Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Beta measures a stock's volatility in comparison to the overall market. By definition, the market, such as the S&P 500 Index, has a beta of 1.0.

A beta above 1.0 suggests a stock is more volatile than the broader market, and a beta below 1.0 indicates the opposite. Low-beta stocks can provide several beneficial advantages for portfolios, including defensive qualities.

They can also offer stabilization when combined with high-beta stocks, helping to give a more balanced risk profile.

Three low-beta stocks – Interactive Brokers IBKR, Elevance Health ELV, and Consolidated Edison ED – could all be considered for those looking for a more conservative approach.

In addition to decreased volatility, all three sport a favorable Zacks Rank, reflecting optimism among analysts.

Let’s take a closer look at each.

Elevance Health operates as a health benefits company, supporting consumers, families, and communities throughout the care journey to lead healthier lives. The company sports a favorable Zacks Rank #2 (Buy), with earnings expectations inching higher nearly across the board.

ELV’s latest quarterly results pleased investors, with shares moving well higher after the earnings release. Regarding headline figures, Elevance posted a 1% beat relative to the Zacks Consensus EPS estimate and reported sales modestly below expectations.

Earnings grew 12.5% year over year, whereas sales increased 1%. Below is a chart illustrating the company’s quarterly revenue.

Image Source: Zacks Investment Research

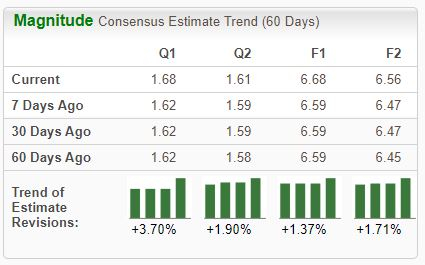

Interactive Brokers Group operates as an automated global electronic market maker and broker. Analysts have positively revised expectations across the board, landing the stock into a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

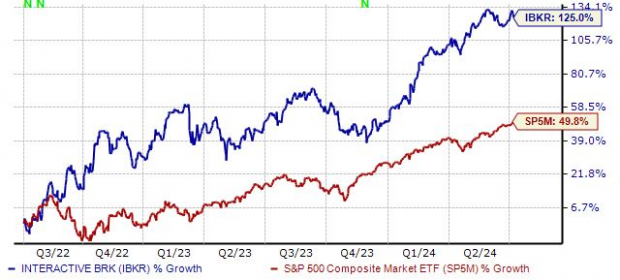

It’s worth noting that the stock is a big-time outperformer over the last two years, adding an impressive 125% in value compared to the S&P 500’s 50% gain. Increased trading activity has benefited the company nicely over recent years.

Image Source: Zacks Investment Research

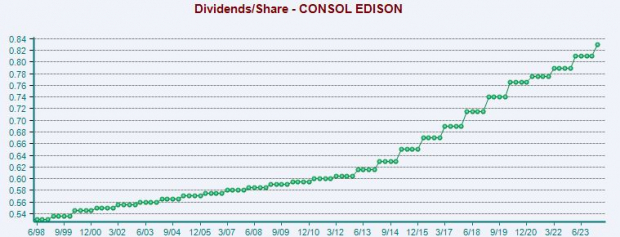

Consolidated Edison, a current Zacks Rank #2 (Buy), is a diversified utility holding company with subsidiaries engaged in both regulated and unregulated businesses. The company has been a great earnings performer, exceeding the Zacks Consensus EPS estimate by an average of 6% across its last four releases.

Income-focused investors could find ED shares attractive, currently yielding a solid 3.8% annually. Dividend growth is also apparent, with the company sporting a modest 2% five-year annualized dividend growth rate.

The company has long displayed a shareholder-friendly nature, as we can see illustrated below.

Image Source: Zacks Investment Research

Low-beta stocks can provide several beneficial advantages for portfolios, including defensive qualities.

They can also offer stabilization when combined with high-beta stocks, helping to give a more balanced risk profile.

And for those seeking a more conservative approach, all three low-beta stocks above - Interactive Brokers IBKR, Elevance Health ELV, and Consolidated Edison ED – could be considerations.

In addition to decreased volatility, all three sport favorable Zacks Ranks, reflecting optimism among analysts.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Consolidated Edison Inc (ED) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.