What Do You Trade on Forex?

Source: regularguy.eth/Unsplash

Are you interested in learning what can be traded on the Forex market, what drives it, and where exchange rates come from? If so, we have good news for you: Just2Trade's ultimate guide provides all the important information related to the FX market: how FX P&L and Forex trading work, what leverage, margin, pip, spread, and lot are, what to pay special attention to, how to start Forex trading, and much more. So let's not waste any more time and take a closer look at the Forex market together.

Table of Contents

What Is Forex Trading?

Forex trading is the process of exchanging one currency for another. To trade Forex, you must sell one currency while simultaneously buying another.

Each currency in the pair is identified by a three-letter code, which typically consists of two letters representing the region and one letter representing the currency. For example, USD represents the US dollar, and JPY represents the Japanese yen. In the USD/JPY currency pair, you buy US dollars by selling Japanese yen.

Some of the most popular FX pairs include the British pound versus the euro (GBP/EUR), the euro versus the US dollar (EUR/USD), and others.

Where Do Exchange Rates Come From?

Spot Forex transactions, also known as spot trades, occur in the spot Forex market between institutional traders, also known as FX dealers.

What is being exchanged in the spot foreign exchange market? Contracts – the spot contracts for foreign exchange (FX).

FX spot contracts require a physical exchange of the underlying currencies at a predetermined rate.

It is important to note that you are not trading the underlying currencies themselves, but rather a contract for their exchange.

Four Types of Forex Pairs

Here are the four main types of Forex pairs:

Major Pairs: Seven currencies make up the major pairs, or 80% of all Forex trading worldwide, including EUR/USD, USD/JPY, GBP/USD, and USD/CHF.

Minor Pairs: These are less commonly traded pairs that often pit major currencies against one another rather than the US dollar. They include GBP/JPY, EUR/CHF, and EUR/GBP.

Exotic Pairs: Exotic currency pairings pit a major currency against a small- or emerging-market counterpart, consisting of USD/PLN, GBP/MXN, and EUR/CZK.

Regional Pairs: These are pairs that are classed as regional pairs, like Scandinavia or Australasia. They include EUR/NOK, AUD/NZD, and AUD/SGD.

The majority of FX transactions are conducted by banks and private individuals who are looking to buy a currency that is expected to appreciate relative to the currency they sell. However, even simple money exchanges, like when traveling, involve a Forex transaction.

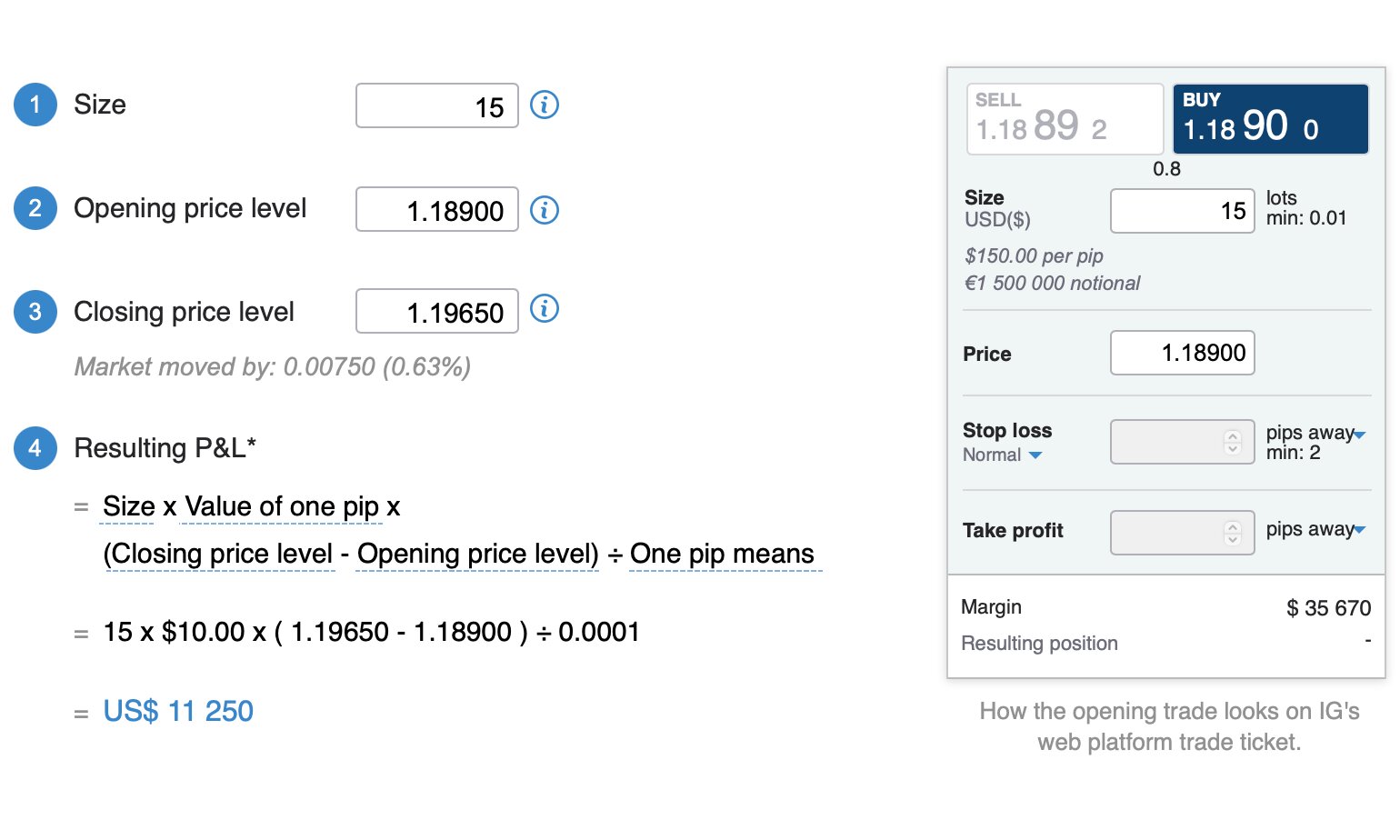

See How FX P&L Works

Using EUR/USD as an example, change the size and the opening/closing levels to observe the impact on profits.

How Does Forex Trading Work?

Over-the-counter (OTC) markets are where institutional Forex trading takes place directly between two parties, with no centralized exchanges (like the stock market), but rather a global network of banks and other companies that manage the institutional FX market.

Forex transactions are distributed among four important Forex trading hubs located in several time zones: London, New York, Sydney, and Tokyo. The FX market operates 24/7, so you can trade Forex at any time of the day or night.

Most traders that speculate on foreign exchange rates do not really take delivery of the actual currency. Instead, Forex traders will forecast exchange rates in order to profit from changes in market prices. Trading derivatives, such as a rolling spot FX contract, is the most well-liked method of accomplishing this.

By trading derivatives, you can make predictions about the price changes of an asset without owning it. For example, when trading Forex with Just2Trade, you can predict the direction you believe the price of a currency pair will move, and your profit or loss will depend on the accuracy of your prediction.

The Three Different Types of Forex Market

The Forex market offers three major trading options: spot, forward, and future.

Spot Forex Market. This is the actual exchange of a currency pair that occurs immediately after a trade is settled, sometimes known as "on the spot," or within a short amount of time.

Forward Forex Market. In the forward foreign exchange market, a contract is an agreement to purchase or sell a predetermined amount of a currency at a predetermined price, with settlement taking place at a predetermined future date or a range of future dates.

Future Forex Market. A futures contract is an exchange-traded agreement to buy or sell a certain quantity of a particular currency at a specified price and date in the future.

Forex Pricing – Base and Quote Currency

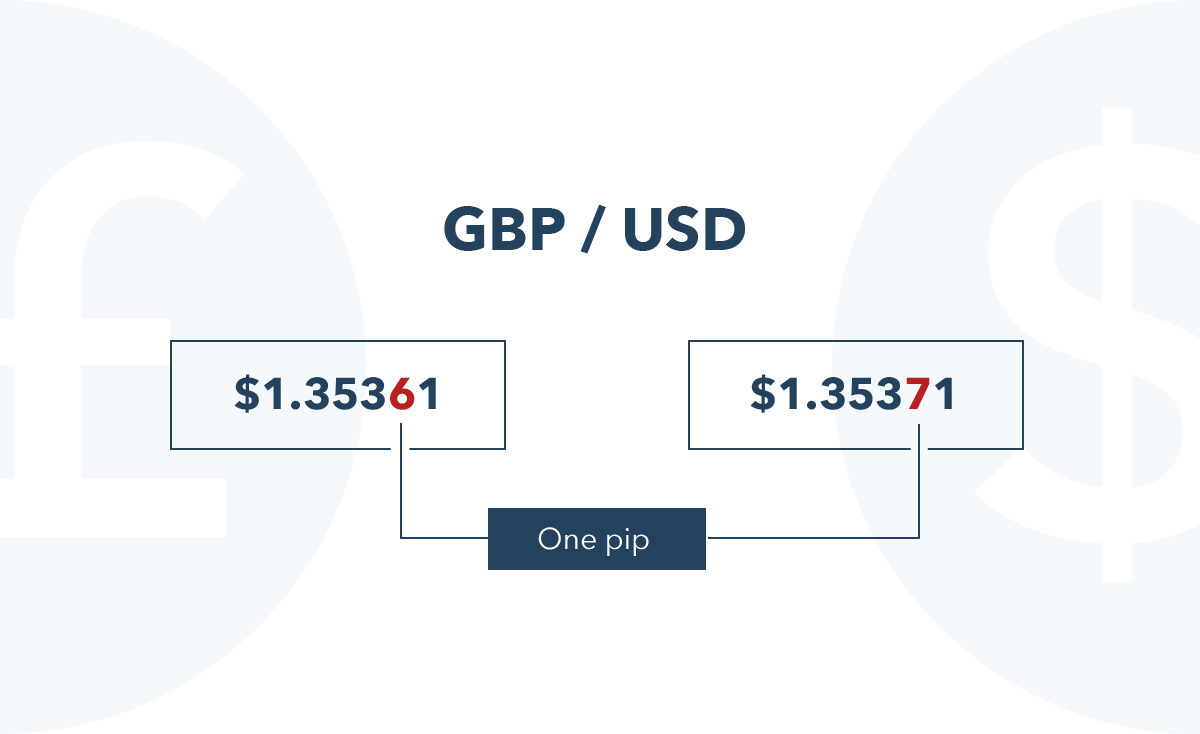

In a Forex pair, the base currency is the first listed currency, and the quote currency is the second. The exchange rate between the base currency and the quote currency determines the price of the Forex pair.

For example, in the GBP/USD pair, GBP is the base currency, and USD is the quote currency. If the exchange rate between GBP and USD is 1.35361, then one pound is equal to 1.35361 dollars.

If the value of the pound increases relative to the dollar, the price of the pair will increase, since one pound will be worth more dollars. Conversely, if the value of the pound decreases, the price of the pair will decrease.

Therefore, if you believe that the base currency in a Forex pair will appreciate relative to the quoted currency, you can buy the pair (going long). If you anticipate a decline, you can sell the pair (going short).

Numbers on a Screen

You are actually placing bets in the direction that numbers will move on a screen.

Here is a useful illustration.

Assume there is a website where an iPhone can be purchased or sold.

The price of the iPhone fluctuates frequently on this website depending on the number of people buying versus selling their iPhones.

Technically, you could write it as follows if the cost of an iPhone is now $1,000:

iPhone/USD = 1,000

You can trade one iPhone for 1,000 USD.

Similar results if the iPhone's pricing was expressed in euros. You may write it as follows if the price of an iPhone right now is €900.

iPhone/EUR = 900

You can exchange one iPhone for 900 euros.

For this example, let's assume that the iPhone is priced in US dollars. As you watch the price fluctuate up and down on your computer screen, you are fixated on it.

What is Leverage in Forex Trading?

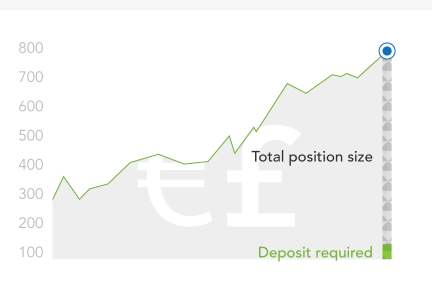

The opportunity to open a position using leverage is one of the main benefits of spot Forex trading. Leverage allows you to increase your exposure to the market without having to make a full financial commitment.

You don't have to pay the full value of your trade upfront when trading with leverage. Instead, you only need to make a small margin deposit. Your profit or loss when you close a leveraged position is determined by the total value of the trade.

Leverage can increase your profits, but it also increases the potential for losses, which could be greater than your initial investment. It is therefore important to learn how to manage your risk when using leveraged trading.

What is the Margin in Forex Trading?

Leveraged trading heavily relies on margin, which is the initial deposit required to open and maintain a leveraged position. The amount of margin needed varies based on the broker and the size of the trade.

Margin is usually expressed as a percentage of the total value of the position. For instance, to open a trade on the EUR/USD pair, a margin deposit of 2% of the position's value, or $200, may be sufficient, even though you are exposing yourself to a risk of $10,000.

What is a Pip in Forex Trading?

The unit of measurement for movement in a Forex pair is called a pip. A Forex pip refers to a change in a currency pair's fourth decimal place. So, if EUR/USD changes from $1.35361 to $1.35371, it has moved one pip. Micro-pips, also known as pipettes, represent a fraction of a pip and are the decimal places displayed after the pip.

The Japanese yen is the main exception to this rule, as it is quoted in significantly smaller amounts than most currencies. In this case, a change in the second decimal place represents one pip. So, EUR/JPY has moved one pip if it changes from 172.119 to 172.129.

What Is the Spread in Forex Trading?

The spread is the difference between the quoted buy and sell prices for a given Forex pair. For example, if the buy price for the EUR/USD pair is 1.7645 and the sell price is 1.7649, the spread would be 4 pips.

Starting a long position involves trading at the buy price, which is slightly higher than the market price. To start a short position, you trade at the sell price, which is slightly lower than the market price.

What Is a Lot in Forex Trading?

Lots are groups of currency used to standardize currency exchange trades. A standard lot in Forex trading is 100,000 units of the given currency. As an alternative, you can occasionally exchange micro lots and mini lots, which are worth 10,000 and 1,000 units, respectively.

Since not every Forex trader has $100,000 to invest in every trade, many Forex trading services give leverage.

What Moves the Forex Market?

The forces of supply and demand dominate the Forex market, as they do in most other financial markets, so it is crucial to comprehend the forces at play.

Central Banks

Central banks are responsible for managing the money supply and have the power to make decisions that significantly impact the value of their own currencies. For example, implementing quantitative easing, which involves adding more money to an economy, can lead to a decrease in the value of its currency.

Central banks also control the base interest rate of an economy. If you buy an asset in a currency with a high interest rate, you might earn more money. This could attract investors to a country that has just raised its interest rates, strengthening its economy and increasing the value of its currency.

However, higher interest rates may also make borrowing money more difficult. This can make investing harder and cause currencies to fall if borrowing becomes more expensive.

News Reports

Generally speaking, commercial banks and other investors want to invest in economies that have a promising future. As a result, if some good news about a region is reported, it will boost investment and raise the value of the currency from that region.

The difference between supply and demand will drive up the price of the currency unless there is a corresponding increase in supply. The price of a currency might also drop as a result of a piece of bad news that discourages investment. Therefore, the reported economic health of the nation or region that a currency represents is usually reflected in its value.

See what's coming up by looking at our economic calendar, and pay special attention to:

Inflation figures;

GDP;

Production reports;

Retail sales;

Employment.

Market Sentiment

The sentiment of the market, which often changes in response to news, can have a significant impact on the value of a currency. Trades will be made based on traders' expectations of where a currency is heading, and they may influence others to do the same, increasing or decreasing demand.

FAQ

Source: Jason Briscoe/Unsplash

Still have any questions about Forex trading? If so, let's have a look at the FAQ list below – there, you'll definitely find the answers to all of your outstanding issues.

How is the Forex market regulated?

Since there is no overarching authority to oversee the FX market around the clock, there is little regulation despite its enormous scale. Instead, there are a number of national trading organizations throughout the world that regulate other markets and domestic Forex trading to make sure that all Forex providers follow particular requirements.

How much money is traded on the Forex market daily?

The daily volume of Forex trades amounts to approximately $5 trillion, or about $220 billion per hour. Institutions, businesses, governments, and currency speculators form the majority of the market participants. Approximately 90% of currency trade activity is speculative, and the US dollar, euro, and yen make up the lion's share of this activity.

What are the gaps in Forex trading?

Gaps are intervals when the market experiences a sudden increase or decrease in price with little to no trading in between, resulting in a "gap" in the normal price trend. Although gaps do occur in the Forex market because it operates 24 hours a day, 5 days a week, they are much less frequent than in other markets.

How much does it cost to start trading Forex?

The cost of starting Forex trading will depend on which currency pairs you choose to buy or sell. Everything is straightforward and will be affected by your decisions.

When is the best time to trade the Forex market?

Given that the Forex market's liquidity and volatility can impact its prices, the best time to trade will depend on your personal risk tolerance. The foreign exchange market is open 24 hours a day, five days a week (EST) from 3 a.m. on Sunday to 5 p.m. on Friday, which allows you to trade at a convenient time and take advantage of multiple active sessions.

How do I open a Forex trading account?

Here is a simple step-by-step guide to help you open a Forex trading account without any difficulties:

Visit the broker's website to review the various account options.

Complete the application form.

After submitting the application, you will receive a username and password to access your account.

Log in to the brokerage's client portal.

Arrange a bank transfer to deposit funds into your account.

You are now ready to start trading Forex once your account is funded. That's it!