Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Growth investing is widely popular, with investors targeting companies expected to grow their earnings and revenues at an above-average level. It’s a development that commonly follows through to share outperformance.

Of course, investors should also be aware of the increased volatility these stocks can face, as unforeseen circumstances can always hamper their bright outlooks.

For those seeking a group of strong growth stocks, Nvidia NVDA, e.l.f. Beauty ELF, and Wingstop WING could all be considerations.

Let’s take a closer look at each.

Nvidia

Nvidia yet again blew away quarterly expectations in its quarterly print, with unrelenting demand for AI chips driving robust performance. Earnings and revenue grew 460% and 260%, respectively, whereas Data Center sales melted 430% higher from the same period last year.

Shares soared following the release, with the company enjoying post-earnings positivity all throughout 2024. In addition to a 10-for-1 split, the company also announced a 150% boost to its quarterly dividend payout, reflecting a shareholder-friendly nature.

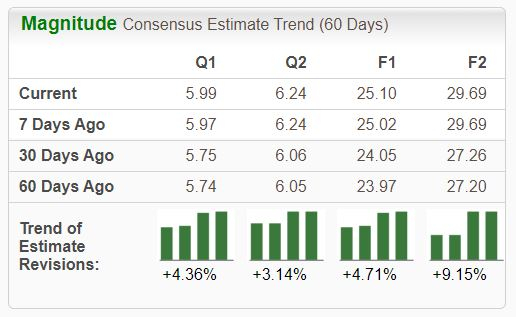

Nvidia’s earnings outlook only continues to get brighter, with the stock remaining a highly-coveted Zacks Rank #1 (Strong Buy). Shares represent a prime opportunity for any investor seeking AI exposure, with demand expected to remain strong.

Image Source: Zacks Investment Research

e.l.f. Beauty

ELF shares soared post-earnings, helping snap a nasty downtrend. Up nearly 30% in 2024, shares have widely outperformed relative to the S&P 500, building on years of outsized gains. The company’s quarterly consistency can’t be overlooked, beating consensus earnings and revenue expectations in 10 consecutive releases.

The company’s growth has been remarkable, posting double-digit percentage year-over-year sales growth consistently. Concerning its latest release, earnings grew 15% alongside a sizable 71% sales bump.

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

The stock remains a solid selection for growth-focused investors, underpinned by its Style Score of ‘B’ for Growth.

Wingstop

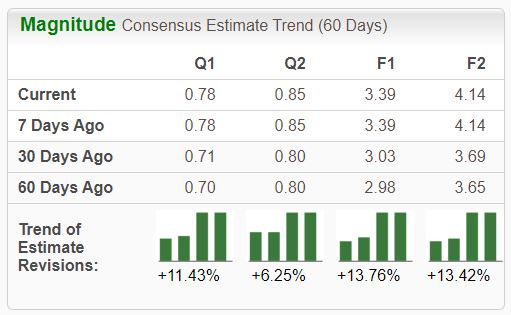

WING shares have been notably strong in 2024 on the back of better-than-expected results, up nearly 44% and widely outperforming relative to the S&P 500. The stock sports the highly-coveted Zacks Rank #1 (Strong Buy), with earnings expectations rising across the board.

Image Source: Zacks Investment Research

Growth is expected to continue in a big way, with consensus expectations for its current fiscal year suggesting 37% earnings growth on 27% higher sales. Growth follows through to FY25, with earnings and revenue forecasted to see growth of 22% and 17%, respectively.

Bottom Line

Growth-focused investors have been rewarded considerably over the last year amid the market’s remarkable run, enjoying significant gains.

And for those interested in joining the strategy, all three stocks above – Nvidia NVDA, e.l.f. Beauty ELF, and Wingstop WING – deserve a look.

In addition to strong growth, all three sport a favorable Zacks Rank, reflecting optimism among analysts.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.2% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.