Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

The arguments against buying Royal Caribbean (NYSE: RCL) stock right now are certainly sound enough. Shares are up nearly 400% for the past year, for example, reaching yet another record high just last week. That's a tough act to follow. The stock's also already priced right at the consensus price target of $166.96, seemingly leaving no upside left to tap. Never mind the economic lethargy chipping away at consumers' willingness -- and ability -- to spend money on discretionary goods and services.

But this may be one of those rare cases where it makes sense to go against the grain and buy Royal Caribbean stock despite the handful of reasons not to. Here's why.

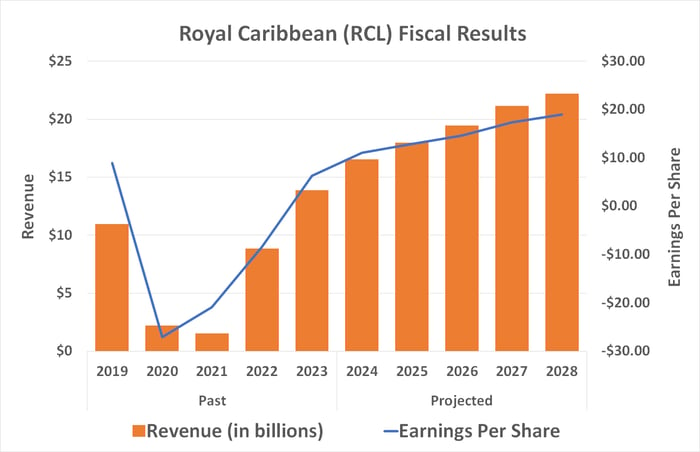

You know the company. Royal Caribbean is of course one of the world's premier maritime cruise lines. It's also parent to Celebrity Cruises and Silversea Cruises. In total, the three brands generated $13.9 billion worth of revenue last year, turning $1.8 billion of it into net income.

You also know the entire cruise industry was upended by the COVID-19 pandemic, which shut it down for the better part of 2020 and 2021. Royal Caribbean was forced to borrow heavily to survive that tough time. Its business bounced back, but the inflated debt burden remains. Naysayers fear it may be more than the company can handle, particularly in light of the economic weakness stemming from lingering inflation.

There's a handful of important nuances about the cruise industry's recovery, though, that are still underappreciated. Chief among them is that in many ways consumers are still learning that cruises are not only affordable vacation options, but that these massive boats are chock-full of all sorts of experiential amenities. The Cruise Lines International Association's most recent report on the matter indicates that in 2022 and 2023, 27% of the industry's passengers were first-time cruisers. Millennials and gen-Xers are particularly big fans of this form of getaway, which offers destination-minded travel completely handled by someone else. With budgets tight but interest in travel still strong, cruises are an ideal option.

And Royal Caribbean's numbers confirm as much. Last quarter's revenue of $3.7 billion was a first-quarter record, up 29% year over year. Moreover, despite continued inflation, analysts are calling for continued revenue and profit growth this year as well as next, and beyond.

Data source: StockAnalysis.com. Chart by author.

Still...with Royal Caribbean stock up as much as it is with no apparent room or reason for more gains, is it too late to buy it?

In a word, no.

Don't misread the message. The stock's easiest and highest growth is likely in the rear-view mirror. Bullishness probably won't be quite as robust or consistent going forward.

But there are a couple of strong bullish arguments for stepping into Royal Caribbean stock here despite the recent run-up.

One of them is its low valuation. Even though it's nearly quadrupled in price just since the middle of 2023, Royal Caribbean shares are still only priced at 15 times this year's projected per-share profits of $11.02, and less than 13 times next year's projection of $12.85 per share. For the sake of comparison, the S&P 500 index is currently trading at 23.6 times this year's expected earnings and more than 20 times 2024's projected profits.

Royal Caribbean is also plugged into a growth trend that doesn't look like it's going to abate anytime soon. Projections from the Cruise Lines International Association indicate the industry delivered a total of 31.7 million individual cruises last year, topping 2019's pre-pandemic tally of 29.7 million, en route to what will likely be a figure just shy of 40 million in 2027. In this vein, an outlook from market research outfit Market.US suggests the industry's worldwide revenue is set to grow at an annualized pace of 11.5% all the way through 2032, as more and more consumers discover all that these ships can offer.

Perhaps the best reason to buy Royal Caribbean stock at this high point, however, is also the least apparent and most counterintuitive one. That's the fact that so many people suspect it can't actually move any higher. Stocks have a funny way of defying the odds -- and logic -- when the growth backstory is as good as this one is.

In this case, continued bullishness could also effectively force the analyst community to start raising its price targets, which of course fans any bullish flames.

There are risks with this stock; the prospect of more serious economic headwinds is one of them. Another pandemic is always a potential tripwire as well. It would also be naïve to ignore Royal Caribbean's long-term debt load of nearly $19 billion, plus another $10 billion in near-term liabilities. The company shelled out $424 million in interest payments during the first fiscal quarter of the year alone. That's not chump change.

If these were serious risks relative to the stock's potential upside, however, we most likely would have seen evidence of it by now. We haven't. Royal Caribbean shares are ... well, still cruising along, suggesting the majority of investors see something worth still buying into even if the average analyst doesn't. In this instance, it could pay to follow the crowd.

This might help make the point: Despite broad economic tepidness and its sizable debt burden, Standard & Poor's as well as Moody's both recently upped their debt ratings on Royal Caribbean's bonds, citing the stability of its business and the company's improving ability to make interest payments as they come due. This was enough to support the refinancing of $1.25 billion worth of debt to less expensive interest rates. At the same time, the other cost-curbing measures improved Q1's per-passenger gross margins by 14% year over year.

Clearly, the company's doing something right.

Before you buy stock in Royal Caribbean Cruises, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Royal Caribbean Cruises wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of July 8, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Moody's. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Founded in 1993 in Alexandria, VA., by brothers David and Tom Gardner, The Motley Fool is a multimedia financial-services company dedicated to building the world's greatest investment community. Reaching millions of people each month through its website, books, newspaper column, radio show, television appearances, and subscription newsletter services, The Motley Fool champions shareholder values and advocates tirelessly for the individual investor. The company's name was taken from Shakespeare, whose wise fools both instructed and amused, and could speak the truth to the king -- without getting their heads lopped off.