Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Logitech LOGI recently launched the Logitech G309 LIGHTSPEED Wireless Gaming Mouse. The G309 mouse is lightweight and features dual-wireless connectivity, precision tracking, low latency, POWERPLAY compatibility, long gameplay and hybrid optical-mechanical switches.

This gaming mouse comes with an integrated HERO 25K sensor, which provides 400 IPS for improved color accuracy, agile responsiveness and sensitivity up to 25,600 DPI. The HERO 25K sensor also consumes less power, allowing the mouse to continuously operate for a minimum of 300 hours on a single AA alkaline battery.

The mouse can also operate without an AA battery as it has POWERPLAY compatibilty. This feature allows gamers to charge the mouse with the Logitech G PowerPlay Wireless Charging System, significantly reducing the weight of the mouse for a better gameplay experience. The G309 mouse weighs 68 grams without the AA alkaline battery when paired with POWERPLAY, whereas with the AA battery, the mouse weighs 86 grams.

The Logitech G309 mouse comes with LIGHTFORCE hybrid optical-mechanical switches for improved response and tactile feedback. Being in the LIGHTSPEED wireless category, the mouse can connect two LIGHTSPEED devices to one receiver. This will enable gamers to operate a gaming keyboard and G309 mouse through a single receiver.

Image Source: Zacks Investment Research

Alongside its gaming portfolio, LOGI is also rolling out innovative products that are aiding its growth in the consumer electronic accessories space. So far this year, Logitech has stormed the webcam market with its AI-powered USB conference camera, MeetUp 2, and other webcams, including MX Brio/MX Brio 705 for Business and Mevo Core 4K.

With all these innovations in place, Logitech benefits from the growing consumer electronic accessories market, which is projected to witness a CAGR of 5.68% from 2021 to 2032, per a Business Insights Research report.

For the office electronic accessories market, LOGI launched the Casa Pop-Up Desk, Signature Slim K950, Slim Combo and Slim Combo for Business keyboards. Furthermore, the company has dedicated an entire lineup of products for Apple’s AAPL Mac under the brand called Logi for Mac products.

To gain popularity among Apple users, Logitech has improved the compatibility of its product lineup with Mac OS and iPadOS by introducing dedicated macOS keyboards for the Apple ecosystem. LOGI’s keyboard portfolio for Mac includes MX Anywhere 3S, MX Keys S, MX Keys S Combo, MX Keys Mini and Ergo Series Wave Keys.

In the past two years, Logitech has certified its peripherals to operate seamlessly with Microsoft MSFT and Intel INTC products. LOGI gained certifications from these giants for its peripherals.

Logitech certified its Sight AI Camera from Microsoft Teams. The company also verified its mouse and keyboard for Intel Evo laptops that meet strict requirements for reliability, interoperability and security.

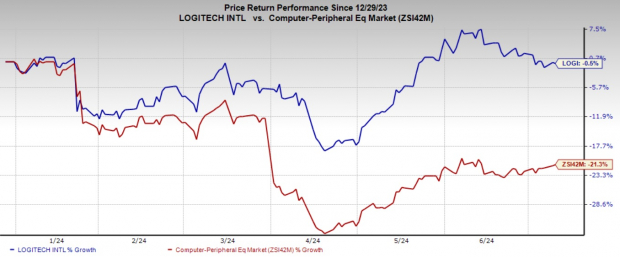

Shares of Logitech have lost 0.5% in the year-to-date period compared with the Zacks Computer-Peripheral Equipment market’s decline of 21.5%. It is on a recovery path from the post-pandemic downturn. The company’s growth is supported by a recovery in the personal computers (PCs) market.

The recovery in this space will provide further growth momentum to Logitech, as PCs are the main sales booster for computer peripheral products. The Zacks Consensus Estimate for LOGI’s fiscal 2025 earnings has been revised upward from $4.25 to $4.28 in the past 60 days.

For fiscal 2025, Logitech expects revenues in the range of $4.3-$4.4 billion. The Zacks Consensus Estimate for the same is pegged at $4.35 billion, indicating growth of 1.1% year over year.

LOGI sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Logitech International S.A. (LOGI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.