Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Leading up to the peak travel season this summer, Panama-based airlines operator Copa Holdings CPA and India-based online travel service company MakeMyTrip Limited MMYT are two stocks investors may want to keep an eye on.

Here’s a look at why now may be a good time to buy both of these travel-related stocks ahead of their quarterly results on Wednesday, May 15.

Copa Holdings Preview

Impressive operating margins attributed to low unit cost and healthy travel demand helped Copa Holdings' post-industry-leading financial results last year. Through its subsidiaries Copa Airlines and Copa Columbia, the company has become a regional leader among airlines in South America with destinations to and from North and Central America and the Caribbean along with its Panama City hub.

Coming off of a very tough-to-compete-against prior-year quarter, Copa Holdings’ Q1 sales are projected to dip -3% to $837.31 million with earnings forecasted at $3.09 per share compared to EPS of $3.99 a year ago. Still, Copa Holdings has surpassed bottom line expectations for 12 consecutive quarters most recently beating Q4 earnings estimates by 14% in February with EPS at $4.47 compared to the Zacks Consensus of $3.90 a share.

What also makes Copa Holdings' robust bottom line attractive ahead of its quarterly report is that CPA trades at just 6.4X forward earnings which is a significant discount to the S&P 500’s 21.9X and the Zacks Transportation-Airline Industry average of 18.4X. Compared to the top regional airlines in the United States this is well below Southwest Airlines LUV at 24.6X and slightly beneath Alaska Air Group ALK and Delta Air Lines DAL at 9.3X and 7.9X respectively.

Image Source: Zacks Investment Research

MakeMyTrip Limited Preview

Outside of offering exposure to India’s economy, MakeMyTrip Limited also serves the United States with its services and products extending to air tickets, customized holiday packages, hotel bookings, train and bus tickets along with car hire and access to travel insurance.

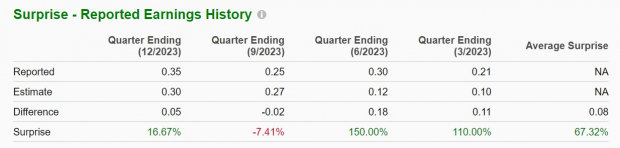

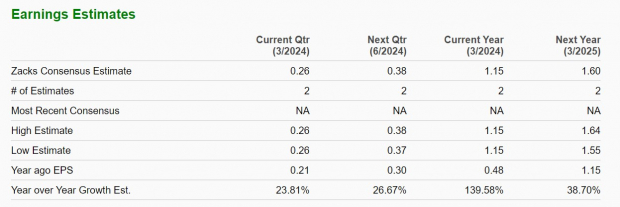

Set to report its fiscal fourth quarter results on Wednesday, MakeMyTrip Limited’s expansion remains compelling with Q4 sales thought to have increased 31% to $195.15 million. Even better, earnings are projected to increase 24% to $0.26 per share versus $0.21 a share in the comparative quarter. Notably, MakeMyTrip Limited has surpassed earnings expectations in three of its last four quarterly reports with Q3 EPS of $0.35 most recently beating estimates of $0.30 a share by 16% in January.

Image Source: Zacks Investment Research

Attractive Growth Trajectories

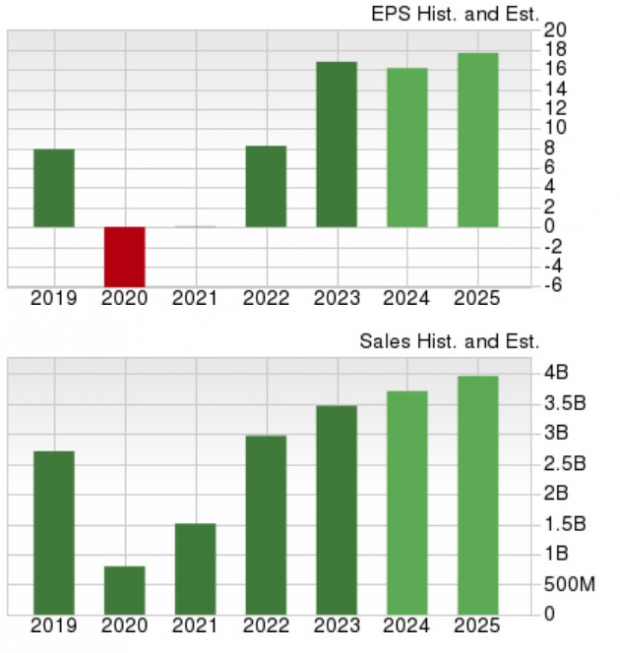

Copa Holdings' total sales are expected to increase 7% in both fiscal 2024 and FY25 with projections edging towards $4 billion. Annual earnings are projected to dip -3% this year but are forecasted to rebound and rise 9% in FY25 to $17.70 per share.

Image Source: Zacks Investment Research

Meanwhile, MakeMyTrip Limited’s total sales are slated to expand 33% in FY24 to $787.71 million compared to $593.04 million last year. MakeMyTrip Limited’s top line is expected to jump another 18% next year with projections at $934.78 million. More importantly, annual earnings are forecasted to soar 139% in FY24 to $1.15 per share versus $0.48 a share in 2023. Furthermore, another 39% EPS growth is expected in FY25 with projections at $1.60 per share.

Image Source: Zacks Investment Research

Bottom Line

Copa Holdings and MakeMyTrip Limited have emerged as winners amid the continued post-pandemic recovery in the broader travel industry. To that point, going into their quarterly reports Copa Holdings stock sports a Zacks Rank #2 (Buy) while MakeMyTrip Limited shares boast a Zacks Rank #1 (Strong Buy).

Buy 5 Stocks BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Special Report, Profit from the 2024 Presidential Election (no matter who wins).

Since 1950, presidential election years have been strong for the market. This report names 5 timely stocks to ride the wave of electoral excitement.

They include a medical manufacturer that gained +11,000% in the last 15 years… a rental company absolutely crushing its sector… an energy powerhouse planning to grow its already large dividend by 25%... an aerospace and defense standout that just landed a potentially $80 billion contract… and a giant chipmaker building huge plants in the U.S.

Don’t Wait. Download FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MakeMyTrip Limited (MMYT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.