Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Shares of Idaho Strategic Resources, Inc. IDR have declined 27% since it reported third-quarter 2024 results on Nov. 4. Despite a strong performance with earnings of 15 cents (a 400% year-over-year improvement) and an 86% surge in revenues, IDR missed the Zacks Consensus Estimates for both metrics.

Along with the weaker-than-expected results, the IDR stock’s decline appears to have been influenced by the recent dip in gold prices. After a solid rally earlier this year, gold seems to have lost its sheen due to a strong U.S. dollar and reduced expectations for Federal Reserve rate cuts.

Image Source: Zacks Investment Research

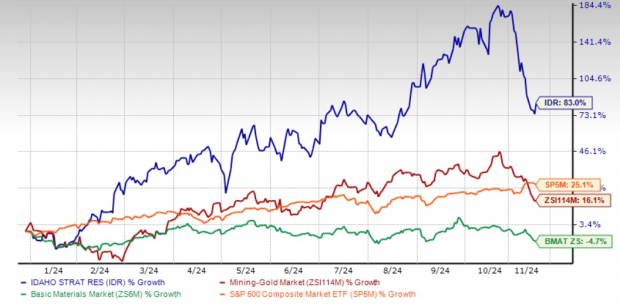

Notwithstanding the recent decline in its share price, Idaho Strategic shares have gained 83% year to date against the industry’s 16.1% rise. The broader Zacks Basic Materials sector has declined 4.7% but the S&P 500 has climbed 25.1% in the same timeframe.

The company has outscored major gold miners like Barrick Gold GOLD and Newmont NEM, which have witnessed year-to-date declines of 6.9% and 1.8%, respectively.

IDR reported revenues of $6.15 million in the quarter, representing an 86.4% year-over-year surge, driven by higher production and gold prices. However, the top line fell short of the Zacks Consensus Estimate of $7.4 million.

IDR produced 2,892 ounces of gold in the quarter, 45% higher than the year-ago quarter. This brings the company’s year-to-date production to 9,025 ounces.

The gross margin improved to 48.7% in the quarter from 33.5% in the third quarter of 2023. Operating income skyrocketed 248% year over year to $1.4 million. The operating margin was 23.4% compared with 12.5% in the third quarter of 2023.

However, exploration expenses were higher in the quarter due to increased surface and underground drilling activities at Idaho Strategic’s Golden Chest Mine. Drilling is expected to continue throughout the fourth quarter, which may hike exploration expenses. All-in-sustaining cost per ounce increased to $1,500.86 in the third quarter of 2024 compared with $1,333.73 in the year-ago quarter due to the increase in exploration costs.

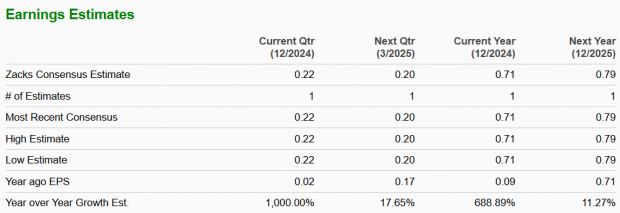

The Zacks Consensus Estimate for IDR’s fiscal 2024 earnings has moved south over the past 60 days. Despite the downgrade, earnings estimates for fiscal 2024 suggest a year-over-year upsurge of 689%.

Image Source: Zacks Investment Research

Earnings estimates for fiscal 2025 have, however, moved up in the past 60 days and indicate a year-over-year rise of 11.3%.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

The company’s gold properties include the Golden Chest mine (currently in production), the New Jersey Mill (majority ownership interest), the Eastern Star exploration property and other less advanced properties.

In 2023, the Golden Chest mine was fully transitioned to underground production. The Golden Chest Gold Mine lies within the Murray Gold Belt. Idaho Strategic has consolidated many historic gold mines and prospects within the belt to form an impressive land package consisting of 1,500 acres of patented mining claims and 5,800 acres of unpatented claims — the largest private land position in the area.

This October, Idaho Strategic announced that it discovered Red Star Vein during a drill program in the Klondike area at the Golden Chest mine. The tonnage and production potential of the Red Star Vein is, however, not fully known at this time. In addition to the Red Star intercepts, the company encountered several veins during the 2024 drill program. These hold promise, considering their proximity to the current production. While it may be early to determine the economic feasibility of these intercepts, investors are upbeat about this discovery, given the solid potential of the Golden Chest mine.

The company ended the third quarter of 2024 with cash and cash equivalents of $8.4 million compared with $2.3 million as of the end of 2023. IDR’s total debt-to-total capital ratio was at 0.06 as of Sept. 30, 2024, much lower than the industry’s 0.16, which is impressive.

An improved cash flow and low debt levels allow the company to invest in existing mines while exploring and developing gold and rare earth element (REE) prospects. Idaho Strategic plans to drill its Eastern Star property soon, expand drilling at Golden Chest and explore the broader Murray Gold Belt District. IDR recently announced plans for a considerably larger trenching and low-impact air rotary drilling program at the Lemhi Pass in 2025.

Idaho Strategic has three REE exploration properties in Idaho — Lemhi Pass, Diamond Creek and Mineral Hill. The company has conducted numerous exploration programs on its REE properties, which include drilling, trenching, sampling and mapping certain areas within its 19,090-acre landholdings.

REE is essential in many rapidly growing clean energy technologies, from wind turbines and electricity networks to electric vehicles. Per the International Energy Agency, REE may see three to seven times higher demand in 2040 from the current levels, whereas supply is expected to merely double. The market is currently dominated by China and there has been an increasing focus in the United States to develop domestic REE capabilities.

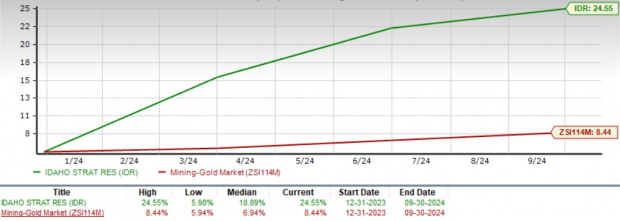

IDR’s return on equity (ROE) — a profitability measure of how prudently the company utilizes its shareholders’ funds — is 22.1%, higher than the industry’s 8.4%. This outscores major gold miners Barrick Gold’s ROE of 5.5% and Newmont’s 8.4%.

Image Source: Zacks Investment Research

Idaho Strategic is currently viewed as relatively expensive, with the stock trading at 5.62X forward 12-month price to sales, higher than the industry average of 2.53X.

Image Source: Zacks Investment Research

IDR offers investors the stability of profitable gold production and the added benefit of diversification through its exposure to REE elements. For those who already own the stock, it will be prudent to stay invested. However, considering its premium valuation and the recent drop in gold prices, new investors can wait for a better entry point. The stock’s Zacks Rank #3 (Hold) supports our thesis.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The solar industry stands to bounce back as tech companies and the economy transition away from fossil fuels to power the AI boom.

Trillions of dollars will be invested in clean energy over the coming years – and analysts predict solar will account for 80% of the renewable energy expansion. This creates an outsized opportunity to profit in the near-term and for years to come. But you have to pick the right stocks to get into.

Discover Zacks’ hottest solar stock recommendation FREE.

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report

Newmont Corporation (NEM) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Idaho Strategic Resources, Inc. (IDR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.