PKN Orlen (PKN) stock forecast for 2024, 2025 - 2030

PKN Orlen is one of the biggest energy firms in Poland and Central Europe. Its areas of expertise include polymers, chemical goods, fuel oil, diesel fuel, and gasoline manufacturing (production and refining). Along with running a network of filling stations throughout Poland and beyond, it also retails petrol under its own brand. In this article, you can see PKN Orlen shares forecasts for 2024 and beyond. You will also get insights into its historical performance, as well as ways to predict the PKN price.

Table of Contents

About PKN Orlen stock price forecast

Short-term PKN Orlen shares forecast 2024

PKN Orlen technical analysis

PKN Orlen Stock Price History

PKN Orlen Stock Price Forecast for 2025

PKN Orlen Stock Price Forecast for 2026

PKN Orlen Stock Price Forecast for 2027

PKN Orlen Stock Price Forecast for 2028

What Affects the PKN Orlen Stock Price?

How to predict the PKN Orlen Stock Price

Conclusion

FAQs

About PKN Orlen stock price forecast

Before we plunge into the PKN forecast, here is a general overview of the stock and experts’ stance for 2024:

-

The current price of PKN is 63.21 PLN.

- Analysts expect PKN to cost almost 74 PLN by the end of 2024, and in 2029, it may even reach 124 PLN.

- Technical indicators on 1-hour graphs show Sell signals, while on a 1D timeframe, Strong Buy signals.

Throughout 2024, PKN is expected to lose positions – its price may gradually reduce to the level of 62 PLN.

In 2025, whe negative trend may continue, with prices falling to the 60 PKN level. So far, there are no circumstances or prerequisites for the stock to reverse its downside movements.

Short-term PKN Orlen shares forecast 2024

Since the Polish economy, and the European economy in general, show no serious signs of growth, 2024 is expected to be relatively stable for PKN. The stock may lose anywhere from 1% to 1.5% of its price, ending the year at the level of 61-62 PLN.

| Date |

Min price |

Max price |

Change |

| April 2024 |

63.514 |

65.274 |

1.44 % ▲ |

| May 2024 |

63.675 |

64.366 |

-0.19 %▼ |

| June 2024 |

63.146 |

64.540 |

-1.91 %▼ |

| July 2024 |

62.831 |

63.220 |

-0.23 %▼ |

| August 2024 |

61.118 |

62.717 |

-2.62 %▼ |

| September 2024 |

60.852 |

61.249 |

0.31 % ▲ |

| October 2024 |

61.367 |

62.461 |

1.64 % ▲ |

| November 2024 |

62.430 |

63.433 |

0.92 % ▲ |

| December 2024 |

62.219 |

62.977 |

0.03 % ▲ |

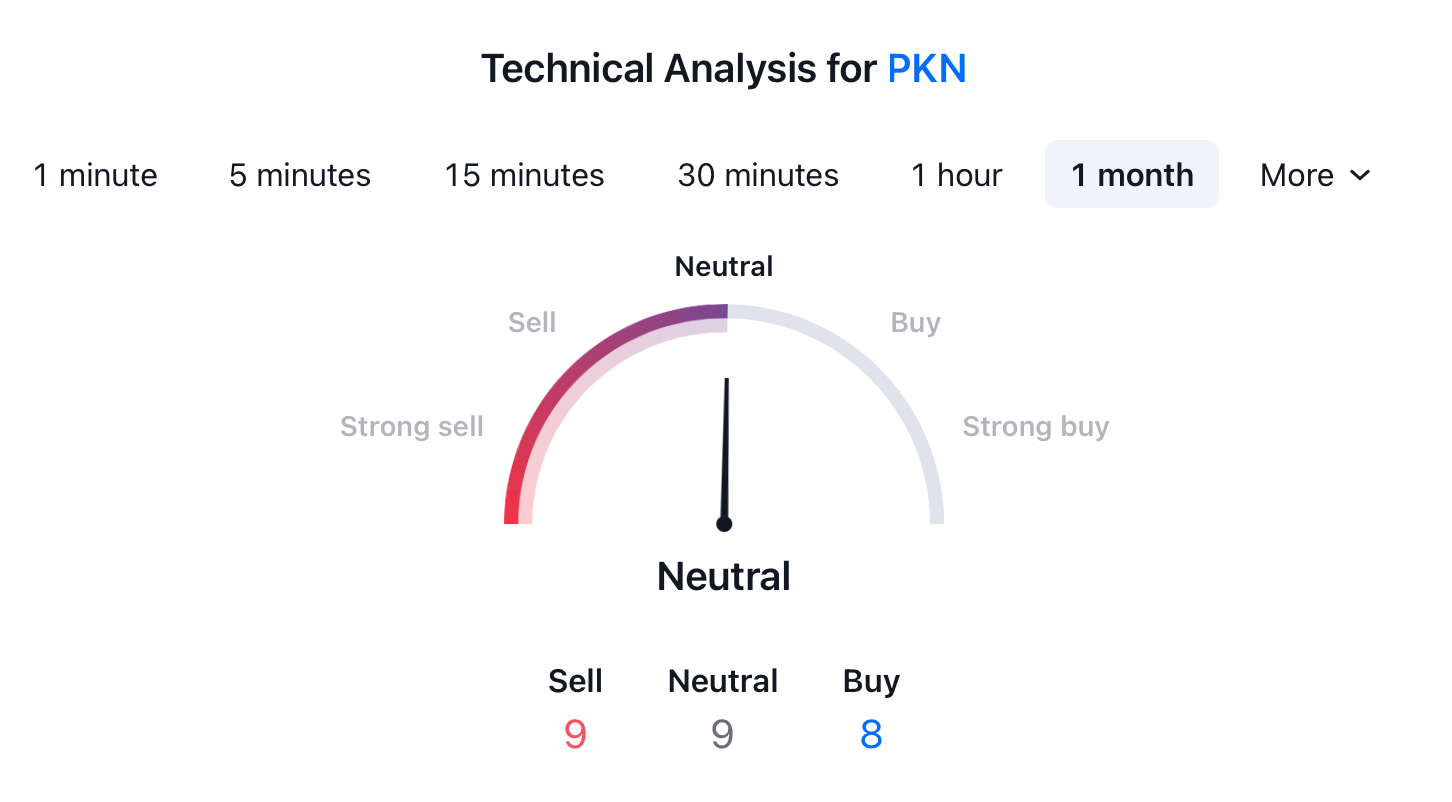

PKN Orlen technical analysis

PKN has gone through a shift in momentum, which hints at a potential downturn in the short or medium term.

Volume and Momentum Analysis

Volume trends in the last several days point to a slowdown in market activity and a decline in trust in PKN cost movements. This volume drop is consistent with the decreasing momentum, suggesting that the upswing may be coming to an end.

Tech Indicators

There is increasing downward pressure as the price action exhibits symptoms of weakness. The declining volume and waning momentum point to the possibility that PKN is about to enter a downturn.

Since PKN suggests a possible change in direction, traders should proceed carefully. To reduce risks, it's critical to keep a careful eye on price changes and be ready to modify methods as necessary.

Analyzing a 1-month timeframe, there is no clear trend, and no buy or sell signals. Traders are also indecisive, and aren’t hurrying to invest in PKN elong terms.

PKN Orlen Stock Price History

2023 was full of upward and downward price swings – The PKN price changed by as much as 10% and 13%, which is quite volatile for a regular stock such as this. Despite all the sudden movements, the price stayed pretty much the same, growing by one half of a Polish złoty.

| Date |

Price |

Open |

High |

Low |

Change % |

| 12/01/2023 |

65.50 |

59.10 |

67.17 |

58.61 |

+10.94% |

| 11/01/2023 |

59.04 |

67.50 |

67.59 |

58.40 |

-11.22% |

| 10/01/2023 |

66.50 |

58.72 |

69.16 |

54.43 |

+13.29% |

| 09/01/2023 |

58.70 |

63.00 |

64.19 |

57.80 |

-6.90% |

| 08/01/2023 |

63.05 |

71.40 |

71.46 |

61.37 |

-11.81% |

| 07/01/2023 |

71.49 |

64.50 |

71.72 |

62.86 |

+10.99% |

| 06/01/2023 |

64.41 |

60.81 |

67.26 |

60.70 |

+7.01% |

| 05/01/2023 |

60.19 |

63.12 |

65.05 |

59.60 |

-5.09% |

| 04/01/2023 |

63.42 |

58.96 |

65.06 |

58.04 |

+8.89% |

| 03/01/2023 |

58.24 |

66.66 |

67.60 |

53.38 |

-12.63% |

| 02/01/2023 |

66.66 |

64.94 |

66.86 |

61.50 |

+2.68% |

| 01/01/2023 |

64.92 |

64.24 |

67.60 |

61.10 |

+1.06% |

The recent PKN price history shows downward movement from 65 PLN to 63 PLN. PKN is expected to continues losing its positions.

| Date |

Min price |

Max price |

| 2024-03-15 |

63.750 |

64.700 |

| 2024-03-14 |

63.440 |

64.170 |

| 2024-03-13 |

61.550 |

62.380 |

| 2024-03-12 |

61.840 |

62.640 |

| 2024-03-11 |

62.100 |

62.680 |

| 2024-03-08 |

62.640 |

63.050 |

| 2024-03-07 |

62.050 |

62.500 |

| 2024-03-06 |

62.730 |

63.160 |

| 2024-03-05 |

61.110 |

62.010 |

| 2024-03-04 |

62.050 |

63.740 |

| 2024-03-01 |

62.720 |

63.370 |

| 2024-02-29 |

61.980 |

63.440 |

| 2024-02-28 |

63.880 |

65.660 |

| 2024-02-27 |

65.520 |

66.290 |

PKN Orlen Stock Price Forecast for 2025

Throughout 2025, the PKN price will keep moving downwards, and is likely to reach the 60.0 support level. Generally, no large price fluctuations are expected.

| Date |

Min price |

Max price |

Change |

| January 2025 |

61.056 |

63.442 |

-3.15% ▼ |

| February 2025 |

60.244 |

60.976 |

0.19% ▲ |

| March 2025 |

59.821 |

61.118 |

0.68% ▲ |

| April 2025 |

61.439 |

63.090 |

1.36% ▲ |

| May 2025 |

61.493 |

62.133 |

-0.19% ▼ |

| June 2025 |

60.877 |

62.339 |

-2.06% ▼ |

| July 2025 |

60.623 |

61.053 |

-0.59% ▼ |

| August 2025 |

58.963 |

60.449 |

-2.52% ▼ |

| September 2025 |

58.677 |

59.208 |

0.51% ▲ |

| October 2025 |

59.145 |

60.192 |

1.51% ▲ |

| November 2025 |

60.385 |

61.251 |

0.81% ▲ |

| December 2025 |

60.031 |

60.858 |

-0.09% ▼ |

PKN Orlen Stock Price Forecast for 2026

According to WalletInvestor’s AI-based PKN Orlen forecasts, the stock price will go below the 60 PLN threshold, which may trigger a serious long-term downtrend.

| Date |

Min price |

Max price |

Change |

| January 2026 |

59.063 |

61.294 |

-2.78% ▼ |

| February 2026 |

58.074 |

58.778 |

-0.04% ▼ |

| March 2026 |

57.647 |

59.044 |

0.80% ▲ |

| April 2026 |

59.220 |

60.883 |

1.38% ▲ |

| May 2026 |

59.297 |

59.866 |

-0.15% ▼ |

| June 2026 |

58.761 |

60.159 |

-1.79% ▼ |

| July 2026 |

58.354 |

58.878 |

-0.79% ▼ |

| August 2026 |

56.752 |

58.217 |

-2.45% ▼ |

| September 2026 |

56.495 |

57.022 |

0.25% ▲ |

| October 2026 |

56.920 |

57.927 |

1.55% ▲ |

| November 2026 |

58.111 |

59.061 |

0.89% ▲ |

| December 2026 |

57.853 |

58.736 |

-0.53% ▼ |

PKN Orlen Stock Price Forecast for 2027

During 2027, a minor price deflation can occur. An AI forecast claims that the PKN price will fall from 57 PLN to 55.6 PLN.

| Date |

Min price |

Max price |

Change |

| January 2027 |

57.081 |

59.123 |

-2.31% ▼ |

| February 2027 |

55.866 |

56.643 |

-0.35% ▼ |

| March 2027 |

55.437 |

56.825 |

0.70% ▲ |

| April 2027 |

56.924 |

58.664 |

1.49% ▲ |

| May 2027 |

57.110 |

57.680 |

0.21% ▲ |

| June 2027 |

56.655 |

57.987 |

-2.07% ▼ |

| July 2027 |

56.250 |

56.698 |

-0.57% ▼ |

| August 2027 |

54.597 |

56.132 |

-2.43% ▼ |

| September 2027 |

54.304 |

54.793 |

0.09% ▲ |

| October 2027 |

54.693 |

55.667 |

1.66% ▲ |

| November 2027 |

55.837 |

56.861 |

1.37% ▲ |

| December 2027 |

55.676 |

56.571 |

-0.80% ▼ |

PKN Orlen Stock Price Forecast for 2028

In 2028, the PKN price may fall from 54.6 PLN to 53.3 PLN. However, this technical analysis is very long term, so it is far from accurate. In such a distant future, there may be many factors shaping its cost.

| Date |

Min price |

Max price |

Change |

| January 2028 |

54.631 |

56.946 |

-3.16% ▼ |

| February 2028 |

53.677 |

54.633 |

-0.43% ▼ |

| March 2028 |

53.253 |

54.595 |

0.39% ▲ |

| April 2028 |

55.116 |

56.516 |

1.06% ▲ |

| May 2028 |

54.933 |

55.683 |

0.38% ▲ |

| June 2028 |

54.299 |

55.811 |

-2.48% ▼ |

| July 2028 |

53.964 |

54.509 |

-0.43% ▼ |

| August 2028 |

52.441 |

54.044 |

-3.02% ▼ |

| September 2028 |

52.113 |

52.564 |

0.24% ▲ |

| October 2028 |

52.582 |

53.788 |

2.24% ▲ |

| November 2028 |

53.838 |

54.681 |

0.85% ▲ |

| December 2028 |

53.495 |

|

-0.61% ▼ |

What Affects the PKN Orlen Stock Price?

Since PKN Orlen is a major oil and gas company based in Poland, the cost of this stock depends on the local economy and industry to a large extent. However, these are not the only aspects that matter. Basically, there are two main categories of factors: internal and external.

Internal factors:

-

The company’s financial performance, including its profitability, revenue growth, and operational efficiency. If PKN Orlen generates strong profits and maintains a stable revenue growth, investors will be more likely to invest in the stock, which will naturally lead to a price boost.

- Strategic decisions, such as acquisitions, mergers, and investments in new projects. Successful decisions contribute to the company's growth: investors become more confident in the stock, and their purchases drive the growth in the price.

External factors:

-

Global oil and gas market. Changes in oil prices, as well as supply and demand, can have a significant impact on the company's financial performance and, consequently, its stock price. For example, if oil prices rise, it can lead to higher profits for PKN Orlen.

- Economic conditions, both in Poland and globally. Growth, inflation, interest rates, and other macroeconomic factors influence investor sentiment and company performance.

- The political and regulatory environment, both in Poland and internationally. For example, changes in taxation, environmental regulations, or trade rules can impact the company's operations and financial performance.

How to predict the PKN Orlen Stock Price

First of all, to make reliable PKN orlen shares forecasts, traders should perform a fundamental analysis:

-

Analyze PKN Orlen's financial statements, including balance sheets, income statements, and cash flow statements, in order to assess the company’s financial health, earnings growth, and profitability.

- Study the oil and energy industry trends, PKN Orlen's market share, competition, regulatory environment, and potential growth drivers or risks.

- Monitor macroeconomic indicators such as oil prices, interest rates, GDP growth, and inflation rates.

Then comes the technical analysis of the stock:

-

Technical analysis tools can help investors identify patterns such as moving averages, support and resistance levels, trendlines, and chart patterns (head and shoulders, hammers, flags, and triangles).

- Technical indicators like Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Bollinger Bands, and stochastic oscillators serve to identify potential buy or strong sell signals.

- It’s also important to analyze trading volume patterns to confirm price movements and assess the strength of a trend.

Conclusion

If you are looking for conservative assets to trade, PKN Orlen can be a decent choice, because it is not prone to significant volatility within a day. Plus, no major price shifts are expected in 2024. However, if you want to invest in prospective stocks, this is not the best time to buy PKN, because forecasts are rather negative.

FAQs

Will the PKN stock price drop / fall?

AI-generated technical analysis suggests that PKN will keep losing its value, both in 2024, and in the longer term. We may witness a PKN price of 62.9 by the end of this year. In 2025, it may even go below the 60.0 psychological threshold, which may trigger negative investing sentiment.

Will the PKN stock price crash?

There are no signs of PKN Orlen bankruptcy – the company is functioning normally, and investors keep buying their stocks. Hence, the chance of a PKN stock price crash is almost non-existent.

Will the Polski Koncern Naftowy ORLEN stock price hit the 100 PLN price in a year?

This is not likely, because the majority of PKN forecasts are pessimistic: the stock price is expected to keep lowering by 1-2% every year. Besides, a huge volume of money input would be needed for such a large price boost.

Will the Polski Koncern Naftowy ORLEN stock price hit the 200 PLN price in a year?

This is not likely, because the majority of PKN forecasts are pessimistic: the stock price is expected to keep lowering by 1-2% every year. Moreover, the price of 200 PLN is even more unrealistic in the perspective of one year.

How many shares does PKN Orlen have?

As of March 2024 (the time of writing this article), PKN Orlen has 1,162,416,107 shares, which make a market cap of 73.348 bln PLN.