Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Simon Property Group SPG recently announced a reinvestment to incorporate luxury living at San Diego's top shopping destination, Fashion Valley.

The move aims to boost foot traffic and sales and attract top-tier tenants, fortifying its place in the retail real estate market and ensuring long-term value creation.

Fashion Valley, as part of a mixed-use redevelopment project, will soon feature 850 multi-family luxury residences with the help of apartment developer AMLI Residential. The project will also include 100,000 square feet of new retail and dining experiences to complement fresh and lush open green spaces and ample parking for residents and guests.

Per Mark Silvestri, president of Development at Simon Property, "Simon is leading the evolution of today's retail landscape with the strategic transformation of key properties across the country. We're excited about this next phase of Fashion Valley as we continue to reinvest and add a walkable, livable lifestyle community that is intertwined with handpicked luxury brands that can only be found here. This redevelopment marks a new era of sophistication and convenient living in San Diego."

This retail and residential revitalization project is expected to commence promptly after the scheduled closure of JCPenney by the end of 2025, with an estimated completion date in late 2026.

Fashion Valley has recently undergone a multimillion-dollar revitalization, enhancing the shopping experience with a fresh new appearance and the introduction of exclusive luxury brands such as Dior, Bottega Veneta, David Yurman, and Dolce & Gabbana. Additionally, it has been revealed that three more luxury brands will be added to the lineup, including Celine in the second quarter of 2024, Christian Louboutin, and Fendi in 2025.

Last week, Simon Property announced reinvestment plans for Houston’s iconic The Galleria, underscoring its strategy to enhance its property portfolio. Upgrades will commence this summer and are slated for completion by early 2025.

In April 2024, the company also announced enhancements to its Woodbury Common Premium Outlets shopping center as part of a broader redevelopment initiative.

Simon Property has been restructuring its portfolio, aiming at premium acquisitions and transformative redevelopments. In fact, over the past years, the company has been investing billions to transform its properties, focusing on creating value and driving footfall.

Solid retail-real-estate demand for premium properties is likely to drive healthy demand for its properties, aiding leasing activity, occupancy levels and rent growth. Focus on supporting omnichannel retailing and developing mixed-use assets are encouraging. A healthy balance sheet will likely aid growth endeavors. However, growing e-commerce adoption and high interest rates remain concerns.

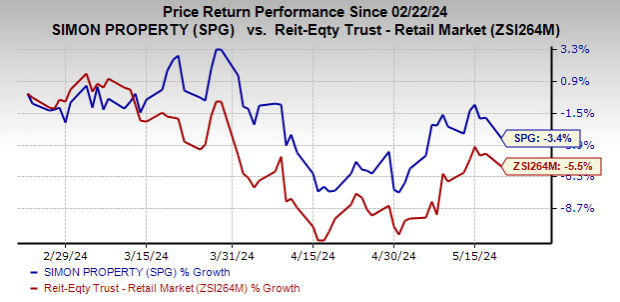

Over the past three months, shares of this Zacks Rank #3 (Hold) company have declined 3.4%, narrower than the industry’s decline of 5.5%.

Image Source: Zacks Investment Research

Some better-ranked stocks from the retail REIT sector are Kite Realty Group Trust KRG and Acadia Realty Trust AKR, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for KRG’s 2024 funds from operations (FFO) per share has been revised a cent northward over the past week to $2.05.

The Zacks Consensus Estimate for AKR’s current-year FFO per share has been revised a cent upward over the past month to $1.28.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Buy 5 Stocks BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Special Report, Profit from the 2024 Presidential Election (no matter who wins).

Since 1950, presidential election years have been strong for the market. This report names 5 timely stocks to ride the wave of electoral excitement.

They include a medical manufacturer that gained +11,000% in the last 15 years… a rental company absolutely crushing its sector… an energy powerhouse planning to grow its already large dividend by 25%... an aerospace and defense standout that just landed a potentially $80 billion contract… and a giant chipmaker building huge plants in the U.S.

Don’t Wait. Download FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.