Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Investors closely monitor insider buys, as they can deliver a positive message to shareholders, reflecting overall business confidence.

Of course, many strict rules apply to insiders.

Insiders can’t trade based on material nonpublic information, they must pre-clear all trades, and all transactions of the company’s stock must occur during the Window Period.

In addition, insiders have a longer holding period than most, a critical aspect that investors should be aware of.

Three companies – Caterpillar CAT, PPG Industries PPG, and Hubbell HUBB – have all seen recent insider activity. For those interested in trading like the insiders, let’s take a closer look at each.

Caterpillar

CAT shares have delivered solid gains so far in 2024, gaining 21% compared to the S&P 500’s 10.4% climb. A director recently made a splash following the release of its quarterly results, acquiring 500 shares at a total transaction value of over $168k.

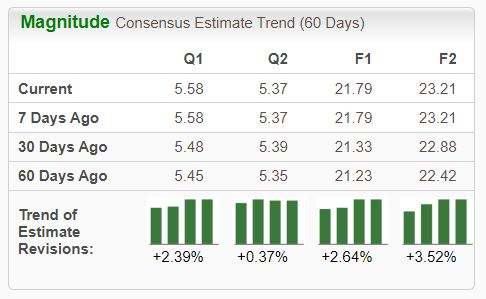

Analysts have positively revised their earnings expectations across the board, undoubtedly a bullish sign.

Image Source: Zacks Investment Research

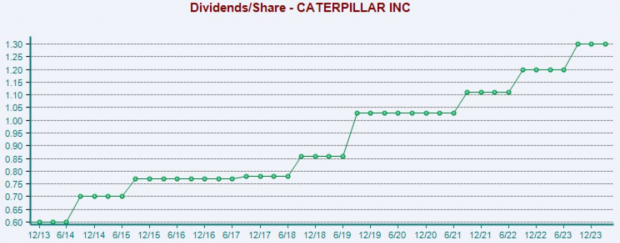

The company has long displayed a shareholder-friendly nature, holding the ranks of a Dividend Aristocrat. Shares currently yield a solid 1.5% annually paired with a sustainable payout ratio sitting at 24% of the company’s earnings.

Image Source: Zacks Investment Research

PPG Industries

PPG shares have been notably strong in May so far, gaining nearly 6% and outperforming relative to the S&P 500. The CEO recently swooped in for a purchase, buying roughly 2k shares at a total cost of just below $275k.

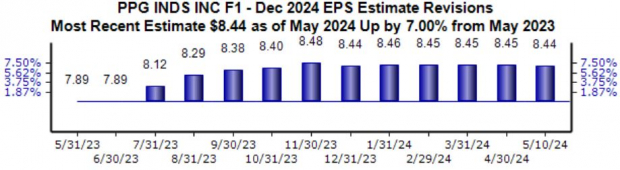

The company’s current year outlook has shifted positively over the last year, with the $8.44 Zacks Consensus EPS estimate up 7% and suggesting 10% year-over-year growth.

Image Source: Zacks Investment Research

Hubbell

HUBB shares have delivered a strong performance in 2024, up nearly 22% and outperforming relative to the S&P 500. A director recently acquired 500 shares at a total transaction value of just under $190k.

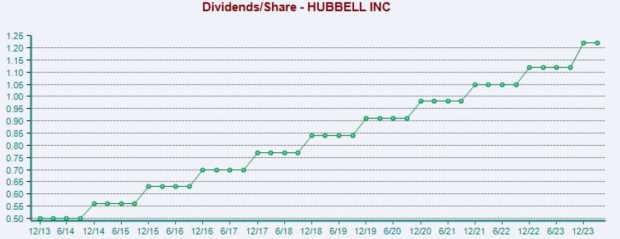

Like those above, the company has been committed to increasingly rewarding shareholders, carrying a 7.7% five-year annualized dividend growth rate. Shares currently yield 1.2% annually paired with a sustainable payout ratio sitting at 32% of the company’s earnings.

Image Source: Zacks Investment Research

Shares faced pressure post-earnings following its latest release before quickly reversing course, with HUBB posting a 1.7% beat relative to the Zacks Consensus EPS estimate and posting sales modestly ahead of expectations.

Bottom Line

Many investors closely monitor insider buys, as they can provide a high level of confidence and conviction.

And recently, all three stocks above – Caterpillar CAT, PPG Industries PPG, and Hubbell HUBB – have seen recent insider activity.

Buy 5 Stocks BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Special Report, Profit from the 2024 Presidential Election (no matter who wins).

Since 1950, presidential election years have been strong for the market. This report names 5 timely stocks to ride the wave of electoral excitement.

They include a medical manufacturer that gained +11,000% in the last 15 years… a rental company absolutely crushing its sector… an energy powerhouse planning to grow its already large dividend by 25%... an aerospace and defense standout that just landed a potentially $80 billion contract… and a giant chipmaker building huge plants in the U.S.

Don’t Wait. Download FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.