Tesla (TSLA) Stock Forecast & Price Prediction

Tesla, one of the world’s most notable automobile brands, is a bone of contention between bears and bulls. Today, the company’s market cap is $788 bln, which is more than many other competitors have. At their most thriving times, Tesla’s valuation was $1.2 trillion, which raises the question: “Is it fairly priced?” In this guide, we will take a look at TSLA stock price performance, what forms its cost, and how it will be impacted by market sentiments, changes within the company, and competitors’ products.

Table of Contents

What to Watch for in Tesla's 2023-2024 Earnings

Fair Value Estimate for Tesla

Tesla Historical Price/Fair Value Ratio

Long-Term Tesla Stock Price Prediction

Tesla Stock Forecast Based on Technical Analysis

Economic Moat Rating

Risk and Uncertainty

A Bullish Outlook on TSLA

A Bearish Outlook on TSLA

Conclusion

FAQ

What to Watch for in Tesla's 2023-2024 Earnings

Automotive profit margins

These serve as a crucial indicator of the financial impact of Tesla's pricing reduction approach, which is intended to increase demand. Presumably, the company's margins will probably be worse in 2024. This might be caused by price reductions and adjustments in profit projections.

Energy generation and storage profits

Although it is expanding, Tesla's primary source of income remains the car industry. After turning a profit last year, EG&S has had robust growth in 2023 as a result of a sharp increase in the market for energy storage and big batteries. As the market for stationary energy storage is growing, this area will emerge as a significant secondary profit source.

New products and services

The community is waiting for management opinions on new offerings, such as Cybertruck and fully autonomous software. The much anticipated Cybertruck would be Tesla's fifth automobile to reach the market, providing the corporation with a new product to boost sales with. Once the entire version of the software gets released, one of Tesla's biggest auxiliary earning streams will be their fully autonomous driving software, which will open up revenue growth and profit opportunities from each vehicle sold.

Fair Value Estimate for Tesla

When compared to our long-term fair value assessment, Tesla's stock is a little bit overpriced. So far, a fair suggested value is $215 per share (with an average capital cost of less than 9%).

In the near future, Tesla will increase the number of vehicles it delivers annually to around 1.8 million in 2023, a 37% increase from 2022. However, the automotive gross margin declined to 19% in 2023 from 29% in 2022 owing to price reductions that considerably outweigh cost savings.

In the longer term (by 2030), Tesla will supply about 5 mln vehicles annually. This includes fleet sales, which present the business with a possibility of growth. The management's ambitious target of selling 20 mln cars by the end of this decade is far higher than third-party experts predict. According to estimations, Tesla will first successfully launch its light truck, sports car, semi-truck, and finally its entry-level sedan and SUV platforms after increasing the number of Model Y deliveries.

In conjunction with an increased production of higher-priced Model Y vehicles, segment gross margins will rise to around 31%, leading to an increase in automotive profits that surpasses growth in sales.

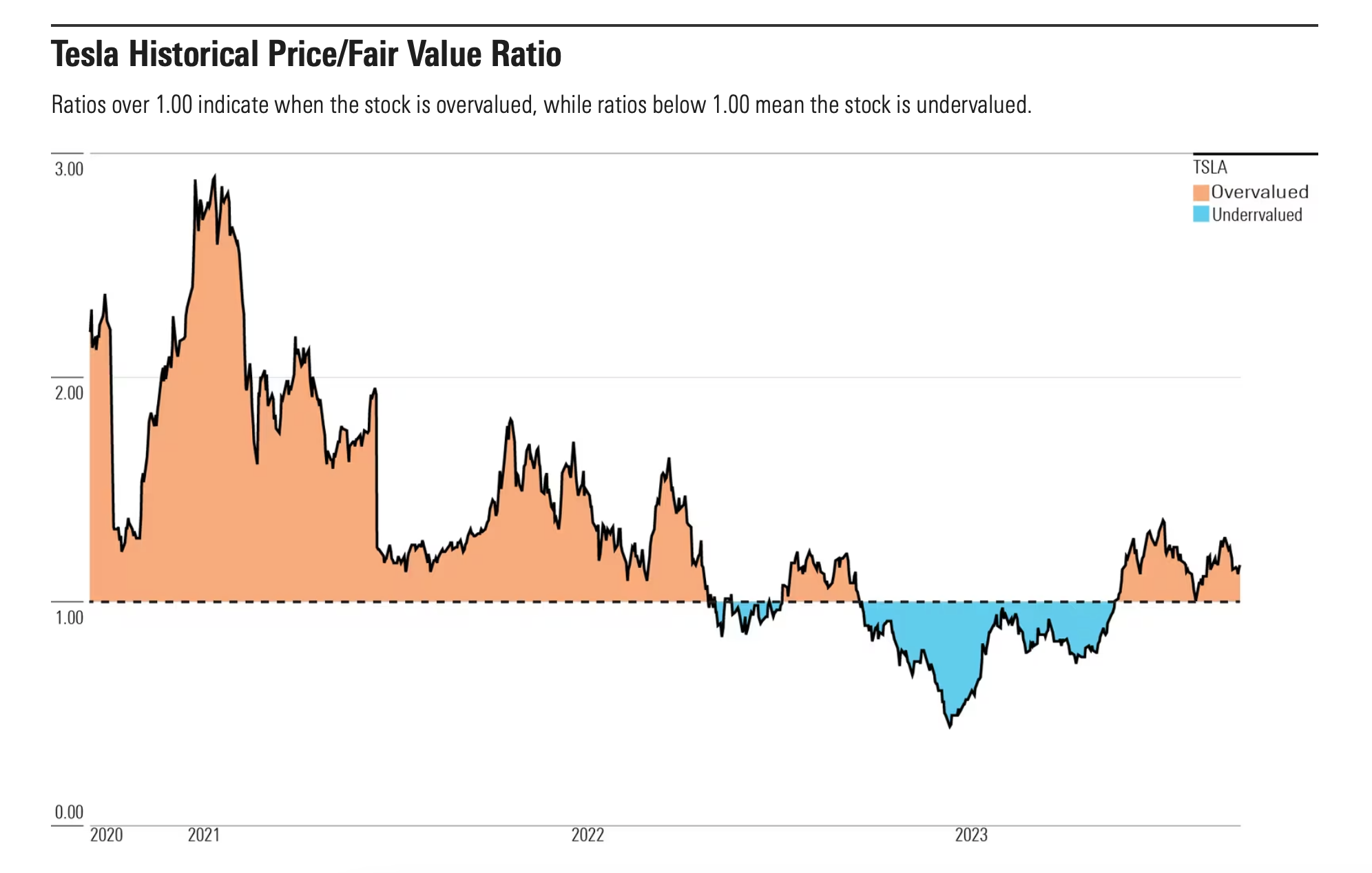

Tesla Historical Price/Fair Value Ratio

With a ratio greater than 1.00, the stock is overpriced; when it is less than 1.00, the stock is undervalued. As you can see on the graph, the stock is very expensive.

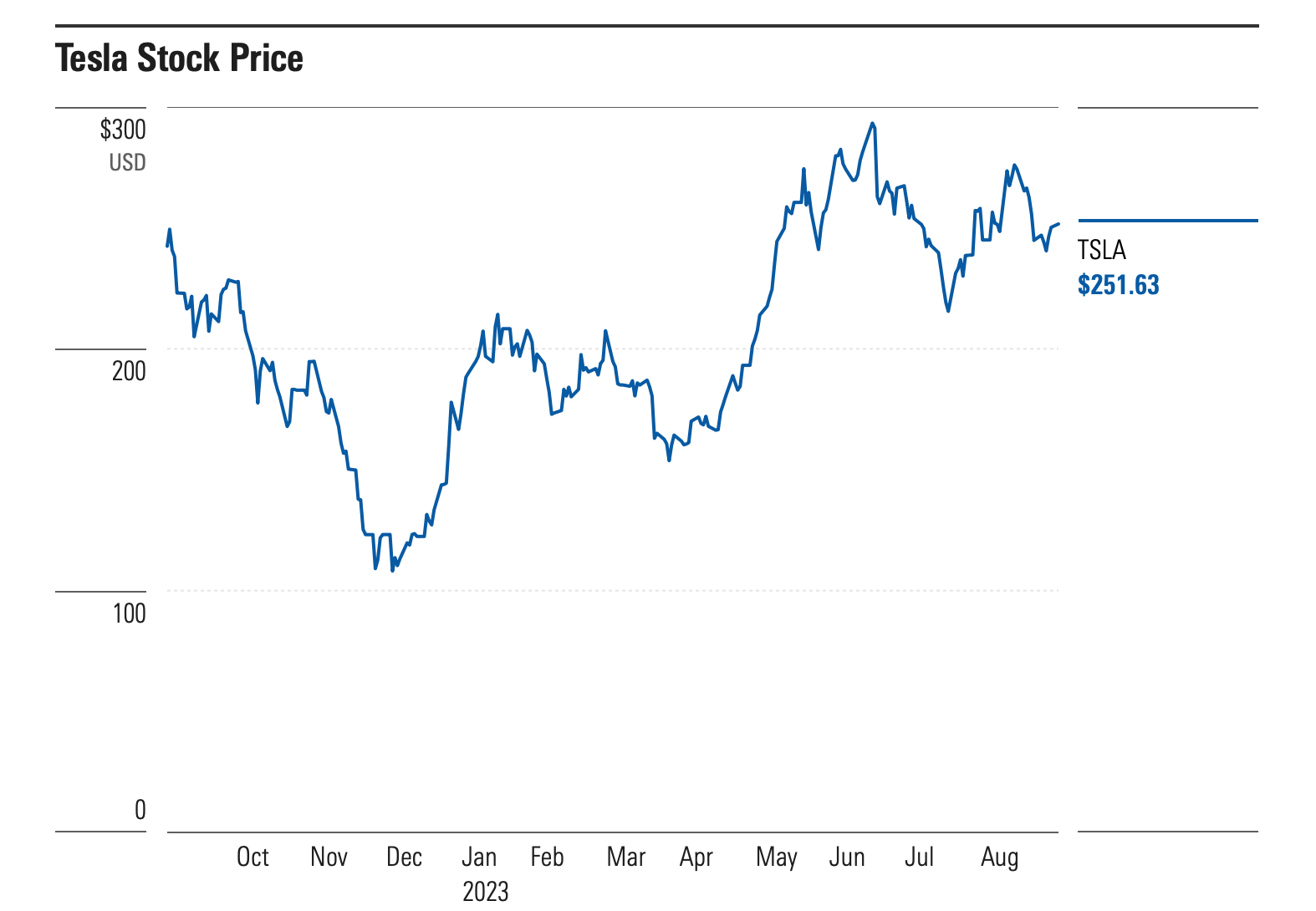

Here is Tesla’s historical price performance: as we see, its price skyrocketed in 2020, plummeted by the end of 2022, and kept within the $150-$300 range throughout 2023.

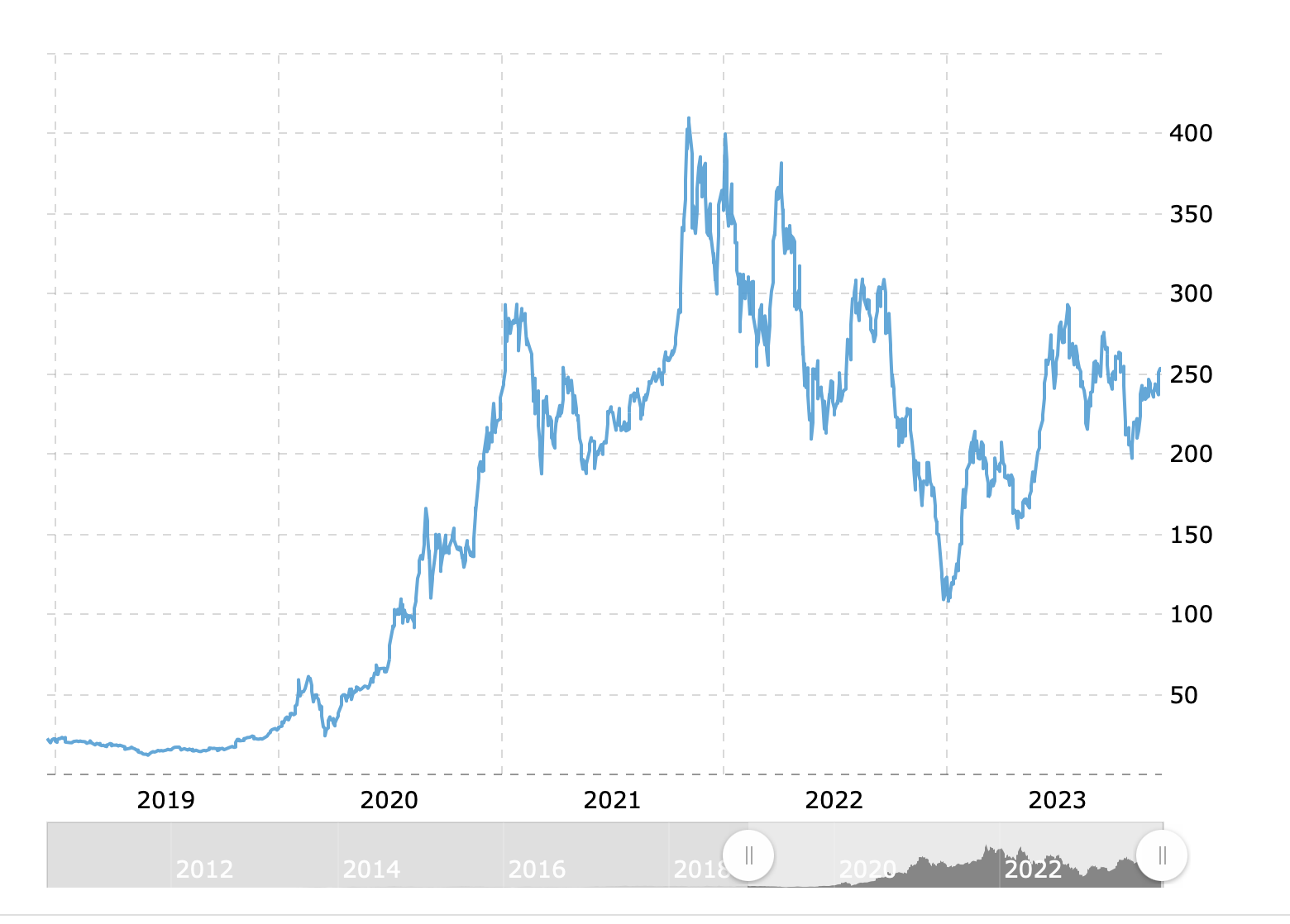

Tesla's historical daily share price chart and statistics, adjusted for splits and dividends, goes back to 2010.

-

As of December 18, 2023, the most recent closing stock price for Tesla is $252.11.

- In November 2021, the closing price of Tesla shares reached an all-time high of $409.

- At $299.29, the 52-week high stock price for Tesla is 18.7% more than the current share price.

- $101.81 is the 52-week low price of Tesla shares.

- Over the previous 52 weeks, the average price of Tesla stock has been $213.62.

Long-Term Tesla Stock Price Prediction

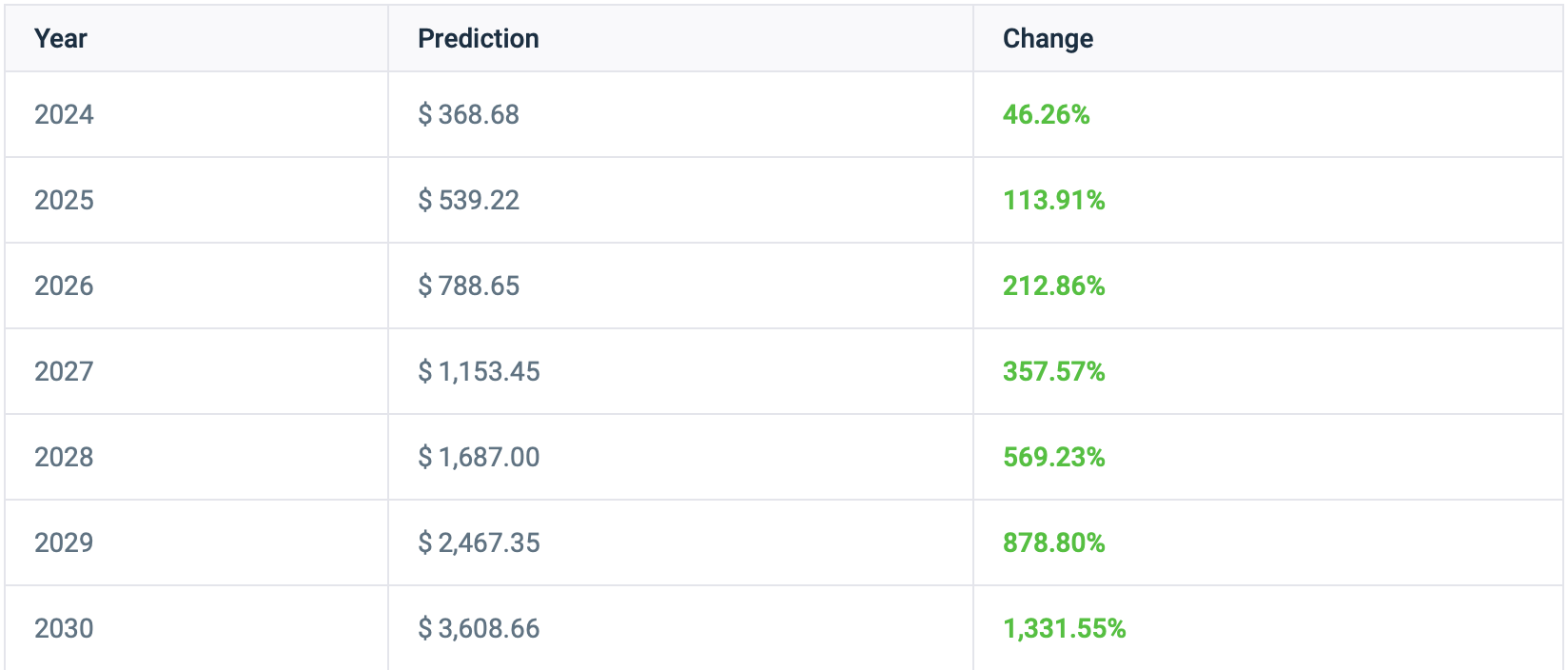

Judging by the average yearly growth of TSLA in the last 10 years, the Tesla stock forecast for the next year is $368. Here are Tesla stock predictions for each year up until 2030:

Tesla Stock Prediction 2025

The current estimate for the price of Tesla stock in 2025 is $539, based on the assumption that shares would continue to rise at the same average annual pace as the previous ten years. This would result in a price gain of 113.91% for TSLA.

Tesla Stock Prediction 2030

If the Tesla stock continues to increase at its current 10-year average pace, it will reach $3,608.66 in 2030. The price of TSLA stock will increase by 1,331.55% if the 2030 forecast for Tesla stock comes true.

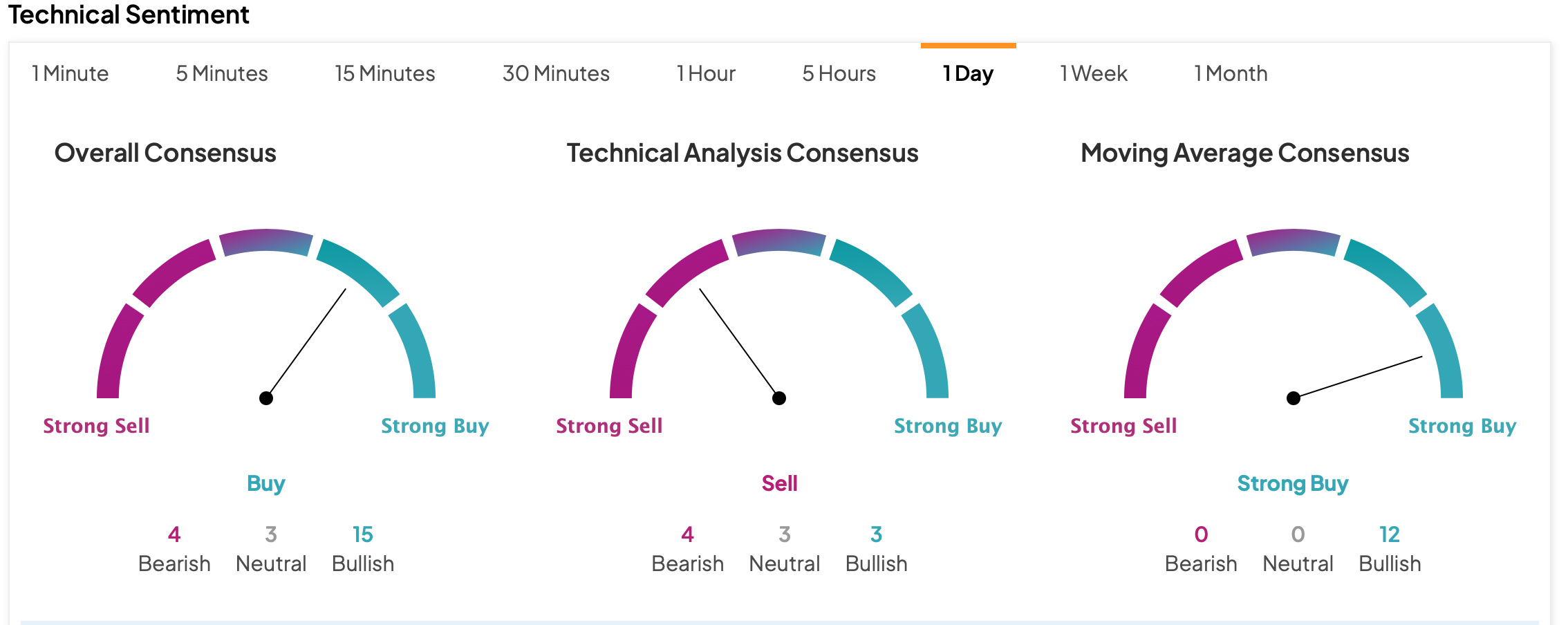

Tesla Stock Forecast Based on Technical Analysis

Based on 32 Wall Street analysts' opinions, there is a high projection of $380.00 and a low forecast of $85.00, with an average price goal of $245. From the previous price of $252.08, the average price target indicates a move of -2.43%.

The overall mood for the TSLA stock prognosis, based on the latest data, is positive, with 24 technical analysis indicators indicating bullish signs and 2 negative indications.

According to CoinPriceForecast’s latest predictions, the price of TSLA would reach $350 by mid-2025 and $500 in the next year. In 2027, Tesla is expected to reach $600, followed by $700 in 2029, $800 in 2031, and $900 in 2034.

Economic Moat Rating

Because of its cost advantage and intangible assets, Tesla has a narrow economic moat. The company's positioning as a luxury automobile attracts premium pricing, and its knowledge of electric vehicle production enables it to produce its cars at a lower cost than its rivals.

Chinese electromobile manufacturers are poised to offer more competitive pricing, making their models more available. However, technological advancements and further innovations will keep rivals behind for years to come. Prioritizing the premium car market allowed Tesla to generate a lot of publicity that was not limited to its clientele. Strong customer demand resulted in the company's later, less expensive models, such as the Model 3 and Model Y.

With the introduction of new models like the Cybertruck and non-expensive cars (worth $25,000, which is comparable to an average sedan or SUV), the company's strong brand will continue to drive customer demand.

Thanks to its manufacturing capacity, Tesla has a cost advantage in the production of EVs. From slightly more than 100,000 deliveries in 2017 to over 1.3 mln sales in 2022, the company's overall vehicle volume has significantly increased. In the same time frame, the company's gross profit margin increased from 20% to 26%, excluding the sale of regulatory credits, and its average cost of goods sold per car decreased by nearly 50%, from $84,000 to less than $39,000.

Tesla will maintain lower prices even when legacy automakers start producing more EVs, because the company has announced plans to further decrease battery cell costs by 56% over the next few years. Since traditional automakers won't want to construct as many new plants from scratch as Tesla, it may take years for them to catch up, if it ever happens. This is because Tesla's cost per vehicle is expected to decline.

Tesla's moat is very likely to hold up over time and enable it to provide higher-than-average returns on capital. The company stands all chances to outpace its cost of capital for at least the next 20 years, which guarantees a broad moat grade.

However, given the speed at which autonomous vehicle technologies are developing, as well as the potential to completely change how people use cars, the next ten years are extremely unpredictable for both Tesla and the larger automotive sector. Hence, we believe that a narrow moat rating — which is based on a 10-year excess return duration — is more appropriate.

Risk and Uncertainty

Given the variety of possible outcomes for the company, Tesla's uncertainty is very high.

Due to its strong cyclical nature, the automobile industry is vulnerable to sudden drops in demand when the economy is doing poorly. As the leader in the electric vehicle market, Tesla faces increasing competition from established automakers as well as fresh competitors. To stay ahead of other manufacturers, they might need to lower costs as more affordable EVs go on sale, which would cut their already record-breaking earnings. More EV options might make people think less highly of Tesla. The company is making significant investments in capacity growth, which come with a risk of overspending and delays.

In an effort to preserve its technical edge, the corporation is also investing in research and development; however, there is no assurance that these efforts will be successful. The CEO of Tesla has somewhat more than 20% of the company's equity, which he utilizes as security for personal loans, increasing the possibility of a big debt repayment transaction.

As an automaker, the company is vulnerable to possible flaws in its software for autonomous driving, which might lead to recalls. If this does happen, the TSLA price may experience a moderate impact. Retaining employees is another risk. A decrease in Tesla's positive brand image might occur if the company is unable to retain important personnel, such as CEO Elon Musk.

A Bullish Outlook on TSLA

Here’s what Tesla proponents say:

-

With its technologies for electric vehicles (EVs), driverless cars, batteries, and solar power systems, Tesla has the potential to upend the auto and power generating sectors.

- Over the next few years, as unit manufacturing costs are reduced, Tesla will enjoy larger profit margins.

- The best function of any EV on the market is provided by Tesla, thanks to a combination of its innovative supercharger network and industry-leading technology, which should help the company stay at the top of the market as EV adoption rises.

A Bearish Outlook on TSLA

Bears voice the following opinions:

-

Because both established manufacturers and recent entrants are making significant investments in EV research, sales growth for Tesla is expected to slow, and the company may have to lower pricing as a result of heightened rivalry, which would reduce profit margins.

- Tesla's lower-priced Model 3 automobiles will suffer from its reliance on Chinese-made batteries, since these vehicles will not be eligible for federal subsidies in the United States.

- Prices for solar panels and batteries may drop more quickly than Tesla can cut expenses, meaning that they will make little to nothing on the energy production and storage side.

Conclusion

Tesla is the best-performing automobile brand so far, but the future of the TSLA stock is under question because of fierce competition. Apparently, TSLA is severely overpriced, so it is not likely that its price will overcome the $1,000 threshold. Innovations and affordable models can help the company attract new buyers with Chinese and other automakers flooding the market with other electric vehicles. Most likely, the TSLA price will stay in the range of $200-300.

FAQ

What is the Tesla stock forecast?

Within the upcoming months, TSLA is expected to trade for $230-250. When it comes to 1-year projection, the stock is not likely to overcome the $360 level. However, it heavily depends on the company’s upcoming product releases and competitors’ offers.

What is the Tesla stock prediction for 2025?

If the company continues performing at the same rate as in the last 10 years, the TSLA stock price is expected to reach the level of $530 by the end of 2025. Some websites provide more moderate predictions for TSLA: $430-450 (which it may even reach in 12 months).

What is the Tesla stock prediction for 2030?

By 2030, TSLA is expected to overcome the $3,530 level if the company continues growing at the same rate. However, considering how many competitors are popping up, and the growing complexity of innovations, this sounds a bit unrealistic.

Will Tesla stock reach $2,000?

It depends on the timeframe. To reach this threshold, the company needs to display a 700% growth, which does not seem possible in a 5-year perspective. Such a stock price can be witnessed in the future, but not in the next few years.

Will Tesla stock reach $5,000?

To reach a stock price of $5,000, Tesla would need to grow by almost 2,000%, which is currently extremely unrealistic.

Will Tesla stock reach $10,000?

This is not likely, to say the least. Reaching such a pricing threshold requires a growth of 3,946.29%. So far, Tesla has no outstanding product or feature to outperform competitors and multiply the number of customers. Even in the long term, $10,000 is a very high price target.

Is Tesla a good stock to buy?

Since TSLA is heavily overpriced, and competitors are storming the market with more affordable electric vehicles, Tesla is not likely to maintain the title of the dominant company in the EV industry. Besides, Elon Musk’s opinions and behavior have a great impact on the TSLA price, which means it can move in an unexpected direction at any moment. However, the stock is steadily growing by 20% year over year, so it is a nice long-term investment.

)