Silver Price Prediction

Forecasting the future price of silver is a topic of great interest for investors, traders, and enthusiasts alike. As silver holds a significant place in the global economy and finds use in various industries, understanding its potential price trajectory provides valuable insights for informed decision-making. In this article, we delve into silver price forecasts spanning the years 2023 to 2030.

Table of Contents

What does the price of silver depend on?

Silver Price Forecast 2024

Silver Price Prediction 2025

Silver Price Forecast 2026

Silver Price Forecast 2027

Silver Price Forecast 2028

Silver Price Forecast 2029

Silver Price Forecast 2030

Ways to forecast the price of silver

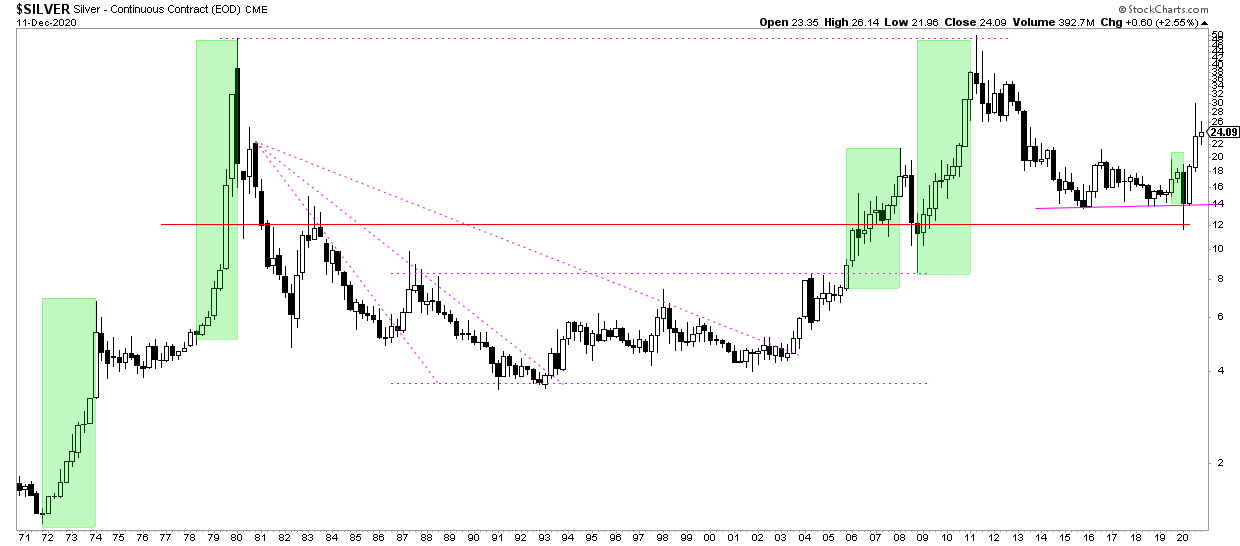

Silver price history chart for 10-20-50 years

Long-term silver price prediction chart for 10 years

Silver Forecast - Fundamental Outlook 2024

Silver Technical Outlook

FAQ

What does the price of silver depend on?

It is not only the economic situation that determines silver prices and makes forecasting them difficult. The value of this precious metal depends on:

-

Interest rates;

- Geopolitical situation;

- Inflation rates;

- Economic situation in the industry.

Silver is a metal used in the jewelry industry. However, other companies (such as tech producers) are increasingly willing to use it. Silver is used, among others, by the photovoltaic and automotive industries (mainly in electromobility).

Silver Price Forecast 2024

The 2024 silver market forecast indicates a year marked by slight initial volatility. Overall, analysts agree that the price for silver in 2023 will be around $24-$26 per ounce.

Despite slight fluctuations and variations in forecasts from different sources, the silver prediction in 2024 has a positive outlook, likely driven by factors including market demand, investment trends, and economic indicators.

The silver price forecast for 2024 according to Walletinvestor.com is as follows:

| Date |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

| April 2024 |

24.274 |

24.186 |

24.186 |

24.602 |

| May 2024 |

24.154 |

23.709 |

23.564 |

24.154 |

| June 2024 |

23.762 |

23.166 |

23.166 |

23.777 |

| July 2024 |

23.172 |

23.973 |

23.167 |

23.973 |

| August 2024 |

23.960 |

24.300 |

23.846 |

24.300 |

| September 2024 |

24.423 |

23.349 |

23.349 |

24.475 |

| October 2024 |

23.313 |

23.502 |

23.228 |

23.518 |

| November 2024 |

23.461 |

23.450 |

23.422 |

23.505 |

| December 2024 |

23.458 |

23.433 |

23.279 |

23.458 |

The short-term silver price prediction suggests a stable trend, with anticipated slight incremental gains over the coming months. This pattern indicates a consistent yet modest upward trajectory in the market, reflecting steady investor confidence and a balanced supply-demand dynamic.

The detailed data below from CoinPriceForecast provides specific figures, showcasing the expected gradual rise in silver prices, aligning with a cautiously optimistic market outlook for the near future.

- Monday, Mar 18 - $25.41

- Tuesday, Mar 19 - $25.41

- Wednesday, Mar 20 - $25.41

- Thursday, Mar 21 - $25.41

- Friday, Mar 22 - $25.41

- Saturday, Mar 23 - $25.41

- Sunday, Mar 24 - $25.41

- Monday, Mar 25 - $25.41

- April 15 - $25.43

- May 15 - $25.45

- June 15 - $25.47

- July 15 - $25.67

- August 15 - $26.05

Here’s a concise summary of what industry specialists forecast the price of silver to be in 2024:

Physical Gold

-

Predicts silver prices will reach around $27 per ounce.

- Highlights that physical silver demand climbed due to technological advancements and a narrowing Gold:Silver ratio.

Goldman Sachs

-

Expects silver to average $29.50 per ounce.

- Points to strong annual demand for industrial metals, especially for green technologies, and limited mine supply.

Bank of America

-

Forecasts an average price of $30 per ounce.

- Cites higher inflation, a weaker US dollar, and strong investor demand as key drivers.

Reuters

-

Anticipates silver will be priced at $25 per ounce.

- Suggests growth may be modest unless there’s a cut in interest rates by the Federal Reserve.

Capital Economics

-

Projects an average price of $27 per ounce.

- Attributes expectations to robust industrial demand, particularly in green tech, and slow mine supply growth.

BTCC

-

Provides a broad forecast range of $18 to $50 per ounce.

- Notes the influence of inflation, interest rates, the US dollar, and overall market sentiment, acknowledging the cyclical nature of silver prices.

Silver Price Prediction 2025

As we look towards the silver price prediction for 2025, the general sentiment among industry experts and market analysts remains optimistic. However, it's important to note that this bullish trend is not expected to be a smooth ride, with various fluctuations anticipated throughout the year.

The silver price forecast for 2025 by WalletInvestor shows the stability of this asset, with prices ranging from $23.078 to $24.528. Let’s have a closer look.

| Date |

Opening price |

Closing price |

Minimum price |

Maximum price |

| January 2025 |

23.469 |

23.736 |

23.457 |

23.766 |

| February 2025 |

23.796 |

24.248 |

23.796 |

24.267 |

| March 2025 |

24.314 |

24.177 |

24.107 |

24.339 |

| April 2025 |

24.191 |

24.145 |

24.145 |

24.528 |

| May 2025 |

24.083 |

23.621 |

23.499 |

24.083 |

| June 2025 |

23.683 |

23.105 |

23.105 |

23.705 |

| July 2025 |

23.094 |

23.889 |

23.078 |

23.898 |

| August 2025 |

23.852 |

24.180 |

23.761 |

24.180 |

| September 2025 |

24.316 |

23.279 |

23.279 |

24.392 |

| October 2025 |

23.266 |

23.395 |

23.170 |

23.450 |

| November 2025 |

23.408 |

23.383 |

23.349 |

23.435 |

| December 2025 |

23.396 |

23.375 |

23.203 |

23.396 |

DigitalCoinPrice has a more optimistic analysis:

| Month |

Minimum Price |

Average Price |

Maximum Price |

| Jan 2025 |

$54.24 |

$56.41 |

$58.19 |

| Feb 2025 |

$54.49 |

$55.60 |

$58.13 |

| Mar 2025 |

$53.85 |

$62.42 |

$64.56 |

| Apr 2025 |

$53.49 |

$55.05 |

$59.17 |

| May 2025 |

$54.58 |

$56.02 |

$56.55 |

| Jun 2025 |

$54.59 |

$58.15 |

$61.34 |

| Jul 2025 |

$54.34 |

$60.92 |

$62.80 |

| Aug 2025 |

$53.51 |

$54.44 |

$58.08 |

| Sep 2025 |

$53.54 |

$58.12 |

$60.33 |

| Oct 2025 |

$54.04 |

$62.07 |

$64.72 |

| Nov 2025 |

$54.58 |

$59.23 |

$60.42 |

| Dec 2025 |

$53.87 |

$65.01 |

$65.96 |

Silver Price Forecast 2026

Experts across the board share a positive outlook on silver price prediction in 2026. However, there is a spectrum of expectations; while some analysts are measured in their forecasts, anticipating steady but moderate gains, others project a more radiant growth story, envisioning silver as a standout asset in the commodities market.

According to the WalletInvestor forecast, the silver price will continue trading at approximately the same level as in 2025.

| Date |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

| January 2026 |

23.381 |

23.652 |

23.362 |

23.684 |

| February 2026 |

23.710 |

24.155 |

23.710 |

24.172 |

| March 2026 |

24.229 |

24.095 |

24.026 |

24.260 |

| April 2026 |

24.132 |

24.073 |

24.073 |

24.446 |

| May 2026 |

23.987 |

23.531 |

23.432 |

23.987 |

| June 2026 |

23.600 |

23.029 |

23.029 |

23.628 |

| July 2026 |

23.041 |

23.780 |

22.996 |

23.817 |

| August 2026 |

23.802 |

24.203 |

23.682 |

24.203 |

| September 2026 |

24.230 |

23.234 |

23.234 |

24.327 |

| October 2026 |

23.190 |

23.328 |

23.082 |

23.380 |

| November 2026 |

23.343 |

23.332 |

23.273 |

23.362 |

| December 2026 |

23.320 |

23.287 |

23.130 |

23.330 |

DigitalCoinPrice is much more positive in its silver prediction for 2026. According to their forecast, the silver price is going to reach a maximum of $92.73 throughout this year.

| Month |

Minimum Price |

Average Price |

Maximum Price |

| Jan 2026 |

$75.04 |

$76.72 |

$89.02 |

| Feb 2026 |

$74.58 |

$80.95 |

$87.79 |

| Mar 2026 |

$73.90 |

$87.00 |

$92.73 |

| Apr 2026 |

$74.73 |

$78.60 |

$81.61 |

| May 2026 |

$74.61 |

$81.59 |

$84.80 |

| Jun 2026 |

$74.41 |

$83.27 |

$88.85 |

| Jul 2026 |

$74.21 |

$76.92 |

$80.65 |

| Aug 2026 |

$74.36 |

$76.62 |

$79.75 |

| Sep 2026 |

$74.39 |

$81.66 |

$84.67 |

| Oct 2026 |

$74.63 |

$76.19 |

$78.00 |

| Nov 2026 |

$74.68 |

$75.90 |

$79.25 |

| Dec 2026 |

$74.38 |

$79.73 |

$89.57 |

Silver Price Forecast 2027

Heading into 2027, the silver forecast gleams with potential. Analysts predict a robust growth trajectory, buoyed by industrial demand and investment appeal.

WalletInvestor provides the following silver forecast:

| Date |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

| January 2027 |

23.268 |

23.570 |

23.268 |

23.603 |

| February 2027 |

23.625 |

24.059 |

23.625 |

24.074 |

| March 2027 |

24.140 |

24.037 |

23.950 |

24.180 |

| April 2027 |

24.043 |

23.977 |

23.977 |

24.362 |

| May 2027 |

23.856 |

23.513 |

23.349 |

23.856 |

| June 2027 |

23.519 |

22.977 |

22.969 |

23.547 |

| July 2027 |

22.958 |

23.703 |

22.920 |

23.731 |

| August 2027 |

23.736 |

24.116 |

23.608 |

24.116 |

| September 2027 |

24.169 |

23.159 |

23.159 |

24.264 |

| October 2027 |

23.089 |

23.259 |

22.999 |

23.307 |

| November 2027 |

23.278 |

23.255 |

23.198 |

23.287 |

| December 2027 |

23.268 |

23.174 |

23.059 |

23.268 |

The DigitalCoinPrice platform sees silver rising in price. The maximum price can potentially reach $115.

| Month |

Minimum Price |

Average Price |

Maximum Price |

| Jan 2027 |

$97.64 |

$104.60 |

$114.99 |

| Feb 2027 |

$96.77 |

$101.37 |

$103.59 |

| Mar 2027 |

$96.88 |

$97.81 |

$110.05 |

| Apr 2027 |

$96.84 |

$102.35 |

$104.40 |

| May 2027 |

$96.76 |

$106.96 |

$113.23 |

| Jun 2027 |

$97.63 |

$101.80 |

$105.98 |

| Jul 2027 |

$97.38 |

$101.02 |

$104.80 |

| Aug 2027 |

$96.76 |

$103.48 |

$113.43 |

| Sep 2027 |

$97.65 |

$100.99 |

$115.38 |

| Oct 2027 |

$97.48 |

$102.47 |

$112.02 |

| Nov 2027 |

$97.79 |

$100.28 |

$113.76 |

| Dec 2027 |

$97.65 |

$101.86 |

$110.18 |

Silver Price Forecast 2028

Looking ahead to the 2028 silver prediction, the future of this asset looks incredibly promising. Experts are optimistic about its potential for significant growth.

WalletInvestor expects silver prices to keep stable with some minor volatility. The maximum price is going to reach $24.296 in April 2028, while the minimum level is expected to be seen in June, with a price of $22.851.

| Date |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

| January 2028 |

23.256 |

23.542 |

23.256 |

23.542 |

| February 2028 |

23.545 |

24.059 |

23.545 |

24.059 |

| March 2028 |

24.091 |

23.930 |

23.879 |

24.115 |

| April 2028 |

24.026 |

23.965 |

23.965 |

24.296 |

| May 2028 |

23.847 |

23.463 |

23.270 |

23.847 |

| June 2028 |

23.461 |

22.851 |

22.851 |

23.472 |

| July 2028 |

22.884 |

23.666 |

22.884 |

23.666 |

| August 2028 |

23.659 |

24.076 |

23.540 |

24.076 |

| September 2028 |

24.072 |

23.060 |

23.060 |

24.196 |

| October 2028 |

23.000 |

23.201 |

22.924 |

23.231 |

| November 2028 |

23.214 |

23.185 |

23.125 |

23.214 |

| December 2028 |

23.142 |

23.081 |

22.992 |

23.143 |

DigitalCoinPrice, in turn, believes that the silver prices will enter a slight downtrend in 2028 in contrast to 2027.

| Month |

Minimum Price |

Average Price |

Maximum Price |

| Jan 2028 |

$84.46 |

$86.77 |

$88.19 |

| Feb 2028 |

$84.30 |

$93.57 |

$101.39 |

| Mar 2028 |

$84.20 |

$88.68 |

$91.98 |

| Apr 2028 |

$84.62 |

$88.17 |

$89.91 |

| May 2028 |

$84.30 |

$95.35 |

$99.83 |

| Jun 2028 |

$84.70 |

$89.77 |

$93.85 |

| Jul 2028 |

$84.33 |

$85.59 |

$87.49 |

| Aug 2028 |

$84.66 |

$94.55 |

$101.37 |

| Sep 2028 |

$85.15 |

$85.93 |

$99.43 |

| Oct 2028 |

$84.13 |

$89.39 |

$95.45 |

| Nov 2028 |

$84.76 |

$97.40 |

$100.46 |

| Dec 2028 |

$84.89 |

$90.78 |

$93.00 |

Silver Price Forecast 2029

The silver price trend for 2029 ranges between market experts. WalletInvestor predicts a positive trend at the beginning of the year, but expects a drop in March. DigitalCoinPrice, in contrast, is significantly more bullish in its silver price prediction, stating that the maximum price will reach $139 in mid-year.

| Date |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

| January 2029 |

23.162 |

23.489 |

23.162 |

23.489 |

| February 2029 |

23.487 |

24.001 |

23.461 |

24.001 |

| March 2029 |

24.004 |

23.992 |

23.980 |

24.047 |

Silver Price Forecast 2030

Experts' optimistic projections suggest that the price of silver forecast in 2030 may rise as high as $182.37 per ounce. The most recent data indicates that the average price at which silver stocks will trade in that year is $182.11.

DigitalCoinPrice provides a very optimistic view. The platform's silver price forecast is below:

| Month |

Minimum Price |

Average Price |

Maximum Price |

| Jan 2030 |

$171.29 |

$176.39 |

$181.13 |

| Feb 2030 |

$170.89 |

$173.86 |

$183.60 |

| Mar 2030 |

$171.03 |

$179.71 |

$180.93 |

| Apr 2030 |

$171.31 |

$179.16 |

$183.43 |

| May 2030 |

$170.59 |

$174.66 |

$185.16 |

| Jun 2030 |

$170.51 |

$175.95 |

$182.59 |

| Jul 2030 |

$171.62 |

$172.81 |

$189.36 |

| Aug 2030 |

$171.33 |

$184.38 |

$186.53 |

| Sep 2030 |

$171.14 |

$172.70 |

$179.05 |

| Oct 2030 |

$170.63 |

$175.04 |

$181.55 |

| Nov 2030 |

$170.72 |

$182.11 |

$187.76 |

| Dec 2030 |

$170.71 |

$180.44 |

$182.37 |

Ways to forecast the price of silver

A multitude of factors determine silver prices – here is what you should take a close look at to make correct silver price forecasts.

Investment demand

Physical silver investment reached a record-breaking 329 million ounces in 2022, up 18% from the previous year. Why then wasn't the price better if the demand from investments increased to that extent?

TD Securities commodity analysts issued a warning, stating that for the silver market to break free of the gravity at $23 an ounce in the near future, a major shift in investor demand and rekindled industrial interest are required.

Gold/silver ratio

The gold/silver ratio is used to gauge the relative value of gold to silver. Historically, when the ratio is high, silver tends to outperform gold, suggesting a potential increase in silver prices. Conversely, a low ratio may indicate a potential decline in silver prices relative to gold.

Inflation expectations

Investment expectations, such as increased demand for silver due to economic uncertainty or industrial usage, can impact silver prices. If investors anticipate rising inflation, they may buy silver as a hedge, boosting its price. Similarly, expectations of strong industrial growth can increase demand for silver in manufacturing, raising its value.

EUR/USD

When the dollar is strong, it can make gold and silver more expensive for buyers using other currencies. This can lead to a decrease in demand for gold and silver, which can cause the prices to fall. On the other hand, when the dollar is weak, it can make gold and silver less expensive for buyers using other currencies.

Futures market (CoT)

The Commitment of Traders (CoT) report in the futures market can help predict the price of silver by providing insights into the positions and sentiments of large traders (commercial hedgers and speculative traders). A significant imbalance in positions, with commercial hedgers taking opposite stances to speculators, may signal potential price reversals.

Silver price history chart for 10-20-50 years

Over the past 50 years, several significant events have shaped the price of silver:

-

Hunt Brothers' Silver Manipulation (1970s). The Hunt Brothers attempted to corner the silver market in the late 1970s, driving prices to record highs. The US government intervened, leading to a crash in prices. The collapse of the scheme in 1980 resulted in a sharp price decline, and regulatory changes followed.

- 1980s Silver Price Slump. High-interest rates and a stronger US dollar in the 1980s led to a prolonged bear market for silver.

If we take a look at a silver price 20 year chart, we will see that its cost was mainly influenced by:

-

Financial Crisis (2008). The global financial crisis increased demand for safe-haven assets, benefiting silver.

- Industrial Demand (2010s). Increased industrial use, particularly in electronics and solar panels, boosted silver prices.

- Silver Squeeze (2021): Social media-driven retail investor interest led to a short-lived surge in silver prices.

Long-term silver price prediction chart for 10 years

According to BeatMarket, the silver price may show the following performance in the following years:

As for longer-term silver predictions, Coinpriceforecast claims that the silver price may reach $493 during 2033.

Silver Forecast - Fundamental Outlook 2024

Industrial Demand

In 2024, the industrial demand for silver continues to play a pivotal role in its market valuation, leveraging its exceptional electrical and thermal conductivity properties. The metal's inherent antimicrobial features also bolster its increasing utilization in medical applications, signaling a sustained expansion in industrial consumption. A significant driver for silver's industrial demand is its essential role in various green technologies, which are becoming increasingly crucial as the global emphasis on sustainability intensifies.

This pattern suggests a robust industrial appetite for silver, reflecting positively on its market dynamics despite the fluctuations observed in its monthly pricing throughout 2024.

Investment Demand

The investment demand for silver in 2024 shows a nuanced pattern, significantly influencing its price movements. Throughout the years, silver prices have experienced fluctuations, reflecting investors' shifting confidence and market speculation. Investment trends in silver, encompassing physical purchases and ETFs, play a critical role in shaping its market value.

Despite the observable price variability each month, the underlying sentiment appears optimistic, with investors reacting to global economic cues, inflation expectations, and geopolitical events. This year's investment dynamics underscore the importance of monitoring both tangible and paper silver investments, as they collectively dictate the evolving investment landscape and subsequent price forecasts for silver in 2024.

Silver Technical Outlook

If we take a look at technical indicators, we will see that it’s high time to buy silver. Taking into account rising geopolitical tensions, demand for safe-haven assets stays strong, which is bullish for gold and silver.

| Name |

Value |

Action |

| RSI(14) |

56.360 |

Buy |

| STOCH(9,6) |

46.369 |

Neutral |

| STOCHRSI(14) |

0.000 |

Oversold |

| MACD(12,26) |

0.062 |

Buy |

| ADX(14) |

38.008 |

Sell |

| Williams %R |

-54.371 |

Neutral |

| CCI(14) |

6.7383 |

Neutral |

| ATR(14) |

0.1348 |

High Volatility |

| Highs/Lows(14) |

0.0000 |

Neutral |

| Ultimate Oscillator |

49.553 |

Neutral |

| ROC |

0.356 |

Buy |

| Bull/Bear Power(13) |

0.0200 |

Buy |

FAQ

What will silver be worth in 2030?

According to some optimistic silver forecasts, its price will be worth $476 by the end of 2030. However, some analysts provide moderate predictions, saying that silver will cost around $75 per ounce.

What will the silver price be in 2040?

If the dollar remains the major global reserve currency, silver can be worth at least $50 by 2040. Technical analysis provides a price range of $78-$138.

Will silver ever reach $1,000 an ounce?

If you look at the silver price 10 year chart, you will see that at its peak, silver traded around $50 per ounce, and it would have to rise by more than 40x to reach $1,000 an ounce from today’s numbers. It is very unlikely and would only be possible if silver demand surges exponentially or the gold price rises to thousands of dollars.

What year will silver reach $100 per ounce?

So far, there are no technical analyses projecting silver prices of $100 and more. However, a lot depends on geopolitical and global financial conditions. Silver could reach 100 USD per ounce the quickest if inflation approaches double digits.

Will silver ever reach $30 an ounce?

Yes, it has all chances of hitting this threshold. According to technical analyses, it may happen in late 2023 or during 2024.

Will silver rise if the dollar collapses?

Inflation and silver continue to have an inverse correlation. Silver prices decrease when inflation decreases and the value of the dollar rises. Silver prices rise when inflation increases and the value of the dollar declines.

Where will silver be in 10 years?

For sure, silver will stay one of the most valuable commodities, highly sought after in many industries, including automobile, jewelry, and electronics – so the demand is expected to stay pretty high. As for the silver price, it depends on a multitude of factors, including inflation

What will silver be in 2027?

According to Coinpriceforecast, the silver exchange rate in 2027 will reach $55, which is more than its recent high of $50.