Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

International Flavors & Fragrances Inc. IFF reported adjusted earnings of $1.13 per share in first-quarter 2024, beating the Zacks Consensus Estimate of 84 cents. The bottom line improved 30% from the year-ago quarter.

Including one-time items, the company reported earnings of 23 cents against the prior-year quarter’s loss of 4 cents.

International Flavors’ net sales were $2.9 billion in the March-end quarter, decreasing 4.2% year over year. The top line surpassed the Zacks Consensus Estimate of $2.81 billion. In the January-March quarter, currency-neutral sales grew 5% year over year.

In the reported quarter, International Flavors’ cost of goods sold was down 9.1% year over year to $1.88billion. The gross profit rose 6.2% year over year to $1.02 billion. The gross margin came in at 35.3% compared with 31.8% in the year-ago quarter.

Research and development expenses increased 3.1% year over year to $166 million. The selling and administrative expenses rose 7.9% year over year to $490 million in the first quarter. The adjusted operating EBITDA came in at $578 million, up 14.9% from the prior-year quarter’s $503 million. The adjusted operating EBITDA margin was 19.9% compared with the year-ago quarter’s 16.6%.

Revenues in the Nourish segment fell 9.5% year over year to $1.5 billion in the March-end quarter. The figure beat our estimate of $1.46 billion. The adjusted operating EBITDA was $216 million, up 3.8% year over year. Our estimate for the segment’s adjusted EBITDA was $181 million.

Revenues generated in the Health & Bioscience segment were $531 million compared with the year-earlier quarter’s $513 million. Our estimate was $511 million for the same. The adjusted operating EBITDA was $159 million in the quarter compared with $131 million in the prior-year quarter. Our estimate for the segment’s adjusted EBITDA was $142 million.

The Scent segment’s revenues were $645 million compared with the year-ago quarter’s $608 million. The figure was in line with our estimate. The adjusted operating EBITDA improved 49.5% year over year to $157 million. Our model had projected an EBITDA of $101 million for the segment.

Revenues in Pharma Solutions were $227 million in the first quarter, down 10.3% year over year. The figure surpassed our estimate of $223 million. The adjusted operating EBITDA fell 22% year over year to $46 million. Our model had projected an EBITDA of $52 million for the segment.

International Flavors had cash, cash equivalents, and restricted cash of $739 million at the end of the first quarter, up from the $709 million witnessed at the end of 2023. The long-term debt was $9.2 billion at the first-quarter end, flat with that reported on Dec 31, 2023.

International Flavors generated $99 million of cash in operating activities in the first quarter compared with $127 million in the prior-year quarter.

International Flavors expects sales for 2024 to be at the higher end of $10.8-$11.1 billion. Volume is anticipated to be near the higher end of its earlier stated expectation of flat to up 3%. The company expects pricing to increase 1% year over year, up from the previously stated decline of 2.5%. Adjusted EBITDA is expected between $1.9 billion and $2.1 billion.

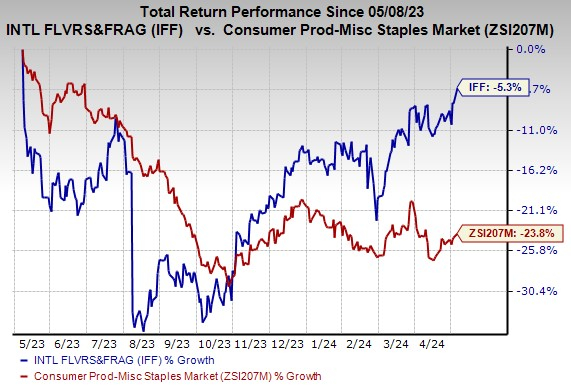

In the past year, IFF’s shares have lost 5.3% compared with the industry’s decline of 23.8%.

Image Source: Zacks Investment Research

International Flavors currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Kimberly-Clark Corporation KMB posted first-quarter 2024 adjusted earnings of $2.01 per share, surpassing the Zacks Consensus Estimate of $1.61. The bottom line increased 20% year over year, courtesy of higher adjusted operating profit.

Kimberly-Clark’s sales totaled $5.1 billion, surpassing the consensus estimate of $5.08 billion. The metric inched down 1% compared with the year-ago period.

Tilray Brands, Inc. TLRY reported break-even quarterly earnings per share, whereas the Zacks Consensus Estimate was pegged at a loss of 4 cents. Notably, the company reported a loss of 4 cents a year ago. It posted revenues of $188.3 million for the quarter ended February 2024, missing the consensus estimate of $200 million. The top line increased 29% year over year.

Newell Brands Inc. NWL posted break-even earnings in first-quarter 2024 against earnings per share of 6 cents in the year-ago quarter. Meanwhile, the consensus mark was pegged at a loss of 7 cents per share.

Net sales declined 8.4% year over year to $1.7 billion on lower core sales, and the impacts of business exits and adverse foreign exchange. Nonetheless, the metric exceeded the consensus estimate of $1.6 billion.

Where Will Stocks Go…

If Biden Wins? If Trump Wins?

The answers may surprise you.

Since 1950, even after negative midterm years, the market has never had a lower presidential election year. With voters energized and engaged, the market has been almost unrelentingly bullish no matter which party wins!

Now is the time to download Zacks' free Special Report with 5 stocks that offer extreme upside for both Democrats and Republicans…

1. Medical manufacturer has gained +11,000% in the last 15 years.

2. Rental company is absolutely crushing its sector.

3. Energy powerhouse plans to grow its already large dividend by 25%.

4. Aerospace and defense standout just landed a potentially $80 billion contract.

5. Giant Chipmaker is building huge plants in the U.S.

Hurry, Download Special Report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.