Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Stryker Corporation SYK recently completed the previously announced acquisition of Artelon, a privately held company specializing in innovative soft tissue fixation products for foot and ankle and sports medicine procedures.

The acquisition will highlight Stryker's commitment to providing distinctive ligament and tendon reconstruction solutions and strengthen the company's product line in the soft tissue fixation sector.

The technologies provided by Artelon complement and expand the range of products that Stryker's foot and ankle specialists and sports medicine experts currently offer. Its innovative synthetic approach aims to enhance biological and mechanical ligament and tendon restoration, and it has been used in more than 60,000 implantations worldwide.

Additionally, through the acquisition, Stryker will be able to more effectively position itself in the sports medicine and foot and ankle markets with cutting-edge biomaterial technology that promotes the recovery of patient's soft tissues.

Stryker has been following an acquisition-driven strategy to boost its growth profile. In 2023, the company acquired several companies to increase its offerings. These include Cerus, which designs, develops and manufactures neurovascular products used for the treatment of hemorrhagic stroke. The business has been integrated with Stryker’s Neurovascular business.

In 2022, Stryker acquired Vocera Communications, entering into the fast-growing digital care coordination and communications segment. In 2021, the company acquired a medical device company, TMJ Concepts, that manufactures patient-specific temporomandibular joint reconstruction prosthesis system.

Stryker also acquired privately-held OrthoSensor in 2021, which is focused on applying digital technologies and big data to total joint replacements. The addition of the OrthoSensor total joint replacements line-up to its legacy Orthopedics product range is expected to help Stryker advance in the field of smart device technologies, including intraoperative sensors, wearables and smart implants.

Per management, these buyouts continue to represent Stryker’s focus on its strategy of boosting category leadership and market-leading growth.

Per a report by Mordor Intelligence, the global soft tissue repair market is estimated to be $14.8 billion in 2024 and is anticipated to exceed $18.8 billion by 2029 at a growth rate of 4.9%

The growing incidence of sports-related injuries is one of the major factors driving market growth, as it is expected to increase the adoption of soft tissue repair procedures.

Given the market potential, Stryker’s acquisition of Artelon is likely to boost the company’s business and generate additional revenues.

In May 2024, Stryker announced the successful completion of the first European surgeries using the Infinity Total Ankle System with Adaptis and Everlast technology. Infinity with Adaptis builds on the legacy of the original Infinity Total Ankle, with a decade of clinical use.

In February, Stryker announced the successful completion of the first shoulder arthroplasty surgeries using Blueprint Mixed Reality (MR) Guidance in Europe. The Blueprint MR Guidance System allows surgeons and their instruments to be guided by 3D images and guidance widgets, which can be displayed on the patient and in the surgeon’s line of sight without disrupting normal workflow.

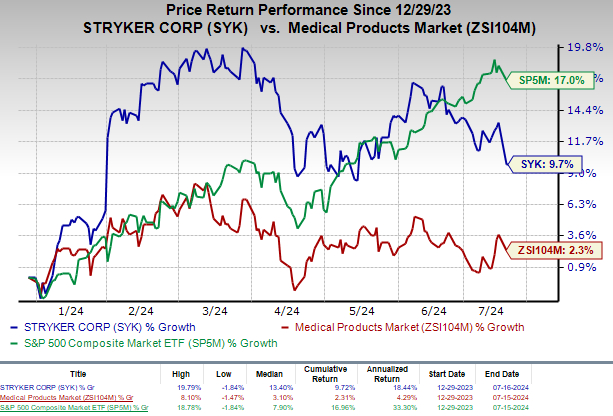

For year-to-date period, SYK shares have rallied 9.7% compared with the industry’s rise of 2.3%. The S&P 500 increased 17% in the same time frame.

Image Source: Zacks Investment Research

SYK carries a Zacks Rank #2 (Buy) at present.

Some other top-ranked stocks in the broader medical space that have announced quarterly results are Elevance Health, Inc. ELV, Hologic HOLX and Universal Health Services UHS

Elevance Health, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 12.2%. ELV’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 2.8%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Elevance Health’s shares have rallied 22.1% compared with the industry’s 5.5% rise in the past year.

Hologic, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 7.4%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 4.94%.

Hologic’s shares have risen 0.3% year to date compared with the industry’s 4.7% growth.

Universal Health Services has an Earnings ESP of +2.91% and a Zacks Rank of 2, at present. UHS has an estimated earnings growth rate of 30.5% for 2024.

UHS’ earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 8.12%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

Stryker Corporation (SYK) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.