Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Earnings season has arrived, with the big banks’ results kicking the period into a much higher gear last Friday. The expectation is for another period of earnings growth, with the Technology sector again expected to do some heavy lifting.

Regarding this week’s docket, investor-favorite Netflix NFLX is scheduled to report on Thursday after the market’s close. The results can provide a small read-through for Roku’s ROKU quarterly results, which are expected on July 25th.

Let’s take a closer look at expectations heading into the release.

Shares plunged following its latest earnings release but have since recovered nicely, now trading near all-time highs and showing considerable momentum. Concerning headline figures in its latest release, NFLX posted a double beat, with earnings and revenue climbing 83% and 14%, respectively.

As usual, subscriber metrics will be key in the upcoming release, though it’s critical to note that the company will no longer report quarterly membership numbers starting next year in 2025 Q1.

Concerning the latest print, total subscribers were reported at 269.6 million, reflecting a 16% jump year-over-year. The company’s subscriber additions have consistently exceeded our expectations as of late, chaining together four consecutive beats.

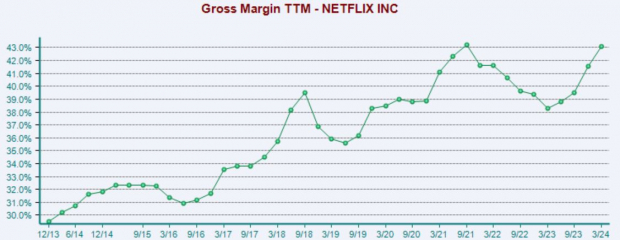

Earnings and revenue expectations have primarily remained the same, with current estimates alluding to 43% EPS growth on 17% higher sales. The company’s profitability has improved nicely amid operational efficiencies, with margins moving higher over the last few periods.

Please note that the chart below is on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Strong subscriber metrics could easily push shares to all-time highs, with the company also currently sporting a favorable Zacks Rank #2 (Buy). Shares aren’t expensive heading into the print, with the current 1.1X PEG ratio at historically low levels.

Roku’s latest set of quarterly results overall reflected healthy trends, with the company growing Streaming Households by 14% and Streaming Hours by 23% year-over-year. Impressively, Roku remains the #1 selling TV OS in the U.S. and Mexico.

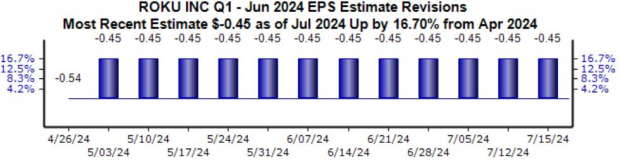

Like NFLX, big growth is expected for Roku, with earnings and revenue forecasted to climb 40% and 10%, respectively. Analysts positively revised their expectations and have kept them stable since, with the -$0.45 Zacks Consensus EPS estimate up 16% since the end of April.

Image Source: Zacks Investment Research

Investor-favorite Netflix NFLX is gearing up to report quarterly results this week, with overall trends leading up into the print remaining positive. The stock continues to sport a favorable Zacks Rank #2 (Buy), with earnings and revenue expectations remaining stable.

The streaming titan’s quarterly results will provide us with a small read-through for Roku’s ROKU quarterly print, which recently posted favorable results that confirmed underlying streaming strength.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Roku, Inc. (ROKU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.