Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Breakouts in the Russell 2000 IWM and Equal Weight S&P 500 Index RSP are telling us some very interesting information. After lagging the mega-cap tech and AI stocks so far in 2024, the rest of the market is catching up, and this is a very bullish development.

Weatherford International WFRD, 3M MMM and Philip Morris International PM are three stocks that are showing clear relative strength following this rotation and enjoy multiple bullish catalysts going forward.

It is worth noting that some of this rotation is short covering, so I have made sure to pick stocks that I believe have enduring bullish catalysts, rather than just transient, short-term strength.

Image Source: TradingView

The major shift that occurred yesterday was the resurgence of value-type stocks, following rising expectations that the Federal Reserve will be cutting interest rates this year.

Because many of these stocks have been dealing with elevated debt servicing costs because of higher interest rates, investors have gravitated toward mega-cap, AI and highly profitable stocks. But now that the market is pricing three rate cuts into the year end, this group is finally getting love again.

Image Source: CME Group

Energy stocks tend to fit into the group of stocks finding buyers in this current rotation. Weatherford International is one that catches my eye.

Although the stock hasn’t experienced an upward earnings revision, giving it a Zacks Rank #3 (Hold) rating, it is showing strong price momentum, and has very high earnings growth forecasts especially compared to its valuation.

Weatherford International provides oil field services and equipment. The company offers drilling solutions, gas well unloading, restoration and other related activities.

After consolidating for nearly three months WFRD stock has broken out above resistance to new all-time highs.

Even more encouraging is Weatherford’s PEG ratio, which discounts a company’s earnings multiple by its earnings growth forecasts. Today, WFRD has a forward earnings multiple of 18.2x and earnings growth projections of 20.1% annually over the next three to five years.

That gives Weatherford a PEG ratio of 0.9, which indicates it may be trading at a discount relative to its growth estimates.

Image Source: TradingView

3M is a diversified multinational conglomerate known for its innovation and broad product range. It operates in various sectors, including safety and industrial, transportation and electronics, healthcare, and consumer goods. Key products include adhesives, abrasives, personal safety equipment, medical supplies, automotive components, and household items like Post-it notes and Scotch tape.

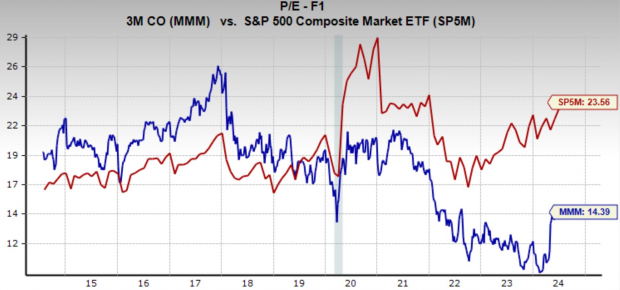

After almost a decade of sideways price action, the stock looks quite appealing from a historical perspective. Today, 3M is trading at a significant discount to its historical median valuation.

At 14.4x, its is well below the market average and its 10-year median of 19.2x. Furthermore, it has a tidy 2.7% dividend yield

Finally, MMM stock price is on the verge of breaking out to two-year highs, showing considerable interest from institutional investors.

Image Source: Zacks Investment Research

Philip Morris International is the tobacco giant known for its flagship brand Marlboro but is amid a massive business shift that should offer major growth tailwinds over the next few years.

Philip Morris International is going smokeless and is committed to transitioning its business to smoke-free products like e-cigarettes and nicotine pouches. This is a massive development and could make sin-stocks like tobacco come back into favor for investors.

Additionally, in the chart below we can see the PM stock was consolidating for nearly three years but staged a big breakout just a couple of months ago. This is very bullish activity and shows institutions are now getting back involved following the business transition.

Philip Morris also offers a hefty dividend yield of 5% for those holding the stock.

Image Source: TradingView

The recent surge in the Russell 2000 and Equal-Weight S&P 500 signals a potential market rotation favoring value-oriented stocks. This presents an opportunity to capitalize on companies with strong underlying fundamentals and compelling growth prospects.

Weatherford International, 3M, and Philip Morris International are all well positioned to benefit from this shift.

Free Report: 5 “Whisper” Stocks Poised to Stun Wall Street

Analysts may be seriously underestimating these stocks. When they announce earnings, they could immediately jump +10-20%.

See Stocks Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

3M Company (MMM) : Free Stock Analysis Report

Philip Morris International Inc. (PM) : Free Stock Analysis Report

iShares Russell 2000 ETF (IWM): ETF Research Reports

Invesco S&P 500 Equal Weight ETF (RSP): ETF Research Reports

Weatherford International PLC (WFRD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.