Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

The 2024 Q2 earnings season is in full swing, with today’s results from the big banks kicking the period into a higher gear. Another period of positivity is expected, with the S&P 500 expected to post positive earnings growth yet again.

And concerning next week’s docket, several reports, including those from Netflix NFLX, Taiwan Semiconductor TSM, and Johnson & Johnson JNJ should be on investors’ radars. Let’s take a closer look at how each stacks up heading into their respective quarterly releases.

Netflix

Streaming titan Netflix is scheduled to report its quarterly results on Thursday, July 18, after the market’s close. Shares plunged following its latest earnings release but have since recovered nicely, now trading near all-time highs.

As usual, subscriber metrics will be key in the release, though it’s critical to note that the company will no longer report quarterly membership numbers starting next year in 2025 Q1.

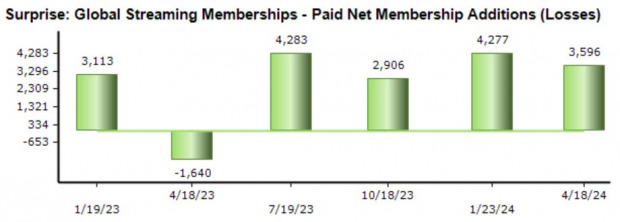

Concerning its latest release, total subscribers were reported at 269.6 million, reflecting a 16% jump year-over-year. The company’s subscriber additions have consistently exceeded our expectations as of late, chaining together four consecutive beats.

Image Source: Zacks Investment Research

Earnings and revenue expectations have primarily remained the same, with current estimates alluding to 43% EPS growth on 17% higher sales. The company’s profitability has improved nicely amid operational efficiencies, with margins moving higher over the last few periods.

Please note that the chart below is on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Taiwan Semiconductor

TSM shares have benefited nicely on the back of the broader semiconductor trade in 2024, gaining more than 80% and widely outperforming. The AI frenzy has been the primary driver behind the semiconductor trade, with companies racing to arm themselves with AI chips.

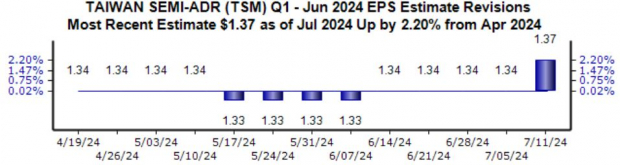

Earnings expectations for the quarter stayed stagnant for some time but have recently ticked higher, with the $1.37 per share estimate suggesting a 20% climb from the year-ago period. Sales expectations have been more positive, with the $20.2 billion expected up 5% over the same timeframe and alluding to a 29% climb year-over-year.

Image Source: Zacks Investment Research

It’s worth noting that valuation multiples have expanded amid investors’ expectations of higher growth, with the current 26.5X forward 12-month earnings multiple above the 19.8X five-year median. Still, the current PEG ratio works out to 1.1X, reflecting that investors aren’t overpaying for growth.

Image Source: Zacks Investment Research

Keep in mind that TSM announced a 10% boost to its payout following the release of its latest results, bringing the quarterly total to $0.45/share. TSM’s commitment to increasingly rewarding shareholders has kept it a favorite among income-focused investors seeking technology and semiconductor exposure.

TSM reports on Thursday, July 18, after the market’s close.

Johnson & Johnson

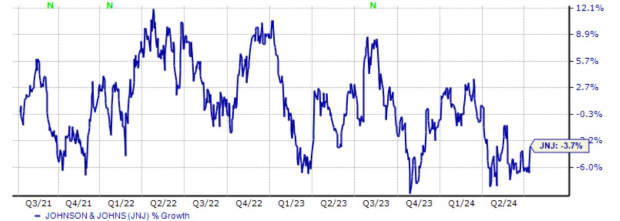

Consumer staples favorite Johnson & Johnson hasn’t seen its shares do much over the last three years, trading sideways and overall losing 4%. Nonetheless, the company has continued to be a strong earnings performer, exceeding our consensus EPS estimate in ten consecutive releases.

Image Source: Zacks Investment Research

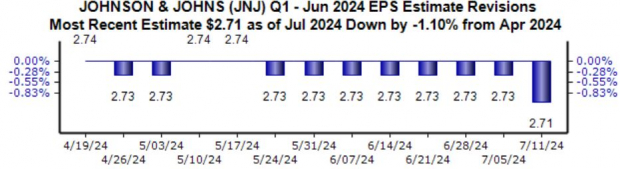

The earnings estimate revisions trend has been slightly bearish for the upcoming release, with the $2.71 Zacks Consensus EPS estimate down 1% since mid-April. As shown below, the estimate was lowered near the beginning of this July.

Revenue expectations have remained the same over the same period, with the $22.4 billion expected suggesting a 12% pullback year-over-year.

Image Source: Zacks Investment Research

JNJ reports on Wednesday, July 17, before the market opens.

Bottom Line

With the 2024 Q2 earnings season kicking into a much higher gear next week, there are several reports investors should keep on their radars, including those from Netflix NFLX, Taiwan Semiconductor TSM, and Johnson & Johnson JNJ.

Free Report: 5 “Whisper” Stocks Poised to Stun Wall Street

Analysts may be seriously underestimating these stocks. When they announce earnings, they could immediately jump +10-20%.

See Stocks Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.