Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Belonging to the auto sector, Allison Transmission provides fully automatic transmissions and propulsion solutions for commercial and defense vehicles with Dorman Products supplying replacement and upgrade parts in the motor vehicle aftermarket.

That said, let’s take a look at why now is a good time to buy these highly-ranked automotive equipment stocks.

Allison Transmission’s “A” Value Score

Notably, Allison Transmission's stock has an “A” Zacks Style Scores grade for Value with its P/E discount being very tempting at the moment. Trading at $82, Allision Transmission’s stock has a 10.6X forward earnings multiple compared to its Zacks Automotive-Original Equipment industry average of 19.1X.

Image Source: Zacks Investment Research

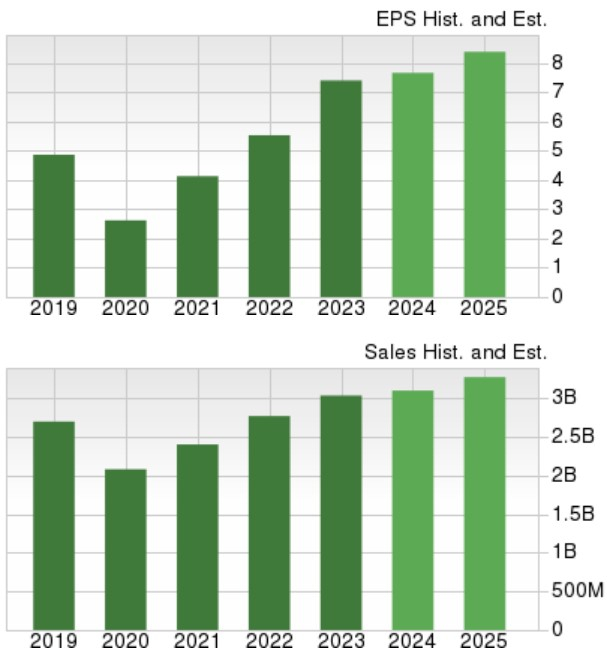

Furthermore, Allision Transmission’s annual earnings are expected to rise 3% in fiscal 2024 and are forecasted to jump another 9% in FY25 to $8.38 per share. Allison Transmission’s stock also trades at 2.2X forward sales which is near the optimum level of less than 2X with the company’s top line projected to expand 2% this year and slated to rise another 5% in FY25 to $3.27 billion.

Image Source: Zacks Investment Research

Dorman Products “B” Value Score

With a “B” Zacks Style Scores grade for Value, Dorman Products stock trades at $97 and 17.4X forward earnings which is nicely beneath the S&P 500’s 21.9X and closer to its Zacks Automotive-Replacement Parts industry average of 14.6X.

Image Source: Zacks Investment Research

Plus, Dorman Products’ EPS is forecasted to climb 22% this year and is expected to grow another 10% in FY25 to $6.14 per share. Dorman Products stock also trades at 1.5X sales with its top line expected to expand 4% in both FY24 and FY25.

Image Source: Zacks Investment Research

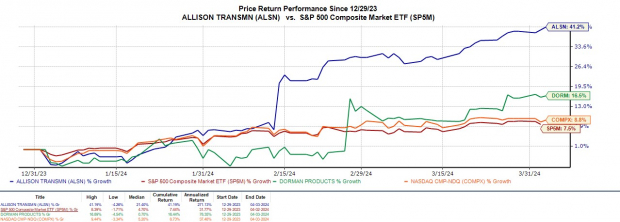

Blazing Price Performances

Year to date, Allison Transmission shares have soared +43% while Dorman Products stock has climbed +16% to largely outperform the broader indexes. Better still, earnings estimate revisions for Allision Transmission and Dorman Products' FY24 and FY25 are noticably higher over the last 60 days which is indicative of more short-term upside.

Image Source: Zacks Investment Research

Bottom Line

With their attractive valuations being accompanied by sound growth, now looks like a good time to buy Allison Transmission and Dorman Products stock. To that point, it would be no surprise if their stocks continued to rip higher this year.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.