Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Aldeyra Therapeutics’ALDX clinical-stage immunology pipeline comprises two candidates, reproxalap and ADX-629, which are undergoing late-stage and mid-stage development, respectively.

The company’s lead product candidate, Reproxalap, is currently being evaluated in two separate phase III studies for dry eye disease and allergic conjunctivitis.

Shares of Aldeyra rallied 43.3% in the past week, driven by the company’s clinical development plan announced on Mar 28, which is intended to enable the resubmission of a new drug application (NDA) of topical ocular 0.25% reproxalap, an investigational RASP modulator, for the treatment of dry eye disease to the FDA.

Per ALDX, dry eye disease is a potentially debilitating and increasingly pervasive condition that affects millions of patients worldwide.

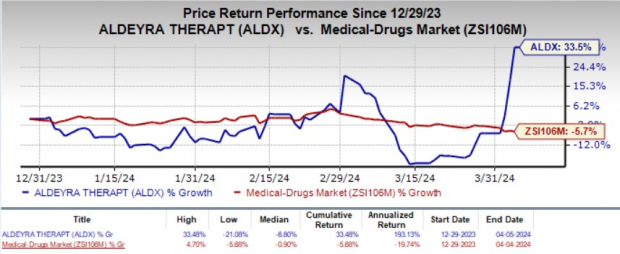

Year to date, shares of Aldeyra have jumped 33.5% against the industry’s 5.7% decline.

Image Source: Zacks Investment Research

We remind the investors that in November 2023, Aldeyra received a complete response letter (CRL) from the FDA for its NDA of reproxalap, submitted in December 2023, seeking approval to treat dry eye disease. Per the FDA, the study results supporting the NDA failed to demonstrate reproxalap’s efficacy in treating ocular symptoms associated with dry eyes, which formed the basis of the CRL issue.

The FDA recommended that at least one additional adequate and well-controlled study should be conducted on the candidate to demonstrate a positive effect on the treatment of ocular symptoms of dry eye.

Following further dialogues with the FDA, last week, Aldeyra announced plans to initiate a dry eye chamber clinical study in the first half of 2024 to address the issues stated by the FDA in the CRL.

Subject to the success of this additional clinical study, the company expects to resubmit the reproxalap NDA for the dry eye disease indication in the second half of 2024. The FDA has indicated that the review period for the potential NDA resubmission will be six months from the acceptance date.

The impending dry eye chamber study is expected to enroll approximately 100 patients to assess the primary endpoint of ocular discomfort. In the study, patients will initially be administered with vehicle (the drug product without the active ingredient) before and during exposure to a dry eye chamber.

Patients who qualify will then be randomized to receive either reproxalap or vehicle before and during exposure to an additional dry eye chamber. The goal of the study is to demonstrate statically significant lower ocular discomfort in the dry eye chamber following treatment with reproxalap than that with the vehicle.

ALDX also expects to parallelly conduct a different dry eye chamber clinical study, apart from the one already planned, under its comprehensive strategy designed to account for disease heterogeneity and potential differences in clinical sites and environment.

In the same press release, the company also reiterated that its cash and cash equivalents of $142.8 million as of Dec 31, 2023, are projected to be sufficient to fund operations beyond 2026, based on current operating plans.

Please note that Aldeyra has an existing exclusive option agreement with AbbVie Inc. ABBV that grants the latter an option to acquire a co-exclusive license to develop, manufacture and commercialize reproxalap within the United States and an exclusive license for the same outside the United States. If AbbVie chooses to exercise the option, ALDX will be eligible to receive a non-refundable option fee of $1 million and an upfront payment of $100 million less option fees.

Under such circumstances, the license grant to AbbVie will make Aldeyra eligible to receive up to $300 million in potential regulatory and commercial milestone payments, which includes a $100 million milestone payment upon the FDA’s approval of reproxalap for dry eye disease.

If the licensing agreement between the companies materializes and is also subject to approval, ALDX and ABBV would share profits and losses from the commercialization of reproxalap in the ratio of 60:40. Outside the United States, Aldeyra would only be eligible to receive tiered royalties on net sales of reproxalap.

The company’s other clinical-stage candidate, oral ADX-629, is currently being evaluated in two separate phase II studies for moderate alcoholic hepatitis and Sjögren-Larsson syndrome.

Zacks Rank and Other Stocks to Consider

Aldeyra currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the drug/biotech industry, worth mentioning, are ADMA Biologics ADMA and FibroGen FGEN. While ADMA sports a Zacks Rank #1 (Strong Buy), FGEN carries a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, the Zacks Consensus Estimate for ADMA Biologics’ 2024 earnings per share (EPS) has remained constant at 30 cents. During the same period, the estimate for ADMA’s 2025 EPS has remained constant at 50 cents. In the past week, shares of ADMA have lost 4.8%.

ADMA beat estimates in three of the trailing four quarters and matched in one, delivering an average earnings surprise of 85%.

In the past 30 days, the Zacks Consensus Estimate for FibroGen’s 2024 loss per share has remained constant at $1.09. During the same period, the estimate for FibroGen’s 2025 loss per share has remained constant at 6 cents. In the past week, shares of FGEN have plunged 32.8%.

FGEN beat estimates in two of the trailing four quarters, missing the mark on the other two occasions, delivering an average negative surprise of 2.26%.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.