Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Catalent, Inc. CTLT recently entered a strategic partnership with Siren Biotechnology. The tie-up aims to support the development and manufacturing of Siren Biotechnology’s adeno-associated viral (AAV) immuno-gene therapies.

The latest partnership is expected to be a significant stepping stone for its Biologics business and solidify its foothold in the niche space.

Under the partnership, Catalent will provide process development and cGMP (current good manufacturing practices) manufacturing of Siren Biotechnology’s AAV vector-based therapeutic candidates for use in clinical trials. Catalent will also support process optimization at its process and clinical development center in Baltimore, MD.

Per Catalent’s management, the partnership is expected to pave the path for the development and commercial manufacturing of safe and high-quality AAV gene therapies to provide life-saving treatments to cancer patients.

Siren Biotechnology’s management believes that the tie-up will result in a robust manufacturing process that will move its therapeutic programs into the clinic as quickly as possible.

Per a report by Grand View Research, the global adeno-associated virus vector manufacturing market was valued at $767.7 million in 2022 and is anticipated to expand at a CAGR of 22.5% between 2023 and 2030. Factors like the increase in the number of clinical trials and clinical trial evaluations of AAV vector-based therapies and technological advancements in gene therapies are likely to drive the market.

Given the market potential, the latest tie-up will likely provide a significant impetus to Catalent in the cell and gene therapy space.

This month, Catalent reported its third-quarter fiscal 2024 results, wherein it recorded a year-over-year improvement in its overall top-line and bottom-line results. Management also confirmed to witness continued momentum in the Biologics segment, which partially drove an increase in consolidated sequential revenues and adjusted EBITDA margin for the second consecutive quarter.

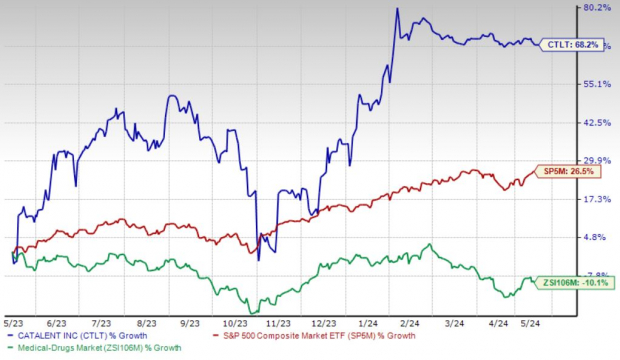

Shares of Catalent have gained 68.2% in the past year against the industry’s 10.1% decline. The S&P 500 has witnessed 26.5% growth in the said time frame.

Image Source: Zacks Investment Research

Currently, Catalent carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Veeva Systems Inc. VEEV and Ecolab Inc. ECL.

DaVita, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 13.6%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 29.4%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 41.9% compared with the industry’s 23.3% rise in the past year.

Veeva Systems, flaunting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 24.1%. VEEV’s earnings surpassed estimates in each of the trailing four quarters, with the average being 8.5%.

Veeva Systems has gained 15.4% compared with the industry’s 47.8% rise in the past year.

Ecolab, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 13.5%. ECL’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 1.3%.

Ecolab’s shares have rallied 34.4% against the industry’s 10.1% decline in the past year.

Buy 5 Stocks BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Special Report, Profit from the 2024 Presidential Election (no matter who wins).

Since 1950, presidential election years have been strong for the market. This report names 5 timely stocks to ride the wave of electoral excitement.

They include a medical manufacturer that gained +11,000% in the last 15 years… a rental company absolutely crushing its sector… an energy powerhouse planning to grow its already large dividend by 25%... an aerospace and defense standout that just landed a potentially $80 billion contract… and a giant chipmaker building huge plants in the U.S.

Don’t Wait. Download FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.