Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

POOLCORP POOL is seeing a slowdown in pool demand this summer. This Zacks Rank #5 (Strong Sell) recently lowered full year guidance.

POOLCORP is the world's largest wholesale distributor of swimming pool and related outdoor living products. It operates about 440 sales centers in North America, Europe and Australia from where it distributes more than 200,000 products to 125,000 wholesale customers.

POOLCORP Warns on the Full Year

On June 24, 2024, POOLCORP warned on the full year as discretionary pool spending has slowed. The company believed that new construction pool activity could be down 15% to 20% for the year with remodel activity down as much as 15%.

For the year-to-date period, POOLCORP's sales were trending down approximately 6.5% from the same period in 2023. While swimming pools and outdoor living projects are expected to decline, it was encouraged as maintenance-related product sales remained stable.

There's been volume growth in chemicals, and equipment sales, excluding cleaners, were down only 2% for the year. That was an improvement from the 3% decline in the first quarter of the year.

Full Year Guidance Slashed

Given the pool slowdown, it's not a surprise that POOLCORP cut its full year guidance. It lowered the range to $11.04 to $11.44 from $13.19 to $14.19.

The analysts followed by cutting their earnings estimates. 5 estimates were cut after the company warned.

It has pushed the Zacks Consensus Estimate down to $11.10 from $13.21. That's at the low end of the company's guidance range.

This is an earnings decline of 16.9% from 2023 as the company made $13.35 last year.

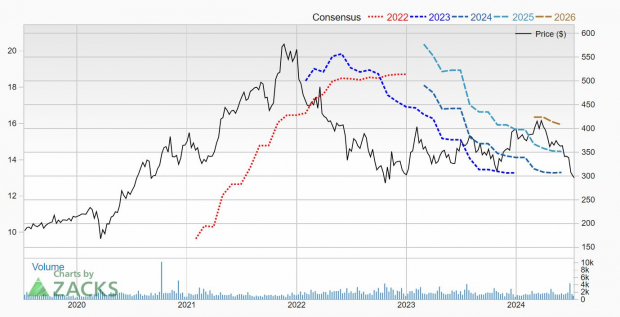

Here's what it looks like on the price and consensus chart.

Image Source: Zacks Investment Research

Shares Fall to New 52-Week Lows

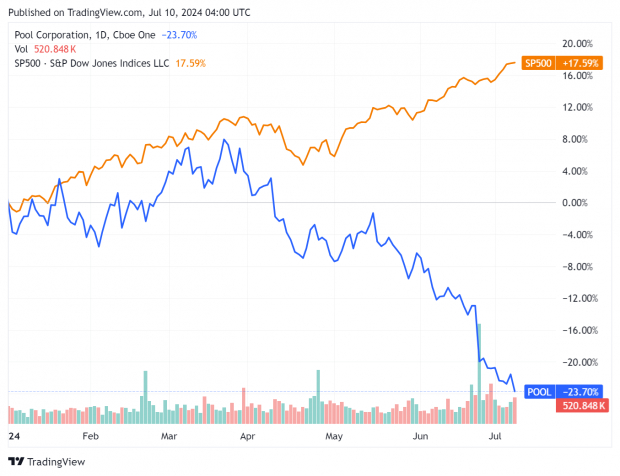

Not surprising, the shares fell on the guidance warning and are now down 23.7% year-to-date.

Image Source: Zacks Investment Research

But with the earnings being cut, the shares aren't that cheap. It's trading at 27x forward earnings.

POOLCORP also pays a dividend, currently yielding 1.6%.

POOLCORP will be reporting second quarter results on July 25, 2024 so the company will give more color then.

But until the pool slowdown hits a bottom, investors might want to stay on the sidelines. Watch the earnings estimates for signs of a turnaround.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pool Corporation (POOL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.