Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Netflix NFLX is set to report second-quarter 2024 results on Jul 18.

For the second quarter of 2024, Netflix forecasts revenues to increase 16%, which equates to 21% growth on a foreign exchange (F/X) neutral basis due to price changes in Argentina and the devaluation of the local currency relative to the U.S. dollar.

The company anticipates total revenues to be $9.491 billion, projecting growth of 15.9% year over year. The Zacks Consensus Estimate for revenues is pegged at $9.53 billion, higher than the company’s expectation.

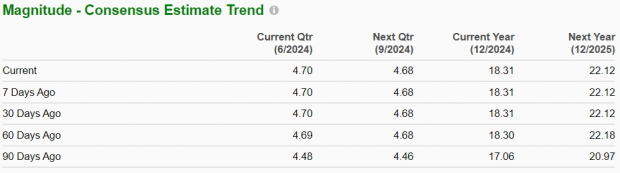

Netflix projects earnings of $4.68 per share, indicating growth of 42.2% year over year. The Zacks Consensus Estimate for the same is pegged at $4.70 per share, currently higher than the company’s expectation. The estimate has been unchanged over the past 30 days.

The company’s second-quarter results are expected to benefit from its diversified content portfolio, which involves heavy investments in the production and distribution of localized and foreign-language content.

Image Source: Zacks Investment Research

In the last reported quarter, the company delivered an earnings surprise of 17.07%. The company’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed in one, the average negative surprise being 9.29%.

Image Source: Zacks Investment Research

Our proven model does not conclusively predict an earnings beat for Netflix this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is not the case here. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

NFLX has an Earnings ESP of 0.00% and a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Netflix anticipates a seasonal decline in paid net additions for the second quarter of 2024 compared to the first quarter while projecting year-over-year growth in global Average Revenue per Membership (ARM) on an F/X basis.

The company's strategic initiatives, including the introduction of ad-supported low-priced plans and the crackdown on password-sharing through paid sharing options in over 100 countries (representing more than 80% of Netflix's revenue base), are expected to have contributed to top-line growth in the second quarter.

These measures, coupled with Netflix's expanding games portfolio featuring titles like Grand Theft Auto: The Trilogy, are likely to have enhanced user engagement and aided in boosting subscriber base in the to-be-reported quarter.

Despite these positive factors, Netflix continues to face significant challenges in the highly competitive streaming landscape. The company contends with robust rivals such as Disney’s DIS Disney+, Warner Bros. Discovery WBD-owned HBO Max, Peacock, Paramount+, Apple’s AAPL Apple TV+ and Amazon. Additionally, Netflix competes for consumer attention against traditional linear TV, YouTube, short-form content platforms like TikTok and the gaming industry. This intense competition for viewers' time and subscription dollars remains a persistent headwind for Netflix as it strives to maintain its market position and drive growth in an increasingly crowded digital entertainment ecosystem.

The Zacks Consensus Estimate for paid total streaming net membership additions is pegged at 5.41 million.

The consensus mark for second-quarter 2024 Asia-Pacific revenues is pegged at $1.03 billion, indicating 12.9% growth from the figure reported in the year-ago quarter.

The Zacks Consensus Estimate for Latin America revenues is pegged at $1.18 billion, suggesting a rise of 9.9% from the figure reported in the previous quarter.

Moreover, the consensus mark for EMEA revenues is pegged at $3.03 billion, suggesting an increase of 18.5% from the figure reported in the year-ago quarter.

The Zacks Consensus Estimate for the United States and Canada revenues is pegged at $4.26 billion, indicating an 18.4% rise from the figure reported in the year-ago quarter.

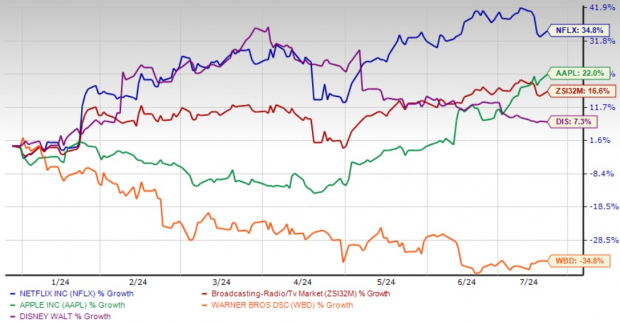

Shares of Netflix have gained 38.4% in the year-to-date period compared with the Zacks Consumer Discretionary sector, Apple and Disney’s rise of 16.6%, 22% and 7.3%, respectively. Shares of Warner Bros. Discovery have lost 38.4% in the same period.

Image Source: Zacks Investment Research

Now, let’s look at the value Netflix offers investors at current levels. Currently, NFLX is trading at 6.85X forward 12 months sales, above its five-year median of 6.02X. Meanwhile, the Zacks Broadcast Radio and Television industry’s forward earnings multiple sits at 4.43X. The company’s valuation looks somewhat stretched compared with its own range and the industry average.

Image Source: Zacks Investment Research

Netflix presents a compelling investment opportunity as a dominant force in the global streaming industry. The company's unparalleled content production capabilities consistently deliver hit shows and movies, driving subscriber growth and retention. Netflix's strategic expansion into ad-supported tiers and gaming diversifies revenue streams while broadening its market reach. The crackdown on password sharing is poised to unlock significant untapped revenue potential. With a robust international presence and data-driven content creation, Netflix is well-positioned to capitalize on the growing global demand for streaming entertainment.

The company's strong brand, innovative technology, and ability to adapt to market trends ensure its continued leadership in the evolving digital media landscape. As streaming becomes increasingly central to entertainment consumption worldwide, Netflix stands to benefit substantially, offering investors exposure to this high-growth sector. However, investors should monitor content costs, subscriber growth rates and evolving competitive dynamics in the streaming industry.

Despite a premium valuation and fierce competition in the streaming sector, Netflix remains a compelling investment. Its first-mover advantage, extensive global footprint and track record of producing culturally significant content set it apart. These factors, combined with Netflix's ability to adapt and innovate, suggest it is well-equipped to maintain market leadership and capitalize on the growing digital entertainment landscape, making the stock worth buying ahead of its second-quarter earnings report.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Warner Bros. Discovery, Inc. (WBD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.