q1 2024

Weekly Charts

The medium-term horizontal trend channel is what we see for Brent Crude NYMEX. This suggests that investors are unsure of what to do and are waiting for cues to change course.

By breaking through the support level at $84.70, the ‘Head & Shoulders’ pattern sent a bearish signal into the future. A decline to $73.38 or below is indicated. There will be resistance at $77.00 if there are positive replies.

Over the past two weeks, there have been extreme fluctuations in WTI oil prices, ranging from 6% to 8%, as both bulls and bears have struggled with the uncertainty surrounding OPEC+'s potential cuts.

WTI oil rate fluctuations have created two weekly consecutive ‘long-legged Doji’ candlestick patterns. These patterns show signs of hesitation, which might potentially drive prices lower.

Furthermore, since November 16, 2023, the daily RSI momentum indicator has been gradually rising after dipping into its oversold zone.

A bullish breakout may be triggered by a clearance over $79.80 (the neckline resistance of the ‘Inverse Head & Shoulders’) and the crucial short-term support at $74.30.

Daily Charts

Brent crude oil price has been moving in a tight track with a small negative sentiment. As long as the price remains above $75, a bullish micro-trend remains. Traders are waiting to test the important barrier at $77 to define the next trend.

WTI rates are starting to show fresh positive signs that may confirm breaking above the $70.50 mark, indicating a potential recovery in the next sessions, primarily targeting the important resistance level of $73.73. Traders expect the WTI oil price to breach the $70.50 level and maintain a below-average level. A nosedive below $67.04 would activate a negative trend.

Oil Brands

West Texas Intermediate (WTI)

WTI is a light sweet crude oil with a low sulfur content and a high API density. A large part of this resource is stored in Cushing, a key center of Oklahoma's oil sector. WTI is a crucial feedstock for American refineries located in the Midwest and the Gulf of Mexico.

Investors and oil corporations trade WTI oil very actively, especially by using CME Group's futures, one of which is Light Sweet Crude Oil (CL) futures.

Brent Crude Oil

The North Sea's Brent oil field is the source of this asset’s name. It serves as a benchmark for the petroleum rate in Europe, Africa, and the Middle East. This type of oil is also extracted from other fields.

The price movement of WTI and Brent futures is highly correlated, and over the last years, Brent's cost has frequently increased by $10+ over average. The cost discrepancy by the end of 2020 was around $3. These variations result from supply and demand, which also includes transportation and storage expenses.

Oil Price Prediction for 2024, and 2025-2030

EIA

Since OPEC+'s policies have introduced voluntary cuts, the EIA claims that, in the beginning of 2024, global oil consumption will surpass its production, driving up the asset’s prices.

In its October Short-Term Energy Outlook, the agency reviewed its 2024 projection for Brent to $94+. It also renewed its forecast for WTI crude oil, stating that it may reach $90 per barrel, which is $7.70 higher than the previous month's estimates.

Goldman Sachs

The leading crude oil bull stated that Brent crude oil prices would be around $95, and WTI around $90 in December 2023, reaching $97 and $100 in 2024, respectively. This prediction was based on the announcement of voluntary production cuts by Saudi Arabia and several other leading exporters.

The company said that, since OPEC can operate without risking a significant market share, they presently have greater power over pricing than previously, and this surprise production decrease aligns well with their pre-emptive strike philosophy.

Barclays

The Barclays 2024 Brent pricing forecast has become more optimistic, rising to $97 per barrel because it anticipates more tightening of market balances in the near future. This may be caused by non-OPEC+ supply improvements, conditioned primarily by the US, as well as persistent underproduction from several OPEC+ producers due to structural constraints.

Barclays suggests buying a Brent contract at $90-$95 per barrel on January 2024 at a net cost of $1.10 per barrel, based on its expectation of a 670 thousand barrel-per-day (kb/d) supply deficit in 2023, and 250 kb/d in 2024.

Citi Oil

According to Citi, the amount of oil used will increase by 1.2 to 1.3 mln bpd in the upcoming year. According to a basic scenario, supply should double during the upcoming year, with a number of South American countries accounting for a sizable portion of that growth. Citi expects oil rates to stay in the same range as now.

JPMorgan

Their Brent projection of $90 is based on the assumption that the OPEC+ coalition will play a major role in maintaining market equilibrium in the upcoming year. When Russian output completely normalizes, and a combination of conventional (Brazil, Norway, Guyana) and nonconventional projects (US, Canada, Argentina) starts delivering an extra 1.6 mln bpd, they anticipate that supply will expand 30% faster than demand in 2023.

OPIS

In 2023, OPIS stated that the rates of $90 for WTI and $96 for Brent were a realistic forecast. The extent to which these figures surpass the forecast will be determined by China's economic revival and the capacity of Western nations to avert a major default.

Infrastructure Capital Advisors

This agency calls China the key player on the market, because it was expected to recover after the COVID-imposed havoc in its economy, and restore oil demand to previous levels. The ICA also said that oil will trade within the $80-$100 range as long as the Ukrainian war keeps going.

Reuters

According to a Reuters survey conducted at the beginning of 2023, oil prices were expected to rise slightly because of a slowing global economy, COVID outbreaks, and threats to demand levels. These factors will also counteract the effects of global crude oil supply shortages brought by sanctions imposed on Russia. Their forecast for the end of 2023 was a bit more precise than other agencies’ predictions: WTI was expected to close at $84, down from the $87 in their previous statement.

BCA Research

BCA provided a bullish Brent spot price prediction of $115 per barrel with an upward skew through the year. This is partially motivated by their belief that, following a disorganized beginning to the reopening of the economy, China will manage to recover anyway.

ING

The Dutch Bank had negative projections for the global oil industry in 2023 because of reduced Russian oil output and OPEC+ production restrictions. According to ING, the shortfall will widen during the year, meaning oil rates may rebound from their present positions.

ING projected that Brent would reach the $104 level over 2023, but they also noted that, given the current state of world politics and the trajectory of the economy, there is a great risk of miscalculations in their estimate.

Algorithm-Based (AI) Oil Price Prediction

By the end of Q4, experts from Trading Economics anticipate that Brent should trade at around $77. The WTI price is expected to be around $73 by December 2023.

Long Forecast’s predictions state that WTI will end 2023 at $66.35 with a maximum price of $77.29 in December, while Brent will end 2023 at $71.28 with a maximum price of $84.71 in December.

Wallet Investor’s forecast is more realistic: the WTI price will be around $68.30 with a maximum price of $70.50 in December 2023, while Brent may end this year at the level of $79.10.

Oil Price Forecast for the Next 5 Years and Further

Some experts are sure that in the mid to long term, there may be less demand for fossil fuels, which could trigger a serious reduction in oil prices in ten years. Hence, it is generally anticipated that oil will cost less than $100 in 2030.

In its annual report, the EIA stated that it maintained a cautious expectation for oil prices in 2030. As of 2025, it projects that the average price of Brent crude oil will be $73 in 2030, $80 in 2035, $87 in 2040, $91 in 2045, and $95 in 2050.

According to energy firm Wood Mackenzie, the oil price in 2030 might drop to as low as $40 per barrel if fuel usage gets reduced by emission limits established to curb global warming.

Recent Historical Changes in Oil Rates

Here are the major events and market sentiments that shaped the cost of the asset over the last few years.

What Happened in 2023

September began with oil rates plunging sharply once again. At the same time, the US stock markets experienced a minor default, reducing the price of the asset by almost 15%. That was the first time since July, when there was a price nosedive below $40 once more. A portion of the decline can be attributed to Saudi Arabia's October sales rates reduction, as well as concerns over a sharp rise in COVID-19 morbidity in a number of nations.

It appears that certain refineries wish to keep oil supplies from reaching all-time highs, as seen by their decision to reduce tariffs once again. The agreements concluded by OPEC+ member nations regarding supply reductions have allowed oil rates to rebound dramatically in recent weeks.

March 9th, 2020: 30% Oil Price Crash

March 9th, 2020 is called "Black Monday" in oil history. Russia and Saudi Arabia had not achieve any progress in their negotiations And the situation was aggravated by the COVID-19 outbreak, which could not but affect oil rates. The demand significantly decreased under such pressure.

Saudi Arabia was planning to pump more oil into the market and raise output significantly. Consequently, the opening price fell by 30%, which was the worst performance since 2016.

April 21st, 2020: WTI Goes Below Zero

In April 2023, the May contract for WTI oil fell by almost 100%. Oil companies would in fact make payouts for purchasers to collect the commodity as the rate dropped within a few hours and then experienced an unparalleled decline to $ -37.63 per barrel during the day.

The primary reason for this was Cushing’s capacity being full. Large corporations and traders were unable to buy oil due to a lack of storage capacity, so they had to cancel their futures until they expired.

Shale Oil Influence

OPEC viewed the Middle East's growing supply as a rivalry, and devised a plan to completely open the oil taps. Shale oil extraction came at a far greater cost. As a result, oil prices fell from over $110 per barrel to less than $30 at the start of 2016. By doing so, OPEC aimed to eradicate shale farmers.

However, they eventually experienced severe setbacks as a result of that decision — their profits fell by more than half. Meanwhile, the shale producers started to gain profits at lower oil prices because they found a strategy to boost efficiency at lower budgets.

OPEC Influence

The goal of OPEC output restrictions is to maintain a fair cost for the asset. Oil prices that are somewhat higher, but still consistent, are beneficial to most countries. In a 20-year perspective, the oil sector needs to make investments worth over $11,000 bln, according to OPEC. It also claims that, despite the introduction of electric vehicles and similar products, demand is still rising.

Conclusion

As a source of energy and a critical commodity around the world, oil is expected to be in high demand in the coming years. However, price growth is under question, because the major exporters are boosting crude oil production rates and rolling out all their supplies, setting prices that OPEC does not approve of. Hence, it is not likely that the cost of oil will surpass and stay above the $85 threshold.

FAQ

Are oil prices expected to go higher?

In a one-year perspective, this remains a big question, because the world’s biggest economies are undergoing a decline. In the most optimistic scenario, oil prices can grow by a few dollars. In this case, Brent oil is likely to trade within the $70-78 range.

Will oil hit $100?

According to forecasts by the major agencies and technical analysis platforms, this is not going to happen in the next five years. However, the price may hit $100 in 2030 and beyond if oil continues being a major source of energy.

What is the forecast for oil prices?

The majority of price forecast makers agree that a bull run is unlikely to happen for both Brent and WTI crude oil prices. Oil prices should stay in pretty much the same range ($65-$80) for global oil markets to recover from the shock of the last few years.

Are oil prices expected to rise in 2024?

Even if oil prices rise, there won’t be a significant breakthrough. Judging by the majority of price predictions, 5-10% is the maximum growth we can count on.

Will the oil price recover?

This is not likely to happen in 2024; however, if the global economy manages to recover in the coming years, tangible price growth may be witnessed somewhere after 2025.

Why did the oil price drop in 2020?

This happened because Cushing (Oklahoma's storage capacity) was full and producers had nowhere to deliver the newly-extracted oil. As a result, investors and traders had to sell their oil futures, which caused the market to crash.