Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Paycom Software, Inc. PAYC is growing its cloud-based HR software business in 2024. This Zacks Rank #1 (Strong Buy) is expected to see double digit sales growth both in 2024 and 2025.

Paycom Software is a leading provider of cloud-based human capital management software, including for HR and payroll. It's a mid-cap company with a market cap of $8.1 billion.

Another Earnings Beat in Q1 2024

On May 1, 2024, Paycom Software reported its first quarter 2024 results and beat on the Zacks Consensus by $0.16. Earnings were $2.59 versus the consensus of $2.43.

An earnings beat shouldn't be surprising as Paycom has a perfect 5-year earnings surprise track record. That is impressive given that many companies were not able to hold onto their earnings surprise streaks during the pandemic.

Revenue was up 10.7% to $499.9 million from $451.6 million a year ago.

Zero Debt and Plenty of Cash

Paycom Software had debt of $0 as of Mar 31, 2024. But it also had cash and cash equivalents of $371.3 million as of Mar 31, 2024, up from $294 million as of Dec 31, 2023.

And that was even after Paycom paid $21.2 million cash dividends and repurchased $3.1 million in stock during the first quarter.

The dividend is yielding 1.1%.

Analysts Remain Bullish on 2024

Paycom Software gave full year sales guidance of a range of $1.86 to $1.885 billion. The Zacks Consensus is looking for $1.87 billion, which is sales growth of 10.2%.

1 estimate was revised higher for 2024 earnings in the last 30 days, pushing the Zacks Consensus up to $7.71 from $7.69. That is still a decline in earnings of 0.5% as the company made $7.75 last year.

But analysts expect earnings to jump another 11.4% in 2025, as the Zacks Consensus is looking for $8.60.

You can see on the price and consensus chart where the analysts got a little bearish about 2024's earnings but also where they are expecting the growth in 2025 and 2026.

Image Source: Zacks Investment Research

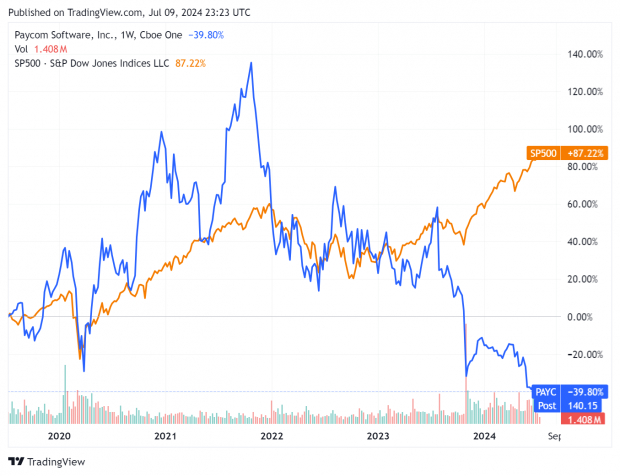

Shares at 5-Year Lows

Despite the bullish fundamentals, the Street has been negative on Paycom's stock for several years. In fact, the stock peaked in 2021 and has now slid to a new 5-year low.

Image Source: Zacks Investment Research

Because of the stock slide, it now has attractive fundamentals. Paycom trades with a forward P/E of 18.2.

For investors looking for a software stock with attractive fundamentals and no debt, Paycom Software should be on your short list.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Paycom Software, Inc. (PAYC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.