Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Although the Zacks Food-Miscellaneous Industry is in the top 28% of over 250 Zacks industries, one noticeable laggard is J&J Snack Foods JJSF with its stock landing a Zacks Rank #5 (Strong Sell) and the Bear of the Day.

In what it has called a softer consumer environment, the snacks, pastries, and frozen beverage provider is also operating in a very competitive landscape that features competitors such as Mondelez International MDLZ, Conagra Brands CAG, Utz Brands UTZ, and Kellogg KLG among others.

Q1 Earnings Miss

Causing concern was J&J Snack Foods’ fiscal first quarter earnings of $0.52 a share in February, which widely missed the Zacks Consensus of $0.87 per share by -40%. Quarterly sales of $348.31 million missed estimates by -4% with the company citing declines in consumer traffic and consumption for its much weaker-than-expected results.

Image Source: Zacks Investment Research

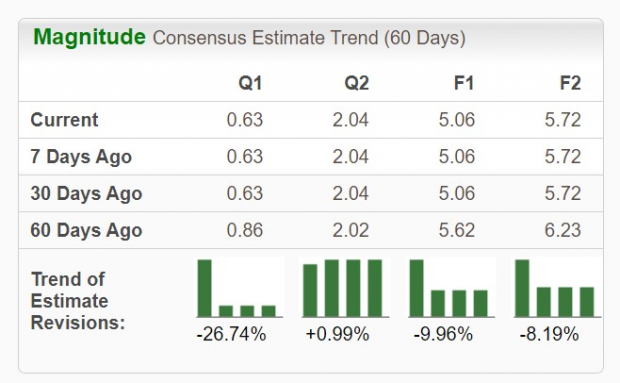

Transpiring from the earnings miss, EPS estimates for fiscal 2024 and FY25 have fallen -10% and -8% over the last 60 days respectively. This has started to dull the anticipation of J&J Snack Foods expansive bottom line with annual earnings still forecasted to rise 12% this year and projected to expand another 13% in FY25 to $5.72 per share.

Image Source: Zacks Investment Research

Premium Fears & Recent Performance

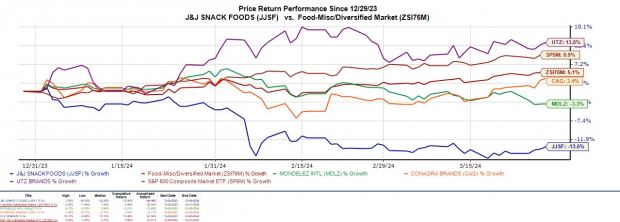

While J&J Snack Foods’ EPS growth may still be enticing the downward earnings estimate revisions suggest more short-term volatility ahead. To that point, JJNF has now dropped -13% year to date to noticeably lag the S&P 500’s +10% and the Zacks Food-Miscellaneous Market’s +5%.

Image Source: Zacks Investment Research

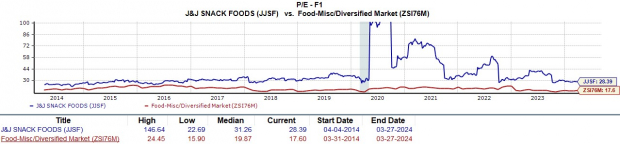

Furthermore, with J&J Snack Foods’ stock trailing the performances of many of its direct competitors it’s noteworthy that JJNF trades at a 28.3X forward earnings multiple which is considerably higher than the industry average of 17.6X and the S&P 500’s 22.1X.

Image Source: Zacks Investment Research

Bottom Line

On the surface, J&J Snack Foods' bottom line expansion may be enticing but the trend of declining earnings estimates paints a cautionary tale. This is especially true considering its stock trades at a premium and has underperformed many of its industry peers.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more. They've already closed 162 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.