Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Koninklijke Philips PHG recently announced the retrospective study results highlighting the financial and medical advantages of Philips' AI-powered cardiac care solutions, which were presented at the Heart Rhythm Annual Meeting in Boston.

Three studies demonstrate how Philips mobile cardiac outpatient telemetry (MCOT) wearable ambulatory monitoring ECG and proprietary AI models applied to ECG digital biomarkers can help to improve diagnosis, reduce readmissions, and lower costs.

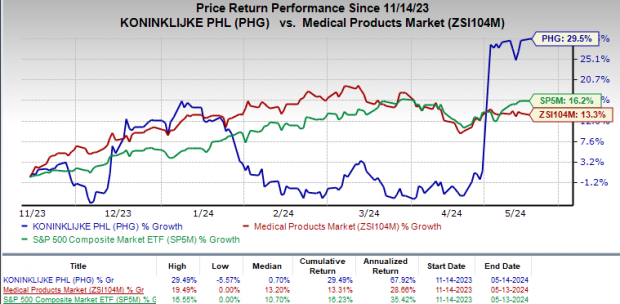

For the past six months, PHG’s shares have gained 29.5% compared with the industry’s rise of 13.3%. The S&P 500 increased 16.2% in the same time frame.

Image Source: Zacks Investment Research

The Philips’ study compared the clinical and financial results of using wearable ECG sensors known as MCOT with implantable loop recorders (ILRs). This study was conducted to assess the potential effects of cardiac remote monitoring technologies on current standards of treatment. The study examined the 18-month period after a stroke event.

The study’s results revealed that when MCOT was used instead of ILR for discharge monitoring, patients experienced significantly lower readmissions. It was also found that the average cost over an 18-month period following the stroke event was significantly reduced. Emergency department utilization was observed to be considerably lower. The study also reported a higher rate of survival for patients with complications and comorbidities from the index stroke.

Per an additional study by Philips, AI-powered ECG biomarker technology makes it easier to detect people who have substantial intermittent bradyarrhythmia, which could lead to more prompt diagnosis and treatment. The study focused on effectively triaging syncope patients by identifying individuals who previously had bradyarrhythmia using an AI-based learning model.

Per a report by MarketsandMarkets, the global AI in healthcare market size is valued at $20.9 billion in 2024 and is expected to reach $148.4 billion by 2029 at a growth rate of 48.1%.

Growth of AI in the healthcare market is driven by the generation of large and complex healthcare datasets, the pressing need to reduce healthcare costs, improving computing power and declining hardware costs, and the rising number of partnerships among different domains in the healthcare sector.

In April, Philips also announced a final consent decree between the FDA and the U.S. Department of Justice. The consent decree primarily focuses on Philips Respironics’ business operations in the United States. It offers clarity and a defined roadmap to demonstrate compliance with regulatory requirements and restore the Philips Respironics business.

PHG carries a Zacks Rank #3 (Hold) at present.

Some better-ranked stocks in the broader medical space that have announced quarterly results are Align Technology, Inc. ALGN, Ecolab ECL and Boston Scientific Corporation BSX.

Align Technology, carrying a Zacks Rank of 2 (Buy), reported first-quarter 2024 adjusted EPS of $2.14, beating the Zacks Consensus Estimate by 8.1%. Revenues of $997.4 million outpaced the consensus mark by 2.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Align Technology has a long-term estimated growth rate of 6.9%. ALGN’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 5.9%.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.3%. ECL’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 1.7%.

Ecolab’s shares have rallied 33.8% against the industry’s 9.3% decline in the past year.

Boston Scientific reported first-quarter 2024 adjusted EPS of 56 cents, beating the Zacks Consensus Estimate by 9.8%. Revenues of $3.86 billion surpassed the Zacks Consensus Estimate by 4.9%. It currently carries a Zacks Rank #2.

Boston Scientific has a long-term estimated growth rate of 12.5%. BSX’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 7.5%.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.