Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Illumina, Inc. ILMN recently acquired Fluent BioSciences, a developer of innovative single-cell technology. This strategic acquisition marks a significant step in Illumina's expansion within the single-cell research domain, aligning with the company’s broader multiomics growth strategy.

The acquisition was completed on Jul 9 and funded with cash on hand. However, other financial terms of the deal were not disclosed.

Fluent BioSciences has developed a highly differentiated single-cell technology that eliminates the need for complex and expensive instrumentation. This novel approach overcomes many of the existing barriers in single-cell analysis, making it more accessible and cost-effective.

Fluent's latest product, PIPseq V, offers exceptional performance with the ability to detect diverse cell types,which are often missed with current methods. It alsohas high scalability and can process a wide range of cell quantities, from 100 to 1 million cells.

By integrating Fluent's unique technology with Illumina's leading sequencing and informatics solutions, including Partek Flow, researchers will gain access to a comprehensive solution for single-cell multiomic analysis. This combined offering is expected to accelerate discovery and facilitate more economical research. Fluent's innovative methods will be incorporated into Illumina’s product portfolio, enhancing the company’s ability to provide end-to-end solutions for single-cell analysis.

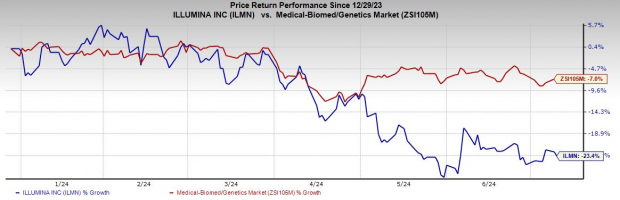

Image Source: Zacks Investment Research

According to a Grand View Research report, the global single-cell analysis market, valued at $4.34 billion in 2023, is projected to witness a CAGR of 18.7% from 2024 to 2030. This growth will be driven by its expanding applications in disease diagnosis, drug discovery, and precision medicine. Technological advancements in single-cell analysis and isolation enhance resolution and sensitivity, enabling the detection of rare cell types and low-abundance molecules. The rising incidence of cancer further propels market expansion, with single-cell technologies providing critical insights into cellular heterogeneity and aiding in the development of tailored treatment strategies.

Illumina is currently keeping up well with its goals to strengthen its foothold in the multi-billion gene sequencing worldwide market with some highly competitive products in its existing portfolio and pipeline. Further, the company is developing sample-to-answer solutions to catalyze adoption in the clinical setting, including in reproductive and genetic health and oncology.

In reproductive health, the company primarily focuses on driving noninvasive prenatal testing adoption globally through technology, which identifies fetal chromosomal abnormalities by analyzing cell-free DNA in maternal blood.

The market adoption of next-generation sequencing (NGS) technology is also accelerating the research for rare and undiagnosed diseases to discover the genetic causes of inherited disorders by assessing many genes simultaneously. Last year, Illumina launched the Global Health Access Initiative to support the acceleration of pathogen sequencing tools in low- and middle-income countries. The program will offer discounted prices for a range of sequencing applications, including drug resistance profiling in tuberculosis and whole-genome sequencing of viruses to monitor their evolution and support outbreak response.

The company also expanded its genomic capabilities in India by opening a new office and state-of-the-art Solutions Center, aiming to advance health care and combat climate change in South Asia. Illumina aims to drive greater adoption of NGS by seeking out collaborations and partnerships with its customers, supporting its expanded work in genomics and multiomics. Its partnership with Henry Ford Health aims to assess the impact of comprehensive genomic testing in cardiovascular disease, particularly in diverse and underserved populations. The strategic approach allows the company to capitalize on its market-leading innovation, further differentiating it and maintaining its prominence across research and clinical markets.

Over the past year, shares of ILMN have plummeted 23.4% compared with the industry’s 7% decline.

Illumina currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Hims & Hers Health HIMS, Medpace MEDP and Haemonetics HAE, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks Rank #1 stocks here.

Hims & Hers Heath shares have surged 139.5% in the past year. Estimates for the company’s earnings have increased from 18 cents to 20 cents for 2024 and from 33 cents to 38 cents for 2025 in the past 30 days.

HIMS’ earnings beat estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 79.2%. In the last reported quarter, it posted an earnings surprise of a staggering 150%.

Estimates for Medpace’s 2024 earnings per share have remained constant at $11.29 in the past 30 days. Shares of the company have surged 72.2% in the past year compared with the industry’s 4.4% growth.

MEDP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 12.8%. In the last reported quarter, it delivered an earnings surprise of 30.6%.

Estimates for Haemonetics’ fiscal 2025 earnings per share have moved 0.4% north to $4.57 in the past 30 days. Shares of the company have dipped 1.3% in the past year.

HAE’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 13.2%. In the last reported quarter, it delivered an earnings surprise of 2.3%.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Illumina, Inc. (ILMN) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.