Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

FXEmpire.com -

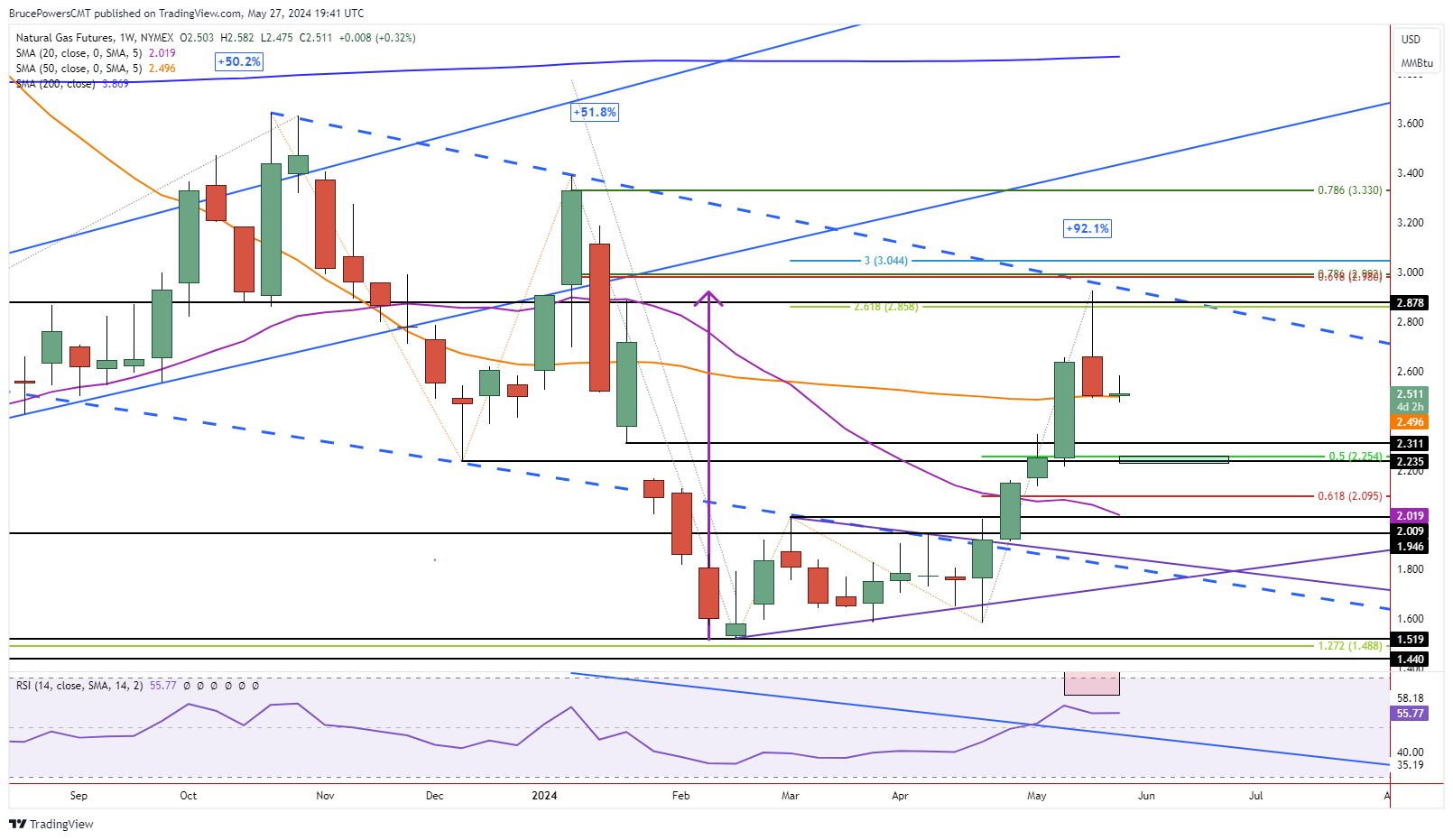

Natural gas further flirts with potential support around the 200-Day MA, currently at 2.46, as the low for the day was 2.475. The 200-Day MA is an obvious area to test for support as this is the first time that it has been approached since the bullish breakout of the line on May 16. It is common for the first test of a moving average as support frequently sees signs of support. However, natural gas is correcting from a strong advance that completed a 1.40 point or 92.1% rally in 13 weeks.

That is an aggressive advance that exceeds all prior rallies since the 10.03 peak in 2022. It has been overdue for a correction and has more than likely only just begun a retracement or consolidation phase. So, the behavior of natural gas around the 200-Day line is important for the short-term as the reaction should provide clues as to what might come next.

Moreover, the weekly chart needs to be considered. Last week ended with a bearish wide ranged red shooting star candlestick pattern with the closing price essentially the low of the week. That low stopped at support seen at the 50-Week MA. Currently, the 50-Week MA is at 2.50. It was broken to the downside briefly today to reach a low of 2.475 before there was a minor intraday bounce.

Since both the 200-Day MA and 50-Day MA identify a similar potential support zone from 2.50 to 2.46, it may have added significance. Nevertheless, a decisive drop through 2.46 has natural gas heading first towards the 20-Day MA at 2.37 followed by a prior interim swing low at 2.31. A more likely lower price target though looks to be around 2.25 to 2.23. That zone is derived from the 50% retracement and a previous swing low from December 13.

Natural gas has been tracing out a declining trend channel that is shown on the chart with dashed declining blue trendlines. Since it hit the top of the channel last week and rejecting price to the downside, the lower area of the channel becomes a potential target. Also, if the 20-Day MA fails to retain support and natural gas drops below it and stays below it, the 50-Day MA at 2.01 becomes a target. It is a match with the prior top of the symmetrical triangle bottom pattern.

For a look at all of today’s economic events, check out our economic calendar.

This article was originally posted on FX Empire

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.