Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Markets tumbled on Tuesday led by a selloff among the medical sector as US regulators unexpectedly declined to raise payments for private Medicare plans.

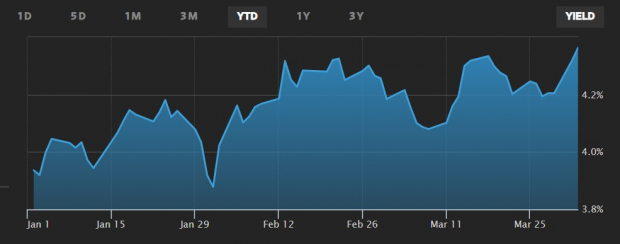

Additionally, manufacturing data indicated that commodity price pressures are still subdued and left doubts that the Fed will cut rates during the second quarter as markets have anticipated. The 10-year Treasury yield also rose to its highest level in 2024 at 4.37%, indicating a tug and pull effect is on the horizon from investors fleeing bonds and seeking out risker assets like stocks and vice versa.

However, while there could be more volatility on the way, here are three highly-ranked stocks that should have more upside and serve as viable buy-the-dip candidates if the opportunity is presented.

Image Source: Wall Street Journal

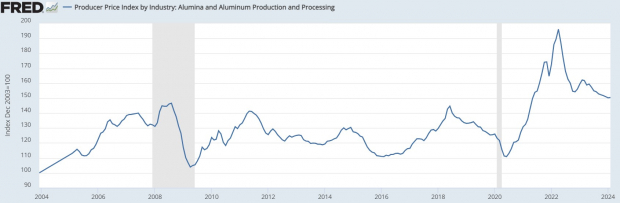

Kaiser Aluminum KALU: Like most commodities, aluminum prices have dropped sharply from their inflationary highs but Kaiser Aluminum is one company that benefitted immensely from the spike in the commodity price over the last few years. Furthermore, Kaiser Aluminum’s reach to a variety of end markets has fueled its expansive growth as a leading producer of semi-fabricated specialty aluminum products.

Image Source: Federal Reserve Economic Data

With Kaiser’s bottom line expected to expand substantially, its probability could even be enhanced if Aluminum prices start to rise again. Notably, Kaiser’s stock has soared +28% year to date and offers a 3.47% annual dividend yield that makes adding positions after a selloff more meaningful. With that being said, Kaiser’s stock was nicely up today while the broader indexes fell.

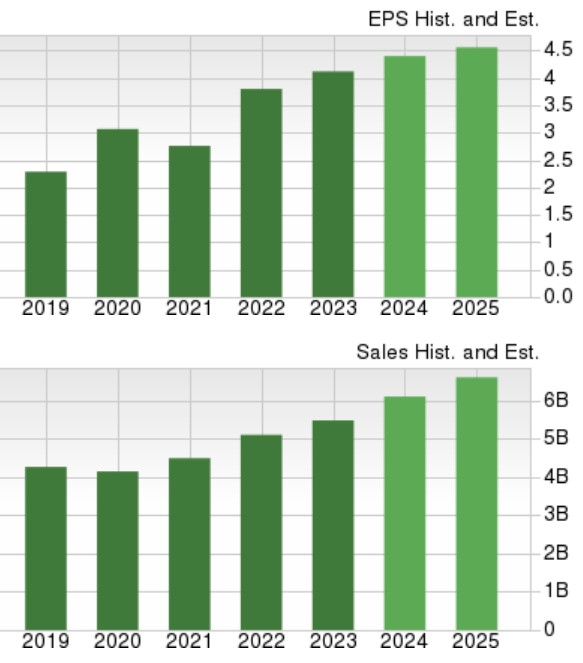

Image Source: Zacks Investment Research

Iron Mountain IRM: The expectations of three rate cuts this year and a more stable operating environment may be crucial for most REITs but Iron Mountains’ steady top and bottom line growth is intriguing. Iron Mountain operates a global real estate network that includes secure storage facilities and data centers with its stock up +13% YTD.

Of course, REITs tend to catch investors’ attention after a market correction due to their enticing dividends and Iron Mountain has a very respectable 3.27% annual dividend yield. However, separating Iron Mountain is its pleasant outlook with total sales projected to rise 11% in fiscal 2024 and expected to climb another 10% in FY25 to $6.68 billion. Even better, Iron Mountain’s annual earnings are forecasted to be up 7% this year and slated to rise another 6% in FY25 to $4.68 per share.

Image Source: Zacks Investment Research

Sunoco SUN: Motor fuel distributer Sunoco LP rounds of the list with crude oil prices surging over the last month and currently at $85 a barrel. With this countering the drop in other commodities along with recent market headwinds, its noteworthy that Sunoco supplies motor fuel to roughly 10,000 convenience stores throughout the U.S.

Image Source: Yahoo Finance

Sunoco’s price performance is virtually flat this year but SUN has a 5.61% annual dividend that certainly suits income investors. Plus, FY24 and FY25 EPS estimates have soared over the last 60 days suggesting more short-term upside.

Image Source: Yahoo Finance

Bottom Line

Like Sunoco, Kaiser Aluminum and Iron Mountain are enjoying positive earnings estimate revisions with all three stocks landing a Zacks Rank #1 (Strong Buy). Most importantly, a stronger outlook and considerate dividend make these stocks ideal buy the dip candidates if the opportunity is presented although they look poised to move higher despite recent market volatility.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.