Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

In a customer-friendly move, Uber Technologies UBER inked a deal with St. Louis-based Save A Lot, one of the largest discount grocers in the United States. Following the partnership, some selected Save A Lot grocery stores will be available through the Uber Eats app. Uber Eats is the online food ordering and delivery platform of UBER.

With UBER and Save A Lot joining forces, more than 150 of Save A Lot’s 600-plus independently owned grocery locations are offering Uber Eats as a delivery method. Another benefit is that Save A Lot shoppers can use their Health Benefit cards to buy multiple items via Uber Eats. Health Benefit cards boost the convenience of eligible individuals for purchasing groceries and over the counter drugs by utilizing their healthcare benefits.

Beryl Sanders, Uber’s director of U.S. Grocery & Retail partnerships said, "Many consumers are price-conscious, and we're excited to continue to partner with brands like Save A Lot to increase value for Uber Eats consumers." To promote Save A Lot's debut on Uber Eats, customers are being offered discounts subject to certain terms and conditions.

Uber’s grocery delivery business has exhibited steady growth since its launch in July 2020 and includes Albertsons Companies, Meijer, Kroger, SpartanNash and Hy-Vee to name a few.

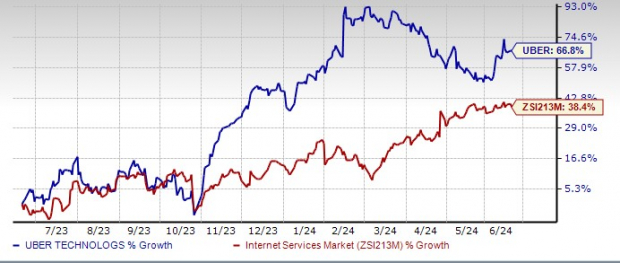

UBER shares have performed impressively, surging 66.8% in a year compared with its industry’s 38.4% growth.

Image Source: Zacks Investment Research

UBER currently carries a Zacks Rank #3 (Hold).

Investors interested in the same industry may consider some better-ranked stocks like Alphabet GOOGL and Crexendo (CXDO).

Alphabet, which currently sports a Zacks Rank #1 (Strong Buy), is being well-served by its a deepening focus on generative AI technology. Its robust cloud division is aiding substantial revenue growth. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for its 2024 earnings has moved north by 12.1% in the past 60 days and is currently pegged at $7.6 per share. Alphabet surpassed the Zacks Consensus Estimate for earnings in each of the past four quarters, the average beat being 11.34%.

Crexendo provides cloud communication platforms and services, as well as video collaboration and managed IT services. The stock carries a Zacks Rank #2 (Buy) presently.

The Zacks Consensus Estimate for its 2024 earnings has remained stable in the past 60 days and is currently pegged at 23 cents per share. CXDO surpassed the Zacks Consensus Estimate for earnings in three of the past four quarters (reporting in-line earnings once), the average beat being 212.5%.

Top 5 Dividend Stocks for Your Retirement

Zacks targets 5 well-established companies with solid fundamentals and a history of raising dividends. More importantly, they have the resources and will to likely pay them in the future.

Click now for a Special Report packed with unconventional wisdom and insights you simply won’t get from your neighborhood financial planner.

See our Top 5 now – the report is FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Crexendo Inc. (CXDO) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.