Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

United Bankshares, Inc. UBSI has entered a definitive merger agreement with Piedmont Bancorp, Inc. to acquire the latter. This marks United Bankshares’ 34thacquisition.

This merger will bring together two high-performing banking companies and strengthen UBSI’s position in the Mid-Atlantic and Southeast.

In the all-share deal, United Bankshares will acquire 100% of the outstanding shares of Piedmont in exchange for 0.300 common shares of UBSI. This will result in an aggregate transaction value of $267 million. Piedmont shareholders will have a 5.4% ownership in the company. The merger has been approved by both companies’ boards of directors. Pre-tax one-time expenses of $27.6 million are expected.

The deal is subject to customary closing norms, including the approval of Piedmont’s shareholders and the receipt of required regulatory approvals, counting the approval of the Federal Reserve. The merger is anticipated to close late in fourth-quarter 2024 or early first-quarter 2025.

The combined company will have more than $32 billion in assets, $23 billion in net loans and $25 billion in deposits. It will have a network of more than 240 locations across eight states and Washington, DC, in other strategic markets in the nation.

Per United Bankshares management, “We share similar commitments to serving our customers and communities with a relationship-focused approach. The greater Atlanta area is the perfect addition to UBSI’s footprint, and we look forward to being a part of the vibrant and fast-growing communities there.”

Per Piedmont management, “We believe this merger will allow us to better serve our current customers and reach new audiences with enhanced products and services, all while maintaining our personalized community bank approach.”

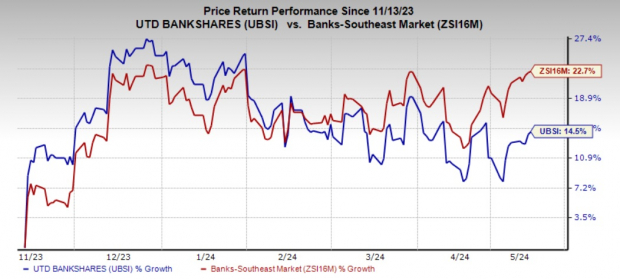

Over the past six months, UBSI shares have rallied 14.5% compared with the industry’s 22.7% growth.

Image Source: Zacks Investment Research

Currently, United Bankshares carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earlier this month, BlackRock Inc. BLK closed the acquisition of SpiderRock Advisors, LLC. This strengthened the company’s capabilities to provide a robust platform to its clients with customized separately managed accounts (SMAs) solutions.

The deal is expected to enable BLK’s SMA solutions to meet the increased demand for personalized, tax-efficient portfolios by wealth managers. The financial impacts of the acquisition will be immaterial to 2024 earnings.

Similarly, last month, UMB Financial Corp. UMBF signed a definitive agreement to acquire Heartland Financial, USA Inc. HTLF in an all-stock transaction valued at around $2 billion.

The deal is expected to further diversify UMBF’s business, adding scale to its consumer and small business capabilities, and expanding its footprint in the Midwest and Southwest markets. HTLF had $19.4 billion in assets, $16.2 billion in total deposits and $12.1 billion in total loans as of Mar 31, 2024.

Buy 5 Stocks BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Special Report, Profit from the 2024 Presidential Election (no matter who wins).

Since 1950, presidential election years have been strong for the market. This report names 5 timely stocks to ride the wave of electoral excitement.

They include a medical manufacturer that gained +11,000% in the last 15 years… a rental company absolutely crushing its sector… an energy powerhouse planning to grow its already large dividend by 25%... an aerospace and defense standout that just landed a potentially $80 billion contract… and a giant chipmaker building huge plants in the U.S.

Don’t Wait. Download FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.